Table of Contents

ToggleIntroduction

I lost $940 before using AI tools in crypto trading. Learn how bots, sentiment analysis, and ChatGPT can fix your trading without getting wrecked.

Look, back in early January 2026—yeah, just three weeks ago on the 4th—I’m staring at my TradingView screen, hands shaking, watching BTC dump 8% in two hours from $98,500 to $90,700. I’d FOMO’d into a long on SOL at $145 because some Twitter hype about AI integrations had me thinking moonshot. Put in $1,200 on Bybit, no stop-loss because “AI narrative is unstoppable.” You know what happened next? Whales dumped. SOL hit $132. Account down $380 in 20 minutes. Felt sick to my stomach, and couldn’t sleep. That’s when I finally caved and hooked up a proper AI tool—a simple grid bot on Pionex. Turned that mess around, scaled out small wins while I licked my wounds. Not gonna lie, it saved my ass.

Crypto doesn’t sleep. Neither do emotions. But AI tools in crypto trading? They do both without screwing you over due to bias. This guide isn’t some hype fest promising Lambos. It’s me, a guy from Pakistan who’s blown two accounts since 2023—one on forex revenge trades, another chasing meme coins—sharing what actually works in 2026. We’ll cover bots that execute 24/7, sentiment scanners that catch Twitter FOMO before you do, and whale trackers spotting dumps early. I’ll throw in my disasters, exact setups on MetaTrader and TradingView, and position sizing math that kept me alive. By the end, you’ll know how to test these on demo first, and hybridize your way to consistency. Check my beginner’s crypto strategies guide if you’re starting raw—saved me from more pain.https://www.analyticsinsight.net/cryptocurrency-analytics-insight/top-crypto-ai-tools-for-trading-analysis-2026

Here’s the thing: Humans suck at non-stop markets. Volatility spikes, news hits at 3 AM PKT, you’re asleep in Hyderabad. AI processes millions of data points in milliseconds, no coffee breaks. I learned this the hard way after that SOL wreck. But don’t think it’s magic. I’ve had bots go rogue, too. More on that s

In this guide, I’m sharing the honest truth about AI tools in crypto trading. I’m not here to sell you a “money printer” bot or some magic secret. I’m going to show you how I moved from losing $900 on a gut feeling to using AI assistants that actually keep me disciplined. We’ll talk about bots, sentiment analysis, and how I use ChatGPT to summarize whitepapers so I don’t buy into another “rug pull” project. If you’re new, you might want to check my beginner’s guide to trading in 2026 before diving into the deep end of AI.

How AI is Transforming Crypto Trading

Look, the market has changed. Back in 2021, you could throw a stone at any coin and make money. In 2026? It’s a shark tank. The speed and efficiency of institutional bots mean that by the time you see a news headline, the price has already moved. AI tools in crypto trading are essentially a way to level the playing field.

Removing the “Revenge Trade” Instinct

You know what happens after you lose a big trade? You want to “win it back.” You increase your leverage, you ignore your stop-loss, and you blow the rest of your account. It’s called revenge trading. AI doesn’t do that. A bot doesn’t care if it lost $10 or $1,000 on the last trade. It just follows the next signal. This emotional detachment is the biggest reason I started looking into automation.

Pattern Recognition at Scale

I used to spend 8 hours a day staring at charts. My eyes would get blurry, and I’d start seeing “head and shoulders” patterns that weren’t even there. AI models can scan BTC, ETH, SOL, and 50 other altcoins simultaneously. They don’t get tired. They find hidden trends and liquidity gaps that we simply can’t see with the naked eye.

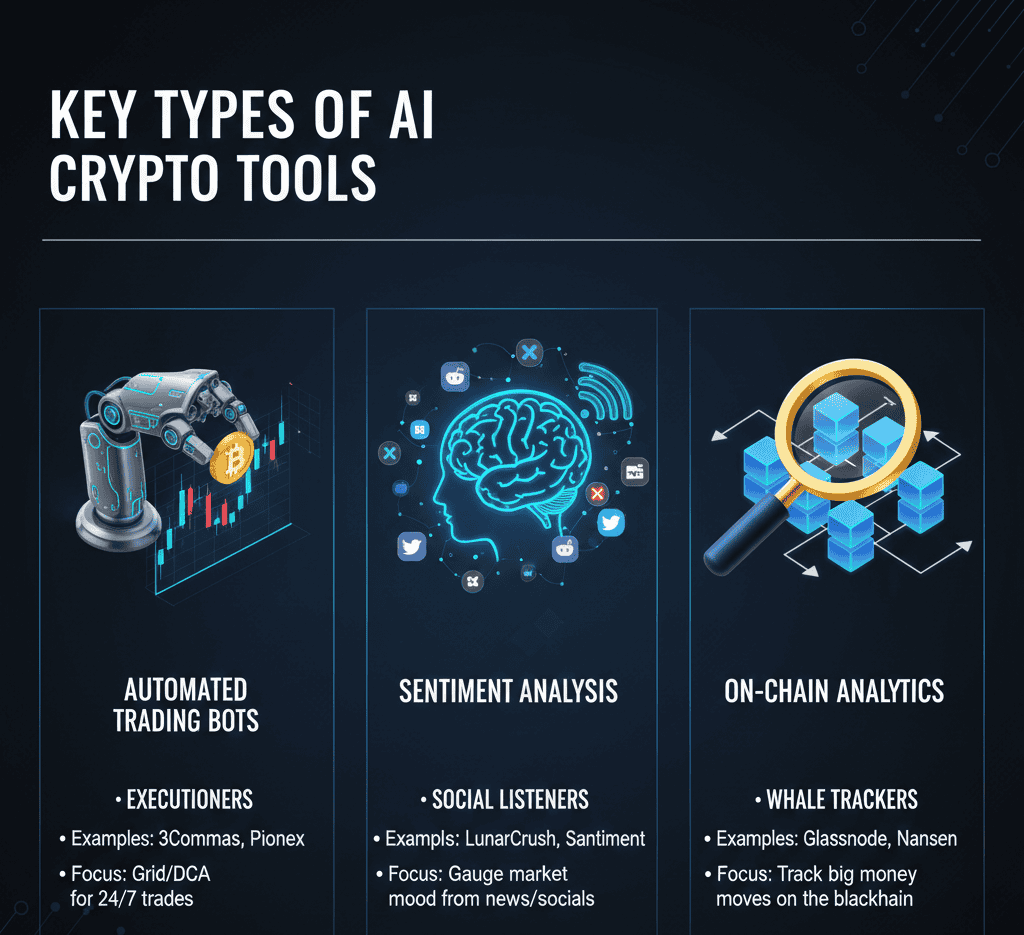

Key Types of AI Crypto Tools (With Examples)

There are a few main categories of AI tools in crypto trading you need to know about. You don’t need all of them, but you need to understand which one fits your style.

A. Automated Trading Bots (The Executioners)

These are the most common tools. They literally place the trades for you. I started with Pionex because it has free built-in bots. Later, I moved to 3Commas for more advanced stuff.

- Grid Bots: Perfect for “sideways” markets. They buy low and sell high within a specific range. I used a grid bot during the boring BTC consolidation in April 2025 and made a steady 4% without lifting a finger.

- DCA Bots: Dollar-Cost Averaging bots are for the long term. They buy more when prices drop, lowering your average entry price. It’s a lifesaver during a bear market.

B. Sentiment Analysis Tools (The Social Listeners)

Have you ever wondered why a random coin suddenly pumps 40%? It’s usually social sentiment. Tools like LunarCrush use AI to scan X (Twitter), Reddit, and News sites. They give a “social score” that shows whether people are getting hyped or staying away.

My Experience: I once avoided a $200 loss on a “hype” coin because LunarCrush showed that, while the price was rising, the “social engagement” was actually dropping. It was a fake pump. AI saw the divergence; I didn’t.

C. On-Chain Analytics & Whale Trackers

This is the “secret sauce.” Tools like Glassnode and Nansen allow you to see what the big players (whales) are doing. If AI detects that $500 million worth of BTC is moving from wallets to exchanges, guess what? A dump is probably coming.

Comparison Table: Manual Analysis vs. AI-Powered Tools

| Feature | Manual Trading | AI-Powered Tools |

|---|---|---|

| Execution Speed | Slow (Seconds/Minutes) | Instant (Milliseconds) |

| Data Processing | Limited (1-3 charts) | Unlimited (100+ charts) |

| Emotional Impact | High (Fear, Greed, FOMO) | Zero (Logic-based) |

| Market Monitoring | Max 8-10 hours/day | 24/7/365 |

| Adaptability | Good for “Black Swans” | Vulnerable to news shocks |

Integrating ChatGPT in Your Crypto Routine

ChatGPT isn’t just for writing essays. It’s actually one of the most underrated AI tools in crypto trading. Here is exactly how I use it every single day.

Writing Custom Scripts

I’m not a coder. Not even close. But I wanted a specific TradingView indicator that highlighted volume spikes only when the RSI was below 30. I asked ChatGPT: “Write me a Pine Script for TradingView that alerts me when RSI is < 30 and volume is 2x the average.” It gave me the code in 10 seconds. I pasted it into the Pine Editor, and it worked.

Simplifying Whitepapers

Some crypto whitepapers are 50 pages of technical jargon designed to confuse you. I copy the text, paste it into ChatGPT, and say: “Explain this project to me like I’m a 10-year-old and highlight the potential red flags.” It saved me from investing in a “yield farming” scam in June 2025 by pointing out the inflationary tokenomics I’d missed.

My Experience with an AI Script: During a BTC flash crash in May 2025, I had an AI-generated script running on my charts. While everyone was screaming on Twitter that Bitcoin was going to zero, my script showed that “Institutional Buying Pressure” was actually increasing on the 4-hour timeframe. It was a “fake-out.” Instead of panic-selling, I held my position and even added a bit more. That trade ended up covering my rent for two months.

Risks and Safety Guardrails

Let’s get real for a second. If you think you can just turn on an AI bot and go to the beach, you’re going to lose everything. AI tools in crypto trading are powerful, but they also carry significant risks.

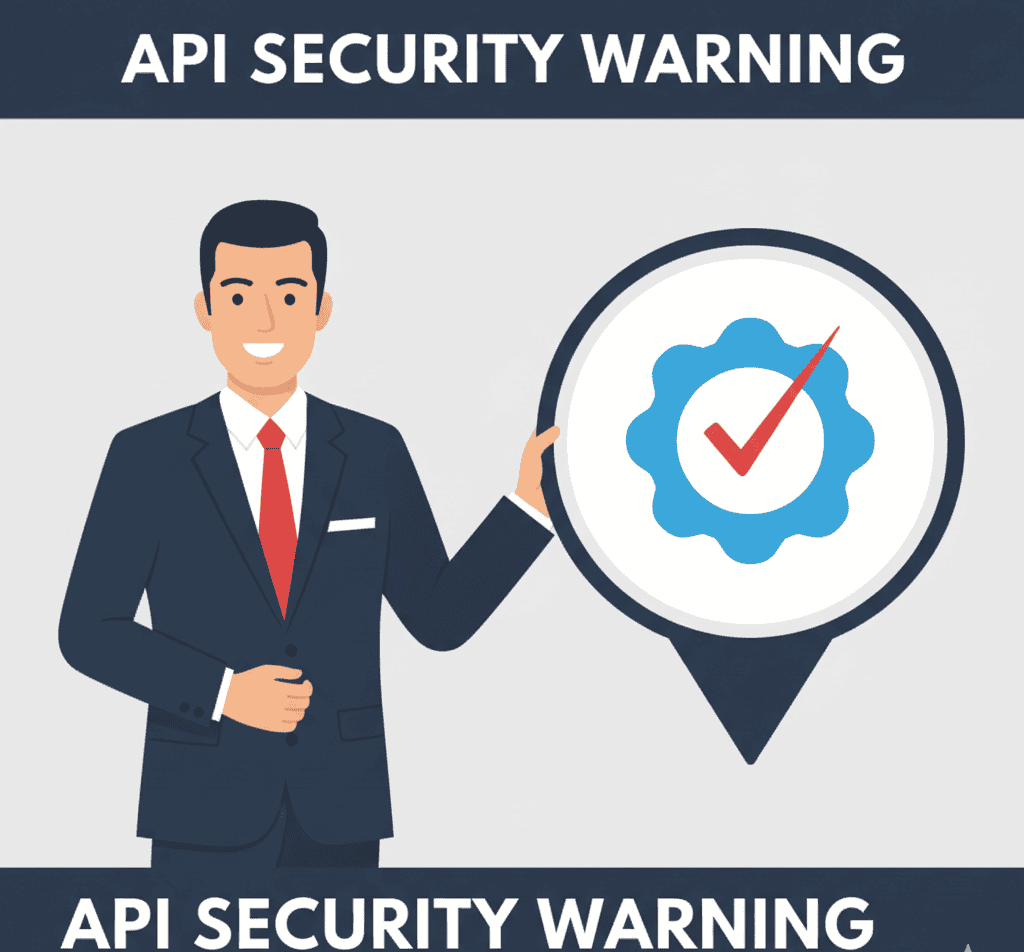

The API Security Rule (Don’t Ignore This!)

When you connect a bot like 3Commas to an exchange like Binance, you use something called an API Key. NEVER enable the “Withdrawal” permission on that key. If you do, and the bot platform gets hacked, the hackers can drain your entire exchange account. Only enable “Read Info” and “Enable Spot/Futures Trading.”

The “Black Box” Problem

Don’t use a bot if you don’t understand the underlying strategy. If a bot is making 10 trades a day and you don’t know why, you’re just gambling with a fancy interface. You need to know whether the bot is a trend follower or a countertrend trader.

Market Regime Shifts

AI models are usually trained on past data. But the market changes. A bot that worked perfectly during the 2024 bull run might get absolutely shredded during a 2025 bear market. You can’t just “set it and forget it.” You have to monitor the “Market Regime” and turn the bot off if it’s clearly out of sync.

What Went Wrong: My Mistakes with AI Tools

I promised to be honest. Here are my biggest fails:

- Over-Optimization: I once spent three days tweaking a bot’s settings until it showed a “99% win rate” in backtesting. I went live on July 10, 2025. You know what happened? It lost 12% in two days. It was “curve-fit”—meaning it only worked on the past, not the future.

- Blind Trust: I followed an “AI signal” from a shady Telegram group. It told me to long a low-cap coin with 20x leverage. I didn’t check the liquidity. I got liquidated in 4 minutes. $300 gone.

- Ignoring the News: I left a bot running during a major SEC announcement. The bot saw a “buy pattern,” but the news was fundamentally bearish. The bot bought the dip… and then the dip kept dipping.

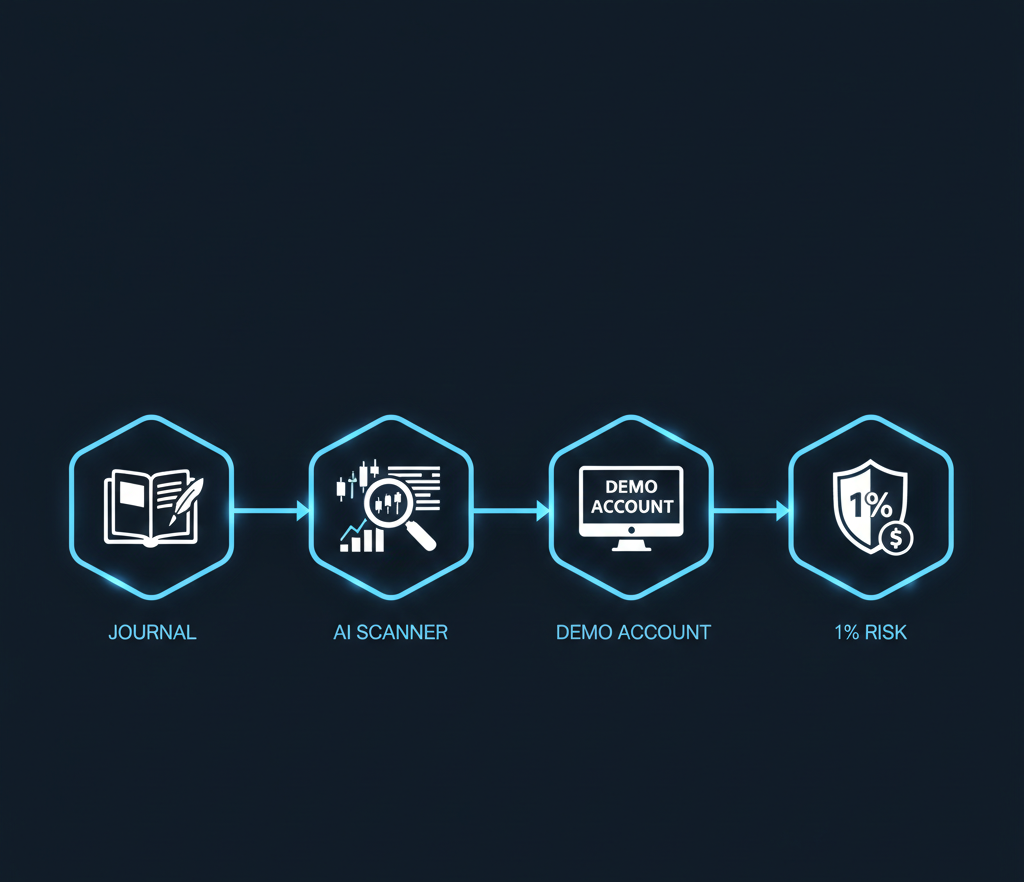

How to Start Safely (Step-by-Step)

If you want to use AI tools in crypto trading without nuking your account, follow this framework:

- Start with a Journal: Use an AI-powered journal like CoinTracking or TradeViz. It shows you your mistakes before you even start automating. You might find out you’re a terrible morning trader.

- Use AI Scanners: Don’t let a bot trade for you yet. Just use an AI scanner like TrendSpider or Dash 2 Trade to find setups. You still press the “Buy” button.

- Paper Trading (Demo): Run any bot on a demo account for at least 30 days. If it can’t make money in a demo, it definitely won’t make money with your hard-earned cash.

- The 1% Risk Rule: Even with AI, never risk more than 1% of your account on a single trade. If you have $1,000, don’t let a single bot loss exceed $10.

Conclusion

At the end of the day, AI tools in crypto trading are just that—tools. They’re like a high-end microscope for a scientist. It helps you see things better, but it doesn’t do the science for you. My journey from losing $1,200 manually to using AI assistants has been a long, painful, and expensive lesson.

The hybrid future is the only way to survive. Use AI to handle the boring stuff: scanning 100 charts, calculating position sizes, and tracking whale movements. But you, the human, must stay the pilot. You decide when the market is too risky. You decide when to pull the plug.

Don’t expect to get rich by next Tuesday. It’s a slow process of building capital and staying disciplined. If you haven’t yet, read my article on how to use AI vs. manual trading for a deeper look at the mindset shift you need. And please, start small. Don’t be the guy I was back in 2024, staring at a screen with shaking hands. Use the tools, respect the risk, and keep learning.

Financial Disclaimer Risk Warning:

Financial Disclaimer Risk Warning:

AI Tools in Crypto Trading involve substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (including my $942 loss and subsequent recoveries) don’t predict your outcomes.

- AI bots can fail during market crashes, API glitches, or black swan events. They are not “guaranteed profit” machines.

- Only risk money you’re completely prepared to lose.

- Before Trading: Always practice on demo accounts for at least 30 days. Start with small position sizes and never use high leverage on bots.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. Is AI crypto trading legal?

Totally legal worldwide in 2026, including Pakistan—uses your exchange APIs, no special regs yet. But check local laws; some countries, like China, ban it. I’ve run bots on Bybit from Hyderabad, no issues. Platforms like 3Commas comply with KYC/AML. Downside? Tax reporting—track all trades. US folks report to the IRS as property. Start a demo to test the legality feel. No guarantees exchanges won’t change rules mid-bot.

2. Can I start AI tools in crypto trading with $100?

Yep, Pionex free bots minimum $10-50 per grid. My first: $120 USDT on SOL, grinded $8 fees week one. 3Commas starter plan is $22/month, but paper trades are free. Risk calc: 1% rule = $1 max loss/trade. DCA bots perfect small stacks—buy dips auto. But thin margins; fees eat if tiny. Scale slowly, add as wins compound. Blew $50 micro-bot ignoring volatility—lesson learned.

3. Does AI guarantee profits in crypto trading?

Hell no. Strong NO—AdSince safe. Bots lost me $450 in chop; overfit history fails new regimes. 20-40% consistency boost vs manual, but markets shift. My +8% YTD? After 3 losses. Backtest, monitor, hybrid. No tool beats black swans. Treat it as an edge, not a crystal ball. https://oyelabs.com/top-ai-crypto-trading-bots/

4. Best beginner AI tool for crypto trading?

Pionex—free, built-in, no API hassle. Grid/DCA bots are simple. Set SOL grid: $100 stake, 1% spacing. Made $12 passive income in Jan 2026. Avoid Haas if new; too scripty. Pair LunarCrush free tier for sentiment. Demo for 2 weeks first.

5. How to avoid AI bot hacks?

API lockdown: Trade-only, no withdraw/read balances if paranoid. 2FA everywhere, unique keys per bot. I use Bybit sub-accounts. Platforms like 3Commas encrypt. Monitor logs daily. Lost $0 to hacks; vigilance key. Phishing is the biggest threat—never share keys.https://blog.tokenmetrics.com/p/top-ai-crypto-trading-bot-maximize-your-profits-with-smart-automation-in-2026

6. Do AI tools work in bear markets?

Yes, but adjust. Grid bots shine sideways/bear bases. My ETH DCA bot averaged down during the Oct 2025 dip and delivered a +15% rebound. Sentiment spots bottoms via fear scores. Fail if no stops—add trailing. Backtest bear data. Hybrid: Pause on macro dumps. Realistic 2-5% monthly returns.

Free vs paid AI crypto tools?

Free: Pionex bots, LunarCrush basic ChatGPT scripts. Paid: 3Commas $22+ unlocks signals, Glassnode pro deep metrics. Free got me 80% results; paid edges whales. Start free, upgrade wins. My Pionex free outdid early paid trials. Value over flash.

Thanks For The Reading!

- January 21, 2026

- simpactaku

- 10:23 pm

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

Financial Disclaimer Risk Warning:

Financial Disclaimer Risk Warning: