Introduction

September 2021. I blew a $1,250 crypto account in under 48 hours trading random altcoins on Binance futures with 20x leverage. Not proud of it. But it happened. I went from feeling like a genius on a Friday night to staring at a margin call screen on Sunday morning, hands shaking, wondering how I’d just torched a month’s salary because I “felt” Bitcoin was about to bounce.

Meanwhile, a couple of months later, in November 2021, I made around $410 in a single week trading EUR/USD and GBP/USD on IC Markets using a simple London session breakout strategy. No insane pumps. No 30% candles. Just boring 20–40 pip moves, tight spreads, and a risk-per-trade of roughly 1%. It felt slow. Honestly? It felt almost too boring. But it worked. And it kept working.

So when people ask, “crypto vs forex, which is better?” it hits a nerve because this question cost me real money and a lot of sleep.

Look, this article isn’t some generic “both have pros and cons” nonsense. You’re getting:

- Specific trades with dates, entries, and exits.

- The exact risk I took, how I sized positions, and where I got wrecked.

- What actually made me shift part of my focus from crypto to forex (and why I still trade both).

If you’re still confused between crypto vs forex, which market fits your personality, your capital, and your lifestyle, this breakdown will help you pick your poison in a realistic way, not a hyped one.

If you want to see how I structure my risk per trade on funded accounts, you can also check a risk management breakdown article on traders. site (search for the funded account risk guide there).

Table of Contents

ToggleWhat Crypto And Forex Really Are (Without The Fluff)

What Forex Trading Actually Means In Practice

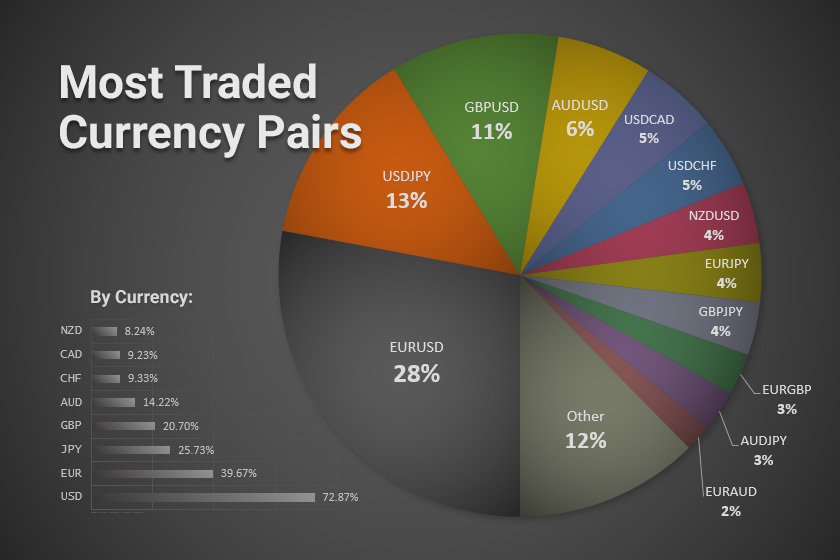

Forex is you betting on the price difference between one fiat currency and another. EUR/USD, GBP/JPY, XAU/USD (gold vs dollar), those kinds of pairs. You’re basically trading global money flows.

- Forex is massive, with trillions in daily volume, so majors like EUR/USD are extremely liquid.

- Moves are usually smaller in percentage terms, but they’re smoother and more stable compared to crypto.

Most forex moves are driven by things like interest rate decisions, inflation data, NFP, and geopolitics. You don’t usually see 25% daily moves on EUR/USD unless the world is literally on fire. And that stability is both a blessing and a curse.

What Crypto Trading Feels Like From The Inside

Crypto trading is betting on digital assets like BTC, ETH, and thousands of altcoins. Many trade 24/7 on exchanges such as Binance, Bybit, OKX, and others.

- Crypto runs non-stop: no weekends, no holidays, no mercy.

- Volatility is insane, especially on small-cap coins, which can move 10–40% in a day.

Instead of central bank speeches, you react to hacks, protocol upgrades, ETFs, or some influencer’s tweet. Crypto doesn’t care that it’s 3:17 a.m. where you live. It moves whenever it wants.

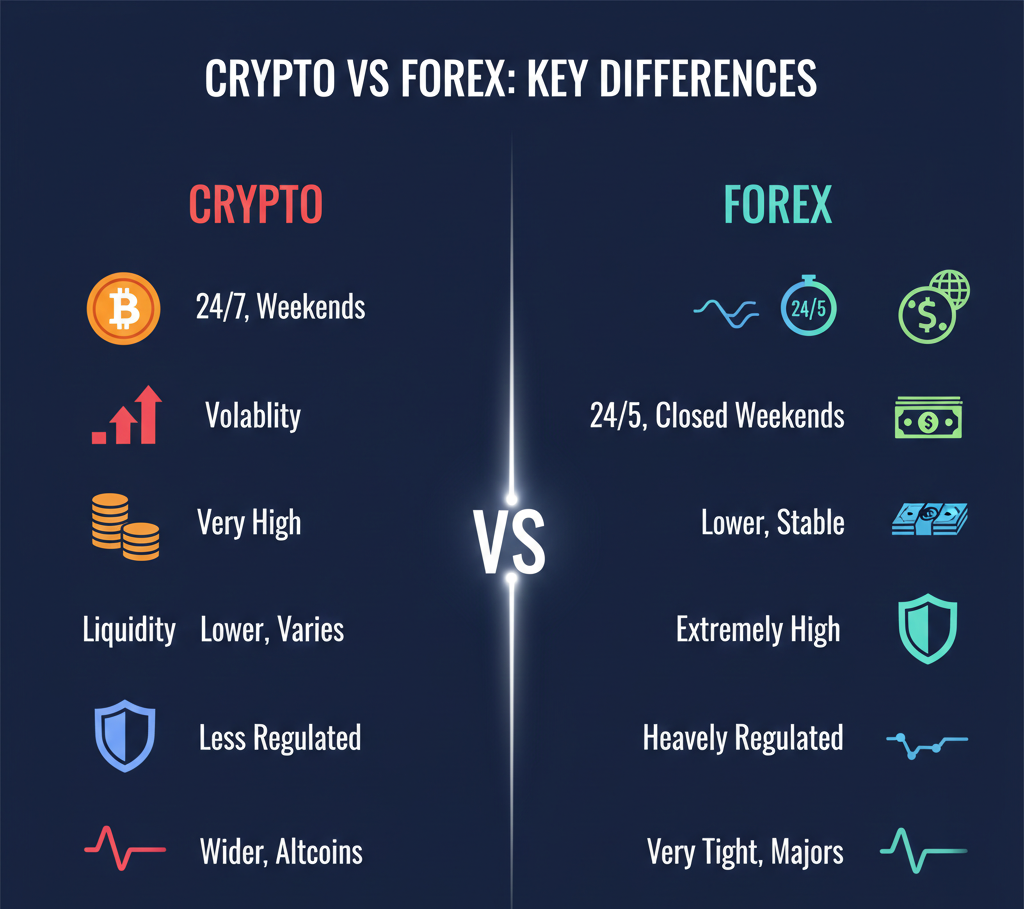

Crypto vs Forex: Key Differences That Actually Matter

Here’s a practical comparison from a trader’s perspective, not a textbook.

Core Comparison Table: Crypto vs Forex

| Market hours | 24/7, including weekends | 24/5, closed weekends |

| Volatility | Very high, double-digit daily moves common | Lower, more stable price ranges |

| Liquidity | Lower overall, varies by coin | Extremely high in majors |

| Regulation | Mixed, often less regulated | Heavily regulated in most regions |

| Typical spreads | Wider, especially on altcoins | Very tight on majors (e.g., EUR/USD) |

| Capital requirement | Smaller accounts can move faster | More capital needed for meaningful returns, even with leverage |

| Drivers | Narratives, tech news, sentiment | Macro data, rates, geopolitics |

| Learning curve | Tech + sentiment heavy | Macro + technical + news flow |

So when people ask which is better, crypto vs forex, the honest answer is that it depends on your risk tolerance, schedule, and emotional stability.

My Crypto Trading Journey: How I Got Wrecked (And What I Learned)

The 2021 Altcoin Futures Disaster

Here’s the thing. Early 2021 felt like free money in crypto. Everyone was making screenshots of 200% gains on Twitter, and I FOMO’d hard.

On 13 March 2021, at around 10:45 p.m., I opened a long position on ADA/USDT on Binance futures:

- Entry: 1.10

- Size: About 2,500 ADA (~$2,750 notional)

- Leverage: 20x

- Account size: About $1,250

- Stop loss: “In my head,” which means nowhere.

Guess what happened next? Price spiked to around 1.13, I felt like a hero, didn’t secure any profit, then a sudden dump sent it to almost 1.01 in under an hour. Liquidation hit before I even had a chance to react properly. I watched my equity bar go from decent green to zero. Total account blown.

Not gonna lie. I felt sick to my stomach and barely slept that night. That single trade taught me more about the dark side of crypto vs forex than any YouTube video ever did.

What Went Wrong On That Crypto Trade

Here’s where I messed up:

- I used insane leverage with no hard stop placed on the actual platform.

- I overexposed my account, risking basically everything on one setup.

- I traded off hype and social media, not a tested strategy or solid levels.

Crypto volatility plus emotional trading equals disaster. That’s the unfiltered truth.

If you’re thinking crypto vs forex and leaning crypto just for “faster profits,” remember those faster profits come with faster and bigger losses too.

My Forex Story: Smaller Moves, More Control

A EUR/USD London Session Week That Changed My View

At the end of November 2021, I challenged myself: trade only EUR/USD and GBP/USD for one week on IC Markets using MetaTrader 4. No indicators except basic EMAs, support/resistance, and session boxes.

One specific trade on 23 November still sticks with me:

- Pair: EUR/USD

- Account size: About $2,000

- Risk per trade: 1% ($20)

- Position size: ~0.2 lots

- Entry: 1.1255 (break above London session high)

- Stop loss: 1.1235 (20 pips)

- Take profit: 1.1295 (40 pips)

That day, the trade hit full TP in around 2 hours during the London–New York overlap. Profit: roughly $40. Nothing crazy. But here’s the crucial thing:

- I knew exactly how much I was risking.

- I wasn’t glued to the chart overnight.

- The move followed my backtested rules around volatility spikes after the London open.

That single week of trading forex with defined risk and a clear schedule made me realize how different crypto vs forex really felt. Forex was slower, yes, but it was also way easier on my nerves.

Mistakes I Still Made In Forex

Don’t think forex magically fixed everything. I still:

- Closed profitable trades too early because I’d been traumatized by crypto reversals.

- Sometimes the stops move too fast to break even, and you get tagged out before the real move.

- Overtraded on NFP week when spreads widened and the market went wild.

So even in forex, emotion didn’t disappear. It just hit slower and more gently.

Risk And Volatility: Where Crypto Hits Harder

Why Crypto Feels Like A Rollercoaster

Crypto’s volatility is its biggest attraction and its biggest trap. A coin like SOL or DOGE can move 15–30% in a day easily when volume spikes.

- That kind of volatility can multiply small accounts fast. But only if risk is controlled.

- But it can also wipe you out in hours if you’re trading with big leverage and no stop loss.

The smaller market size and thinner order books on many altcoins make big, sudden moves much more likely than in major forex pairs.

Why Forex Feels More “Professional”

Forex pairs like EUR/USD and USD/JPY trade in a huge, regulated environment with deep liquidity.

- Daily ranges are usually narrower in percentage terms.

- Spreads are tight, especially during the London and New York sessions.

- Slippage is usually lower if you trade during liquid times.

So when comparing crypto vs forex, forex generally offers lower volatility and a more stable environment, which many beginners find easier to handle emotionally.

Capital, Leverage, And Position Sizing: How I Size In Each Market

How I Size Crypto Trades Now

After that 2021 disaster, I changed everything about how I trade crypto:

- Max risk per trade: 1–1.5% of account.

- Leverage: Usually 3–5x on futures if at all, often just spot.

- Clear stop loss on the chart, placed on the exchange.

Example from mid-2023:

- Pair: BTC/USDT on Binance

- Account: $1,500

- Risk: 1% ($15)

- Entry: 25,800

- Stop: 25,300 (500 points)

To only risk $15 on a 500-point stop:

Position size = Risk / (Stop distance)

= 15 / 500

= 0.03 BTC notional (then adjust for leverage if using it).

This kind of math keeps me from doing something stupid just because the candles look “juicy”.

How I Size Forex Trades Differently

In forex, pips are smaller and more controlled, so I usually:

- Risk 0.5–1% per trade on majors.

- Use fixed pip stops (e.g., 20–35 pips) depending on the setup.

- Adjust lot size with a simple formula:

For EUR/USD:

Lot size ≈ (Account risk in dollars) / (Stop in pips × pip value)

If:

- Account = $2,000

- Risk = 1% = $20

- Stop = 25 pips

- Pip value for 0.1 lot on EUR/USD ≈ $1

Then:

Lot size ≈ 20 / (25 × 1) = 0.8 mini lots (0.08 standard lots).

That level of precision made forex feel more like running a small business and less like gambling.

Trading Hours, Lifestyle, And Sleep: The Part Nobody Tells You

Crypto’s 24/7 Market Nearly Broke My Sleep

Crypto being 24/7 sounds amazing until you’re lying in bed at 3:12 a.m., checking BTC price because you have an open trade with no stop.https://coinbureau.com/education/crypto-trading-vs-forex-trading/

There were weekends in 2022 where I barely enjoyed anything because I kept thinking, “What if my coin pumps and I miss it?” Classic FOMO. Constantly being “on” burned me out harder than any losing streak.

Forex’s Schedule Was A Relief

Forex runs 24/5 with defined sessions: Asian, London, and New York.

- I started focusing mainly on the London open (around 12–1 p.m. PKT) and the New York overlap.

- No weekend trading meant enforced rest, whether I liked it or not.

When comparing crypto vs forex, if you value your sleep and mental health, forex’s structure might suit you better than crypto’s chaotic 24/7 noise.

Regulation, Brokers, And Security

Why Forex Felt Safer On The Structural Side

Most serious forex brokers are regulated by authorities like FCA, ASIC, CySEC, etc., with rules on client fund segregation and leverage limits.

- That doesn’t make them perfect, but there’s a proper framework.

- You usually know who you’re dealing with and where the company is based.

Platforms like MetaTrader 4, cTrader, and TradingView integration make analysis and execution pretty standardized.

The Crypto Side: Great Freedom, Real Risk

Crypto exchanges vary massively in terms of safety and regulation.

- Some are well-known and battle-tested.

- Others vanish, get hacked, or suddenly change rules.

I remember watching one smaller exchange suddenly freeze withdrawals during a market crash in 2022. I didn’t lose funds there, but it scared me enough to spread my capital across bigger, more reputable platforms and cold wallets.

So, on the topic of crypto vs forex, forex usually wins for structural safety and regulation, while crypto offers more freedom but also more ways to get hurt.

Profit Potential: Where I Made More (And Lost More)

Crypto: Fast Upside, Fast Downside

In 2021–2022, some of my best percentage returns were in crypto:

- A 38% gain swing-trading ETH from around 1,900 to 2,650 on spot.

- A 22% short on BTC during a big dump when it broke a major support on TradingView.

But for every nice winner, there was at least one trade where I:

- FOMO’d into a pump late.

- Panic sold on a 15% dip that later fully recovered.

- Got chopped to death trying to “scalp” altcoins with no clear plan.

The variance was brutal.

Forex: Slower, But More Stable

In forex, my returns per trade were smaller in percentage terms, but my equity curve eventually looked smoother:

- Typical wins: 1–3% per week when trading well with 1R–2R setups.

- Drawdowns: more controlled, usually in the 5–10% zone instead of “disaster.”

When comparing crypto vs forex, I made faster money in crypto but more consistent money in forex. Long term, that consistency mattered more than the rush.

Which Market Fits Which Trader Type?

Crypto Suits You More If…

- You’re okay with big swings and unrealized drawdowns.

- You can stomach 20–30% moves without panic selling.

- You like tech, narratives, and fast-changing environments.

- You’re starting with a smaller capital and are willing to lose it if things go wrong.

Forex Suits You More If…

- You prefer tighter control over risk and more predictable volatility.

- You don’t want to babysit charts 24/7; you prefer defined trading sessions.

- You’re interested in macroeconomics, news events, and calendar-based trading.

- You’re okay with compounding slowly instead of chasing moonshots.

If the question is strictly “crypto vs forex, which is better?” then the better one is whichever aligns with your risk tolerance, schedule, and mindset, not the one with the highest potential reward on paper.

My Current Approach: Why I Trade Both

How I Split My Focus Now

These days, I treat:

- Forex is my “base” market for structured, session-based trading.

- Crypto is my “high-risk satellite,” where I size smaller and accept wild swings.

On a typical week:

- I plan 3–5 potential setups in forex around London and New York session overlaps.

- I take only 1–2 high-conviction crypto trades, often around key BTC and ETH levels or major news events.

This hybrid approach finally gave me some balance between excitement and survival.

Biggest Mistakes I Still Watch For

- Overleveraging in crypto when I feel “extra confident.”

- Revenge trading in both markets after a string of losses.

- Ignoring my own trading plan just because Twitter or Telegram is hyped.

Both markets will punish you if you lose discipline. They just do it at different speeds.

Conclusion: Crypto vs Forex – Which One Is Actually Better?

If you forced a choice and asked, “Crypto vs. forex, which is better?” for most new traders who care about survival more than adrenaline, forex is usually the more forgiving starting point.https://marketinvestopedia.com/crypto-vs-forex-which-trading-is-better-in-2025/

- It’s regulated, liquid, and its volatility is intense but not insane.

- You can build a structured routine around sessions, use modest leverage, and focus on 1–3 major pairs.

Crypto, on the other hand, is amazing if you:

- Already respect risk deeply.

- Are comfortable with extreme upside and downside.

- Treat it as high-risk capital you can afford to lose.

Personally, after blown accounts and slow rebuilds, the truth is simple: forex became my “core business,” crypto my “speculative playground.” That mix keeps me in the game while still giving me exposure to big moves when conditions are right.

If you dig into more strategy breakdowns on traders. site, especially the ones covering risk per trade and psychology, you’ll see that the real edge isn’t picking crypto vs forex. It’s learning to manage yourself in whichever market you choose.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Trading (including both crypto trading and forex trading) involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (profitable weeks, losing streaks, and blown accounts) don’t predict your outcomes.

- Crypto and forex are highly leveraged and volatile markets; prices can move quickly against you, and you can lose more than you expect if you misuse leverage or ignore stops.https://www.goatfundedtrader.com/blog/forex-trading-vs-crypto-trading

- Only risk money you’re completely prepared to lose.

- Before Trading: Practice on demo accounts, start small with real money, track your trades, and focus on proper risk management before scaling up.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ Section

1. Is crypto riskier than forex for new traders?

Yes, in most cases, crypto is riskier than forex for new traders because the volatility is much higher, and moves can be brutal and sudden. When coins can swing 10–30% in a single day, any position that’s sized or leveraged badly can get wrecked fast.

Forex, especially major pairs like EUR/USD and USD/JPY, tends to move in tighter ranges with more predictable reactions to macro news and data releases. That doesn’t make forex safe, but the slower pace gives beginners a bit more breathing room to learn about risk management, stop-loss placement, and trade planning without instant liquidation for every mistake.

2. Can I trade both crypto and forex at the same time?

You can, but you probably shouldn’t start that way. Managing trades across two highly different markets doubles the mental load and makes it easier to overtrade or miss key levels. Crypto vs forex isn’t just a question of assets; it’s a question of time zones, market hours, and volatility rhythms.

A better approach for most beginners is to pick one primary market, build a consistent strategy, and add the other as a secondary market only then. For example, you might focus on London session forex trades during weekdays and only take 1–2 planned crypto swing trades per week, instead of randomly chasing moves in both.

3. Which market is better for small accounts?

For very small accounts, crypto can grow (or die) faster due to volatility and the availability of low minimum trade sizes. You can put $100–$200 into crypto and see big percentage moves when the market trends strongly, but you must accept that you can also lose a huge chunk very quickly.

Forex is more stable, but the smaller percentage moves can make it feel slow with tiny accounts, especially if you’re trading with conservative leverage. That said, the skills learned in forex—position sizing, patience, discipline—often transfer very well later if you decide to scale up or move part of your capital into crypto.

4. Is it easier to learn technical analysis in crypto or forex?

Technical analysis principles like support, resistance, trends, and patterns work in both crypto and forex because they’re applied to price charts, not specific assets. However, forex tends to respect certain technical zones and levels more consistently, especially around key sessions and macro events, because the market is very deep and widely followed.

Crypto charts can be more erratic, especially on low-liquidity altcoins, where wicks and stop hunts are common and sentiment shifts rapidly. Many traders find it easier to develop and backtest a technical system on major forex pairs first, then adapt those skills to crypto once they’re comfortable handling risk and volatility.

5. Which is more regulated: crypto or forex?

Forex is far more regulated globally than crypto. Traditional forex brokers usually operate under frameworks set by regulators such as the FCA, ASIC, or similar authorities, with rules on client fund segregation, leverage caps, and reporting. This doesn’t eliminate risk, but it adds structure and some level of protection for traders.

Crypto regulation remains patchy and varies widely by country. Some exchanges are heavily compliant and transparent, while others operate with minimal oversight, creating more counterparty and platform risk. That’s why, when weighing crypto vs forex from a regulatory safety standpoint, forex generally comes out ahead for now.

6. Can I make a full-time income from crypto or forex trading?

It’s possible, but far harder than social media makes it look. Most traders in both crypto and forex either lose money or struggle to remain consistently profitable over the long term. To even have a chance at a full-time income, you’d need sufficient capital, a proven edge, strict risk management, and the ability to handle long flat or losing periods without blowing up.

A more realistic path is to treat trading as a side income or skill you’re slowly building, rather than expecting instant full-time results. Reinvesting profits, logging trades, and continually improving your process in either market is more sustainable than quitting your job after a couple of lucky weeks in crypto or forex.

7. Should beginners start with demo accounts in crypto or forex?

Beginners should absolutely start with demo accounts in forex because most brokers offer realistic simulations with the same pricing, spreads, and execution environment. That allows you to practice order placement, stop loss usage, and strategy testing without risking real money.

For crypto, demo environments are less standardized, but you can still paper trade using TradingView or small test accounts with minimal capital. Whether you choose crypto vs forex first, the key is to treat demo trading seriously, track your performance, and only move to real money when you have a clear, tested plan and basic emotional control.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 22, 2026

- simpactaku

- 5:26 pm

Financial Disclaimer

Financial Disclaimer