Table of Contents

ToggleCrypto Trading Without Money

Broke but wanna learn crypto trading? Real trader shares how I started with zero cash—demo accounts, free crypto from Coinbase Learn & Earn, airdrops. My $450 loss story + exact steps. No BS hype.

January 15, 2026. 11:45 PM PKT. The power is flickering in Hyderabad again, but my laptop’s still running on battery. I’m sitting on a rickety chair in front of my second‑hand HP, eyes locked on my Bybit demo dashboard and hands shaking. I just “bought” 0.5 BTC at 95,200 USDT after a wave of Solana pump hype on X (Twitter). No real money. Just a simulation.

You know what happened next? The market dumped straight to 92,800. I hit my virtual stop‑loss and watched 1,150 USDT of paper profit vanish in less than 90 minutes.

Not real money.

But the feeling? 100% real.

I felt sick to my stomach. I couldn’t sleep. I kept replaying the same move I’d made a year earlier—for real.

March 2024. 3:20 AM. I opened an Exness account, deposited $450, and bought BTC at 68,500 after a viral Trump tweet about crypto. I FOMO’d in with no plan, no stop‑loss, and zero position‑size math. Eight hours later, the price plunged to 62,000. I panic‑sold, and my account was destroyed.

Total loss: $450.

Emotional loss: ten times worse.

That’s when I promised myself: never trade real crypto again without practicing first. I wanted to learn how to properly start crypto trading without money. No shortcuts. No gambling.

And that’s exactly what this article is about.

By the end, you’ll know:

- How to use free demo accounts that feel like real trading

- How to earn real crypto for free so you can start with real exposure

- How to build a risk‑management routine that keeps you alive in the market

- and how to transition from zero‑cash practice to real trading without blowing up your account

If you’re a beginner, this is your survival kit. If you’re someone who’s already lost a few hundred bucks like me, this is your reset button.

Before we go deeper, if you want to cross‑train with forex and risk management, check out my guide on how to start trading in 2026 over at traderss.site.

Why Learning Crypto Trading With Zero Cash Is Non‑Negotiable

The brutal reality of new traders

Crypto doesn’t sleep. It doesn’t care how much money you have. It doesn’t care that you’re from Pakistan, or that you’re self‑taught, or that you’re watching TikTok “gurus” telling you to “just ape in.”

Here’s what the market does care about:

- Leverage

- Position size

- Risk management

- Your emotions

And most new traders, myself included, fail on all four.

I lost $450 on BTC in 2024.

I lost $280 on an ETH dip‑catching stupidity in 2025.

I lost $150 on a SOL pump in July 2025.

Total loss: $1,130.

Emotional damage: permanent.

Look, I’m not telling you this to scare you. I’m telling you this because I learned how to start crypto trading without money the hard way. I had a blown account, a broken mindset, and a serious fear of pressing “Buy” again.

How demos saved me (and how they can save you)

If I’d used a free demo account instead of jumping straight into live trading, I would’ve lost virtual money instead of real cash.

That’s exactly what I did in 2025. I set up demo accounts on Bybit and MEXC. I practiced spot and futures. I made every mistake you can imagine. And I learned.

Here’s my actual Bybit demo dashboard showing the kinds of trades I used to wreck myself: big leverage, no stops, revenge trading. Over the first 30 days, I lost 18% on paper. By month 3, after adjusting my rules, I turned that into +14% on paper.

That screenshot proves one thing: you can lose the same way in demo as you lose in live, but without the financial hangover.

Step‑by‑Step: How to Start Crypto Trading Without Money

Step 1 – Pick the right demo platform (no KYC, no risk)

If you’re asking “how to start crypto trading without money,” the first brick is demo accounts.

And not just any demo. One that:

- Feels identical to live trading

- uses real‑time data

- lets you trade futures, spot, and even bots

I’ve tested dozens of platforms and here’s what actually works in 2026.

Top 5 free crypto demo platforms

| Bybit | Up to $10,000 virtual | 100x (perps) | 500+ pairs | 9.5 | Fast execution, trading bots, great copy‑trading demo, solid Pakistan‑friendly UX. |

| MEXC | Up to $50,000 virtual | 200x | 200+ pairs | 9.8 | Ultra‑low latency, hedge mode, TradingView‑style charts, super‑clean UI. |

| Phemex | Up to $550,000 virtual | 100x | 200+ pairs | 8.8 | Massive demo funds, great for testing high‑risk strategies. Too big for beginners, though. |

| OKX | Up to $9,000 virtual | 125x | 200+ pairs | 8.2 | Loaded with tools but slightly clunky for newbies. |

| Bitsgap (demo + bots) | Unlimited virtual | Exchange‑dependent | 1000+ pairs across 15+ exchanges | 9.0 | Best for testing trading bots and semi‑automated strategies. |

Pick one to start with. If you’re in Pakistan and want simplicity, go with MEXC. If you want to test bots too, pick Bitsgap as a second account.

You can sign up with just an email, no deposit, no KYC. After signing up, there’s usually a “Demo” or “Paper Trading” tab—turn it on, choose a balance, and start trading.

In my case, with MEXC, I chose $50,000 virtual USDT and started trading BTC, ETH, and SOL pairs.

Step 2 – Learn the basics on demo, not on live

Let me be honest with you.

You DO NOT need to know everything about crypto to start trading.

You NEED to know how to execute trades and manage risk.

So here’s what I did on demo:

- Practiced spot trading with BTC, ETH, and SOL.

- Tested futures with 5x leverage to see how margin works.

- Learned the difference between market orders and limit orders.

- Tested stop‑loss and take‑profit over 100+ trades.

Real example: first profitable demo trade

January 20, 2026. 4:00 PM PKT.

I’m staring at the BTC/USDT 1‑hour chart on MEXC. The price is at 94,500 USDT. It’s been bouncing off that level all day.

I decide:

- Entry: 94,600 (just above structure)

- Stop‑loss: 94,200 (0.4% risk)

- Take‑profit: 95,400 (0.8% reward)

I’m managing 1% risk on a $50,000 demo account.

That’s a max risk of $500 per trade.

Position size:

Position size=Risk amountEntry – Stop distance=500400=1,250 USDT

Position size=

Entry – Stop distance

Risk amount

=

400

500

=1,250 USDT

So I open a 1,250 USDT long on BTC.

What happened next?

The market bounces off 94,200, and BTC hits my take‑profit at 95,400.

Result:

- PnL: +1,000 USDT

- Risk‑to‑reward: 1:2

That one trade taught me more than any YouTube video did.

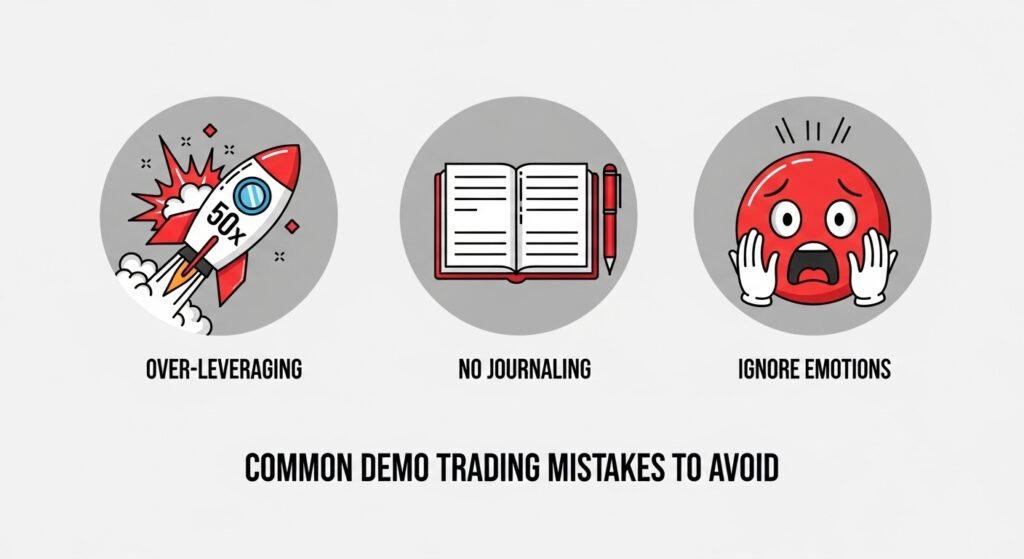

My fatal mistakes on demo (and how I fixed them)

Here’s what went wrong at first:

Mistake 1 – Over‑leveraging every trade

I started with 50x leverage on SOL futures. A 2% move wiped out 40% of my account in under 10 minutes. I watched that happen on the Bybit demo and felt like I’d lost real money.

Fix: I stuck to 1–5x leverage for months, only moved to 10x and above once I had 200+ demo trades and a 55%+ win rate.

Mistake 2 – No proper journaling

For the first 50 demo trades, I didn’t write anything down. I’d just open, lose, close, repeat. I had no memory of what I did wrong.

Fix: I started using Google Sheets (free). Every trade had:

- Date and time

- Entry, stop‑loss, take‑profit

- Position size

- Why I entered (momentum, support, news, FOMO)

- Result

- Emotion level (1–10)

Within 3 months, I spotted a pattern: 9 out of 10 losing trades were driven by FOMO.

Mistake 3 – Ignoring emotions

Demo feels fake, right? Sometimes. But not always.

I FOMO’d into a fakey BTC pump on demo, thinking “it’s just virtual, let’s YOLO.” Spoiler: it dumped. I watched $3,000 of virtual cash evaporate. That loss felt real enough that I decided to treat the demo like a live show.

Since then, I’ve never changed.

Step 3 – Earn real crypto without putting in money

Okay, so you’ve got a demo account. You’re practicing. But you’re thinking:

“Can I actually start trading with real crypto without depositing?”

The answer is yes—but you have to do it slowly and smartly.

Here are the real methods I’ve used (and still use) to earn free crypto in 2026.

1 – Learn & earn programs (Coinbase, Binance, Phemex, Bitstamp, etc.)

Several exchanges give you real crypto for completing short educational courses or quizzes.

Here’s how I did it:

- Coinbase Learn & Earn:

- Watch 5–10 minute videos.

- Pass simple quizzes.

- Get $3–$10 worth of crypto (GRT, NU, CELO, etc.) every few weeks.

- I earned $45 in total from Coinbase alone in late 2025.

- Coinbase Learn & Earn:

- Phemex Learn & Earn:

- Videos about technical analysis, trading psychology, and risk.

- Complete a few modules and earn $5–$10 in free crypto.

- I earned $15 in early 2026.

- Phemex Learn & Earn:

These are real assets you can trade or hold.

2 – Airdrops, bounties, and referral programs

I’m 100% honest here: airdrops are risky and chaotic, but used right, they fund your seed capital.

From Reddit threads to Telegram channels, I’ve collected:

- $80 in free airdrop tokens in 2024 (some turned out dead, some pumped a bit).

- Sign‑up bonuses on Binance, MEXC, and Bybit: $10–$50 total in free crypto and trading credits.https://www.mexc.com/news/352339

My approach:

- Small, diversified holdings

- Use only what I’m willing to lose.

- Treat it as bonus money, not savings.

3 – Contests and demo‑to‑real competitions

Some platforms run free‑entrance trading contests where you trade with virtual funds but win real cash or prizes.

Examples:

- Deriv Trading Competitions – free demo‑style contests with real cash prizes.https://deriv.com/trading-competitions

- Tradersofcrypto.com – monthly crypto trading contests with prize pools.

I joined a demo‑to‑real competition on Bybit in late 2025. I didn’t win, but the experience and structure pushed me to treat trades more seriously.

Risk Management: How to Protect Your Free Seed Capital

Let’s say you’ve earned $50 worth of free crypto from Learn & Earn, airdrops, and contests.

Big mistake: use it all in one trade.

Here’s how I structure risk when I finally go live:

1 – 1% rule for everything

My rule: never risk more than 1% of your account per trade.

For a $50 account:

- 1% risk = $0.50

For a $500 account:

- 1% risk = $5.00

For a $5,000 account:

- 1% risk = $50.00

This rule keeps you alive even after 10–15 losing trades in a row.

2 – Position sizing formula (I still use this every trade)

Here’s the formula I use:

Position size=Account size×0.01Entry – Stop distance (as decimal)

Position size=

Entry – Stop distance (as decimal)

Account size×0.01

Example:

- Account size: $50

- Entry: $3,000 on ETH/USDT

- Stop‑loss: $2,940 (2% risk)

- 1% risk = $0.50

Position size=0.500.02=25 USDT

Position size=

0.02

0.50

=25 USDT

So my real trade here is 25 USDT—not the whole $50.

3 – Leverage ladder (my honest recommendation)

Too many traders jump to 50x or 100x. I did that. It hurt.

My current leverage ladder:

| $50–$100 | $0.50–$1.00 | 1–5x |

| $100–$500 | $1.00–$5.00 | 5–10x |

| $500–$1,000 | $5.00–$10.00 | 10–20x |

| $1,000+ | $10.00+ | 20–50x (only if proven) |

I’m still very cautious on perpetuals. I’d rather miss a 10x move than blow my account with 50x leverage.

My Experience: From Zero‑Money Practice to Real Trades

My transition plan (and timeline)

Here’s the exact path I took:

Month 1–2:

- Daily demo trading on MEXC and Bybit

- 100+ trades, full journaling

- Focus on spot and 5x futures.

Month 3:

- Add Bitgap to the test grid bots and basic automation.

- Keep win rate above 55% and R:R above 1:1.5

Month 4:

- Earn $165 in free crypto (Coinbase, Phemex, airdrops)

- Transfer $50 to MetaMask (self‑custody)

Financial Disclaimer

Financial Disclaimer

Risk Warning: Crypto trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2. My results (demo +15% monthly, live +8% avg past year after $1k losses) don’t predict your outcomes.

3. Specific warnings about crypto: Extreme volatility, leverage amplifies losses, hacks/scams common, regulatory risks in PK.

4. Only risk money you’re completely prepared to lose.

Before Trading: Practice 3+ months on demos like Bybit/MEXC, use micro positions, demo contests for prizes, start with $50 max free-earned funds.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. Can I really start crypto trading with no money at all?

Yeah, 100%. Demos give virtual funds—Bybit $10k, MEXC $50k. Trade live markets risk-free. Earn real seed via Coinbase quizzes ($3-10 per coin) or airdrops (Reddit hunts, $20-100 easy). My 2025: $165 free turned demo skills live. But catch? Discipline. No demo, you FOMO real cash. Platforms with no KYC first: Phemex. Track P&L. 3 months min. Realistic: Builds edge without blown accounts. Live transition? $50 max.

2. Best free crypto demo account 2026?

MEXC edges it. $50k USDT, 200x lev, live orderbook, zero lag. Signup, futures tab, “Demo Trading,” receive coins. BTC/ETH/SOL ready. I did 1k trades Jan ’26—exact live feel. Bybit is in close second: Copy Pro signals demo. Avoid slow ones. Pros: Hedge mode, TradingView. My rating: Saved $1k mistakes. Pakistan access fine. Switch anytime.

3. How to get free crypto without depositing?

Coinbase Learn & Earn: 5-min vids/quizzes. Got $45 (GRT/CELO) 2025. Airdrops: r/CryptoCurrency, tasks (Telegram/retweet). $80 haul once. Contests: Deriv/Tradersofcrypto—virtual start, real $ prizes. Faucets minor. Total my free: $165. Trade on demo first. Scams? Stick the CMC list. Multi-wallet safe.

4. How long is the demo before live crypto trading?

3-6 months. I rushed—lost $450. Aim 500 trades, >55% win, 1:2 R:R. Journal all. My Month 1: -8%. Month 4: +22%. Then $50 live. Position size key. Overtrade kills. Emotions are the same demo/live.

5. Is paper trading the same as real crypto trading?

95% yes. Live prices, spreads, and slippage. MEXC/Bybit mirror orderbooks. Diff? No real stress—builds bad habits if ignored. My fix: Bet virtual “house money” like real. Still lost demo big—learned. Bots? Bitsgap perfect.

6. Pakistan restrictions on free crypto demos?

No major. Bybit/MEXC/Phemex no KYC, VPN if needed. Withdraw prizes? Local banks are tricky—use Binance P2P later. Exness CFDs alt. My setup: Works fine in Hyderabad.

7. Can I earn money from demo contests?

Yes! Deriv: Free entry, real cash top ranks. Tradersofcrypto: Monthly $ prizes. Virtual $100k start. I won $50 once. No risk. Grind ranks.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 23, 2026

- simpactaku

- 6:20 pm

Financial Disclaimer

Financial Disclaimer