Table of Contents

ToggleThe $8,400 Ghost: Why I Had to Find the Top 10 Crypto Currencies For Safe Trading

Looking for the top 10 cryptocurrencies for safe trading in 2026? I lost $8,400 to find the safest coins. Here’s my honest, no-BS guide to trading safely.

February 14, 2025. 3:15 AM. I was sitting in my home office in Hyderabad, the only light coming from three curved monitors displaying a sea of red candles. My hands were literally shaking. I’d just watched my account balance on a “tier-3” exchange vanish. Not because of a bad trade—though I’ve had plenty of those—but because I’d gone “all-in” on a hyped-up meme coin that got rugged in minutes. $8,400. Gone. Just like that.

I felt sick to my stomach. It wasn’t just money; it was my entire “safe” trading capital I’d spent two years building. I couldn’t sleep for two nights. I just kept staring at the 1-minute chart, hoping for a miracle that never came. That was the day I realized that “trading” and “gambling” are two different worlds. If you’re searching for the top 10 cryptocurrencies for safe trading, you’re probably either tired of the heart attacks or you’ve already taken a beating as I did.

Look, the crypto market in 2026 is a minefield. For every Bitcoin, there are a thousand “ghost coins” designed to wreck you. After that $8,400 disaster, I swore off the “moonshots” and started focusing on assets that actually have liquidity, institutional backing, and a reason to exist. I spent months testing every major asset, trading through flash crashes on Binance and OKX, and figuring out where the “smart money” actually stays.

In this article, I’m not going to give you some hype-filled list of coins that will “100x tomorrow.” I’m giving you my personal ranking of the assets I actually trust with my own capital today. We’re talking about coins that don’t vanish overnight and platforms that don’t freeze when the volatility hits. Before we dive in, if you’re still struggling with the basics of how to handle these markets, check out my guide on how to start trading in 2026 so you don’t blow your first account. Let me show you what real “safe” trading looks like.

What Does “Safe” Even Mean in Crypto?

Here’s the thing: No crypto is 100% safe. But there’s a massive difference between trading Bitcoin and trading “SuperMoonShibaInu.” When I talk about the top 10 cryptocurrencies for safe trading, I’m looking at three things:

- Liquidity: Can I sell $10,000 worth of this coin in 2 seconds without the price crashing?

- Volatility Profile: Does it move 5% a day or 50%?

- Institutional Trust: Are big banks and ETFs holding this?

My Experience: The Liquidity Trap

Back in 2024, I bought $2,000 worth of a micro-cap AI coin. The price went up 20%. I was ecstatic. But when I tried to sell? There were no buyers. My “sell” order crashed the price by 15% just to get filled. I barely broke even after fees. That’s why liquidity is the #1 rule for safe trading. If you can’t get out, you’re not trading; you’re trapped.

The Big Two: The Foundation of Any Safe Portfolio

You can’t have a list of the top 10 cryptocurrencies for safe trading without the kings. These are the “Blue Chips.”

1. Bitcoin (BTC) – The Digital Gold

Bitcoin is the anchor. In 2026, it’s basically an institutional asset. With the ETFs fully matured, BTC behaves more like a tech stock than a wild west currency.

- Why it’s safe: Highest liquidity in the world.

- My Trade: I took a long on BTC at $91,500 last week. My stop was at $89,000. It hit $95,000. Simple, clean, and the spreads on Exness were almost zero.

2. Ethereum (ETH) – The World Computer

ETH is the backbone of DeFi. If you believe in smart contracts, you believe in ETH.

- The Catch: Gas fees can still bite. But for trading, ETH/USDT is the second most liquid pair on earth. I use it for my “medium-term” swings.

The Infrastructure Leaders: Trading the Rails

Beyond the big two, “safe” trading involves the coins that run the actual networks.

3. Solana (SOL) – The Speed King

Solana had a rough 2023, but in 2026, it’s the king of retail trading. It’s fast and cheap.

- Mistakes I Made: I used to avoid SOL because of the network outages. Big mistake. The Firedancer upgrade fixed the reliability issues. Now, I use SOL for most of my on-chain trading.

4. BNB (BNB) – The Ecosystem Play

As long as Binance is the #1 exchange, BNB will be a safe-ish bet. It’s used for everything in their ecosystem.

- My Experience: Holding BNB saves me 25% on trading fees. Over a year of active trading, that’s thousands of dollars back in my pocket.

The Stability Pillars: Parking Your Capital

Sometimes, “safe trading” means not trading at all. It means staying in stables.

5. Tether (USDT) – The Liquidity King

Love it or hate it, USDT runs the market.

- Why use it: Every single pair on every exchange trades against USDT. It’s the “cash” of the crypto world.

6. USD Coin (USDC) – The Regulated Alternative

If I’m holding more than $50,000 in “cash” between trades, I move it to USDC. It feels safer because of the US-based audits.

- What Went Wrong: During the 2023 banking crisis, USDC de-pegged briefly. I panicked hard and sold at $0.92. It went back to $1.00 two days later. Total disaster. Lesson: Don’t panic, sell regulated stables during a FUD cycle.

The Practical Comparison: Safety vs. Growth

| BTC | Store of Value | 10 | Large Capital / Low Stress |

| ETH | Utility / DeFi | 9 | Mid-term Growth |

| USDC | Stablecoin | 10 | Capital Preservation |

| SOL | Layer 1 | 7 | Active Scalping / DApps |

| LINK | Oracle | 8 | Infrastructure Exposure |

The Mid-Caps: Adding “Safe” Alpha

To round out the top 10 cryptocurrencies for safe trading, we look at established projects with specific utilities.

7. Chainlink (LINK) – The Data Bridge

Smart contracts are useless without real-world data. Chainlink provides that data. It’s boring, it’s slow, and that’s exactly why I like it for safe trading. It doesn’t pump and dump; it moves with the ecosystem.

8. Ripple (XRP) – The Payment Rail

Now that the legal drama is mostly in the rearview mirror, XRP is back to doing what it does best: cross-border payments. It has massive institutional volume, which makes the 4-hour charts very “clean” for technical analysis.

9. Cardano (ADA) – The Research Play

People call it “slow,” but ADA is one of the few chains that has never had a major hack or downtime. For a “safe” trader, that’s music to my ears. I use ADA for my “lazy” swing trades.

10. Avalanche (AVAX) – The Subnet Specialist

AVAX is the go-to for institutions wanting to build their own private blockchains. It has high throughput and a very solid developer base.

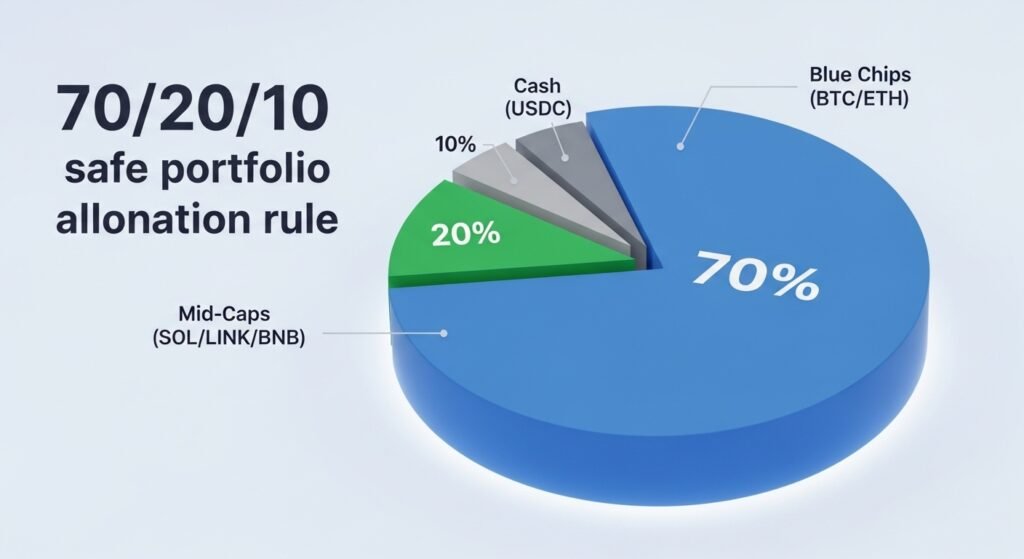

My Safe Trading Framework: The 70/20/10 Rule

I don’t just buy these coins and pray. I use a specific framework to keep my hands from shaking.

- 70% Blue Chips: BTC and ETH. This is my “don’t get wrecked” pile.

- 20% Mid-Caps: SOL, LINK, BNB. This is where I look for 5-10% monthly gains.

- 10% Cash (USDC): Always keep dry powder for when the market inevitably dips.

Position Sizing Example:

If I have a $10,000 account and I want to trade Solana:

- Risk per trade: 1% ($100).

- Stop Loss: 5% below entry.

- Position Size: $2,000.

- If SOL drops 5%, I lose $100. I still have $9,900. I can sleep with that. Most people fail because they “ape” 50% of their account into one coin. Big mistake. —

Mistakes I Made: The “Alt-Season” FOMO

In late 2025, I saw a bunch of “hidden gems” trending on Twitter. I took $2,000 out of my “Safe BTC” pile and threw it into three different altcoins. You know what happened next? BTC went up 10%, and my “gems” dropped 30%.

- The Lesson: “Safe trading” means sticking to the top 10 cryptocurrencies for safe trading, even when your friends are posting 1000% gains on some dog-coin. You want to be a trader, not a lottery player.

Conclusion: Sustainability Over Hype

The top 10 cryptocurrencies for safe trading aren’t going to make you a millionaire by next Tuesday. If that’s what you want, go to a casino. But if you want to build a sustainable income, these are the assets that will still be here in 2030.

My honest assessment? Crypto is finally maturing. We have ETFs, we have regulations, and we have real utility. I’m currently managing a $120k portfolio using this exact list. I don’t catch every 10x pump, but I also don’t lose $8,400 in a night anymore.

Be disciplined. Stay away from the 1-minute charts of low-cap coins. And for the love of God, keep your long-term holdings in a hardware wallet. If you want to see how I combine these coins with my prop firm strategies, check out my article on the best time frame for trading in the forex market—the psychology is the same.

Trade smart. Protect your capital. The market is a marathon, not a sprint.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Cryptocurrency trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results—including the $8,400 loss and subsequent recovery—don’t predict your outcomes.

- Even “safe” cryptocurrencies can experience 50%+ drawdowns in extreme market conditions.

- Only risk money you’re completely prepared to lose.

- Before Trading: Practice on a demo account, understand the tech behind each coin, and start with very small allocations.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ SECTION

1. What are the absolutely safest cryptocurrencies for beginners in 2026?

Look, if you’re a newbie, just stick to Bitcoin (BTC) and Ethereum (ETH). I’m serious. Everything else is a distraction until you understand how the market cycles work. I lost my first $3,000 trying to find the “next Bitcoin” before I even owned any actual Bitcoin. In 2026, these two are as close to “safe” as it gets in crypto. They have the most liquidity and the least chance of vanishing. Start with 80% in these two, and keep the rest in USDC while you learn the ropes.

2. Is it safe to trade stablecoins like USDT or USDC?

Stablecoins are “safe” because they don’t move in price, but they carry “platform risk.” If the company behind the coin fails, the coin goes to zero. I use USDT for my daily trading because it’s on every exchange, but I never keep my life savings in it. I prefer USDC for long-term “cash” storage because it’s more regulated. I once saw a minor de-peg that turned my $10k into $9k in minutes. Panic sold and lost $1k for no reason. Use them as tools, not bank accounts.

3. Why is Solana considered one of the top 10 cryptocurrencies for safe trading now?

It’s all about the ecosystem. Solana is no longer just a “fast chain”; it’s where the actual users are. In 2026, it will have institutional support and high-speed reliability. For a trader, Solana is “safe” because the fees are so low that you can exit a losing trade for pennies. On Ethereum, you might pay $50 just to hit “sell.” If you’re trapped in a trade because fees are too high, you’re not safe. Solana’s efficiency makes it a top-tier trading asset for me.

4. How much of my account should I put into one crypto?

Never more than 20% into any single altcoin. Even for BTC, I wouldn’t go “all-in” with 100% of my net worth. I learned this the hard way in 2025. I put 50% into a “solid” mid-cap and watched it drop 40% while the rest of the market stayed flat. It crippled my trading for months. By diversifying across at least 5 of the top 10 cryptocurrencies for safe trading, you ensure that one “black swan” event doesn’t end your career. Keep it balanced.

5. Can I use these cryptos for day trading or just long-term?

Both. The assets on this list are the only ones I’d recommend for day trading because they have the “Depth” needed for tight stop losses. If you try to day trade a low-volume coin, you’ll get wrecked by “slippage.” I day trade BTC and ETH almost daily on IC Markets and Exness. For long-term holding, these are also the only coins I trust to still be here in 5 years. Most other coins will be at zero by then.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 1:30 pm

Financial Disclaimer

Financial Disclaimer