Table of Contents

ToggleThe $1,200 Lesson: Why Pips Aren’t Just Numbers

I lost $1,200 ignoring pips. Learn what a pip in Forex trading beginners should understand in 2026 through my actual wins, fails, and MT4 disasters.

Tuesday, January 13, 2026. 3:45 PM. I’m sitting in front of my TradingView charts, hands literally shaking. I’d just watched my account balance drop by $1,200 in less than six minutes. Want to know the worst part? I actually got the direction of the trade right. I went long on GBP/USD at 1.2650, expecting a bounce. It bounced. But because I didn’t actually grasp the math behind the move and didn’t truly understand what a pip is in Forex trading, beginners should understand that in 2026, I over-leveraged. A tiny 15-pip “stop run” before the actual move wiped me out.

I felt sick to my stomach. It wasn’t just the money; it was the stupidity of it. I’d spent weeks looking at flashy “Lambo” lifestyle posts on Twitter, but I hadn’t spent ten minutes learning how to calculate the value of a single price tick. If you’re reading this, you’re probably where I was. You want to trade, you want the freedom, but these terms like “pips,” “pipettes,” and “lots” feel like some secret code designed to keep you out.

Look, here’s the thing. If you don’t master this, you aren’t trading; you’re gambling. And the house (the big banks) will win every single time. This isn’t some dry textbook definition. This is the heartbeat of every trade you’ll ever take. In this post, I’m going to break down exactly what a pip is, why it changes based on what you’re trading, and how I finally stopped blowing accounts by actually doing the math.

Before we go deeper, you might want to check out my other guide on How to Set Up Your First MT4 Account, so you can follow along with these examples on a real chart.

Let’s Get Real: What Is a Pip, Anyway?

Look, forget the complex jargon for a second. In the simplest terms possible, a “pip” is the unit of measurement for change in value between two currencies. Think of it like a “cent” to a dollar, but way smaller. Most currency pairs are priced out to four decimal places. That fourth decimal place? That’s your pip.

So, if EUR/USD moves from 1.0850 to 1.0851, that’s a 1-pip move. Sounds tiny, right? It is. But when you’re trading thousands of dollars, that tiny move is what puts food on the table or—if you’re like me back in 2025—gets you wrecked.

The Fourth Decimal Rule

Most pairs follow this rule. Whether it’s AUD/USD, USD/CAD, or EUR/GBP, you’re looking at that fourth digit. But here’s the catch. Not everything follows this. You’ve got the Japanese Yen (JPY) pairs, which are the weird cousins of the Forex world. They only go to two decimal places. For USD/JPY, a move from 148.20 to 148.21 is a 1-pip move.

What the Heck is a Pipette?

You’ll see a fifth decimal on platforms like IC Markets or Exness. That’s a “pipette” or a fractional pip. It’s like a tenth of a pip. Honestly? Don’t stress too much about them early on. They’re great for tight spreads, but they can be confusing when you’re trying to calculate your risk. I remember staring at my MT4 dashboard thinking I was up 100 pips, only to realize I was up 10.0 pips. Total facepalm moment.

My Experience: The Day I Mixed Up Pips and Dollars

It was February 2026, just a few weeks ago. I was trading USD/JPY on my phone while waiting for a coffee. I saw a massive rejection candle on the 15-minute chart. I figured, “Hey, this is a quick 20-pip scalp.”

I entered a 2-lot position. Now, if you know your math, you know a 2-lot position on JPY pairs is roughly $13-14 per pip, depending on the exchange rate. I thought I was trading 0.2 lots.

The price moved 5 pips against me. In my head, I’m down maybe $7. I look at my screen, and I’m down nearly $70. I panicked hard. My heart started racing. I closed the trade immediately out of pure fear. Two minutes later? Price went exactly where I thought it would. Had I stayed in, I would’ve made $280. Instead, I lost $70 because I didn’t understand the relationship between pips and lot sizes in that specific pair.

Why Beginners Should Understand This in 2026

The market in 2026 is faster than ever. With AI-driven algorithms and high-frequency trading, pips can fly by in seconds. If you don’t have a “pip-to-dollar” mental map, you’ll make emotional decisions. And emotional decisions are the fastest way to a blown account.

How to Calculate Pip Value Without Losing Your Mind

You don’t need a PhD in math, but you do need to know how this works. The value of a pip depends on three things:

- The currency pair you’re trading.

- The size of the trade (Lot size).

- The current exchange rate.

The Basic Formula

If you want to be precise, the formula is:

$(1 \text{ pip} / \text{Exchange Rate}) \times \text{Lot Size} = \text{Pip Value}$

But let’s be honest. Nobody does that in their head while the market is moving.

The “Rule of Thumb” for USD-Account Traders

If your account is in USD and the USD is the second currency in the pair (the quote currency), the math is easy:

- Standard Lot (1.00): 1 pip = $10

- Mini Lot (0.10): 1 pip = $1

- Micro Lot (0.01): 1 pip = $0.10

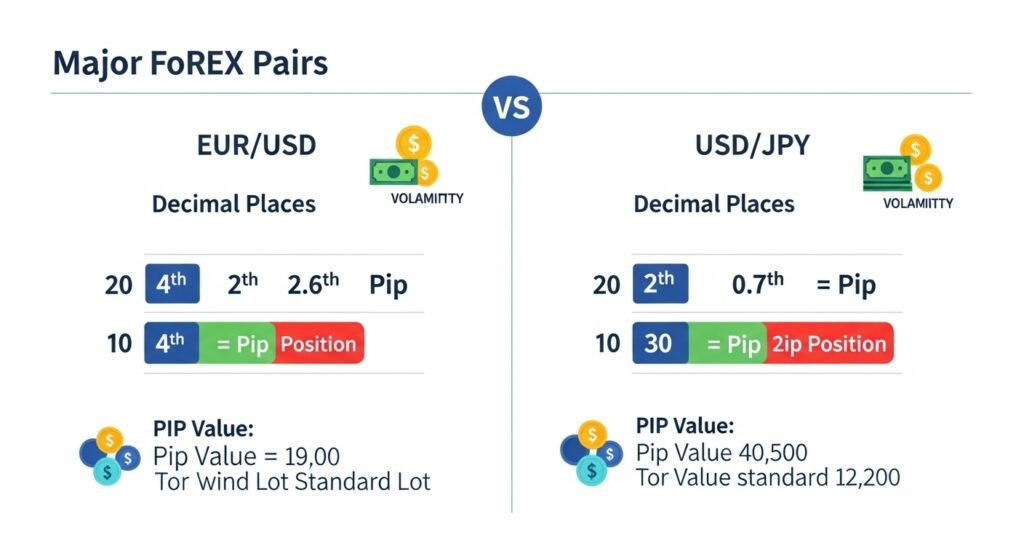

Comparison: Major Pairs vs. Yen Pairs

| Decimal Places | 4 Decimal Places | 2 Decimal Places |

| Pip Position | 0.0001 | 0.01 |

| Pipette | 5th Decimal | 3rd Decimal |

| Volatility | Moderate | High/Spiky |

| Pip Value (per 0.1 lot) | Approx. $1.00 | Varies by rate |

Mistakes I Made (So You Don’t Have To)

1. Thinking All Pips Are Equal

I used to think a 50-pip stop loss on Gold (XAU/USD) was the same as a 50-pip stop loss on EUR/USD. Spoiler: It’s not. Gold moves like a caffeinated squirrel. A 50-pip move on Gold can happen in 30 seconds and, depending on your broker, might be calculated differently. I once took a “small” Gold trade and lost $400 because I didn’t realize how much the “pip” value (or tick value) differed from Forex.

2. Ignoring the Spread

When you enter a trade, you’re already down. Why? The spread. If the spread is 2 pips, you start -2 pips in the hole. I used to set my take profit at 10 pips, but because of a 2.5-pip spread, the price had to move 12.5 pips for me to win. I missed so many targets by half a pip because I didn’t account for the spread. It’s infuriating.

3. The “Lot Size” Trap

This is the big one. Beginners often focus on the $ amount of money they want to make. “I want to make $100 today.” So they crank up the lot size to 0.5. But they only have a $500 account. That means a 10-pip move—which is nothing, literally a random fluctuation—wipes out 10% of their account.

Practical Example: Setting Up a Trade

Let’s look at a real-world scenario. Say you’re looking at What Is a Pip in Forex Trading? Beginners Should Understand in 2026, and you want to apply it to a GBP/USD trade.

- Account Balance: $1,000

- Risk per trade: 2% ($20)

- Entry Price: 1.2700

- Stop Loss: 1.2680 (20 pips)

To find your lot size:

$20 \text{ risk} / 20 \text{ pips} = $1 \text{ per pip}$.

Looking at our rule of thumb, $1 per pip = 0.10 lots.

If you had just guessed and put in 0.5 lots, that 20-pip stop would have cost you $100 (10% of your account). Do that five times, and you’re halfway to a blown account. This is why the math matters.

My Experience: The “Flash Crash” of 2025

I remember a specific Wednesday. I was shorting EUR/USD. I had a 15-pip stop loss. Suddenly, some news dropped—I think it was an unexpected inflation report. The price spiked 40 pips in a second. My stop loss didn’t trigger at 15 pips because the market “gapped.” It closed me out at 32 pips.

I was furious. I felt cheated. But here’s the reality: that’s part of the game. If I hadn’t understood that those 17 extra pips of “slippage” were a possibility, I would’ve been trading way too big. Because I knew my pip values, I only lost $64 instead of the $30 I planned. It sucked, but I lived to trade another day.

Using Pips to Measure Success, Not Dollars

One of the best pieces of advice I ever got was from an old-school trader on a forum. He told me, “Stop looking at your P&L in dollars. Look at it in pips.”

When you focus on dollars, you get emotional. You see $100 and want to click ‘close’ because you’re scared of losing it. Or you see -$50, and you feel like a failure. But if you see +10 pips or -5 pips, it’s just data. It’s a game of numbers.

Why Pips Help Your Psychology

- Consistency: Making 50 pips a week is a measurable goal.

- Scalability: If you can make 50 pips on a $100 account using micro-lots, you can make 50 pips on a $100,000 account using standard lots. The strategy doesn’t change; only the zeros do.

- Objective Analysis: It’s easier to review your trades. “I took a 20-pip loss because I entered late” is better than “I lost $40 and now I’m mad.”

What Went Wrong: A Case Study in “Pip Blindness”

I want to show you a trade I took on USD/CAD back in November 2025. I’ll be honest, it was a total disaster.

- The Setup: Price was hitting a major resistance level at 1.3600. I decided to go short.

- The Error: I didn’t check the spread during the New York/London overlap. The spread had widened to 4 pips.

- The Execution: I set a very tight stop loss of only 10 pips.

- The Result: As soon as I clicked “Sell,” I was already 4 pips down. The price moved 7 pips against me—which is a normal breath for USD/CAD—and I was stopped out. Total time in trade: 45 seconds. Loss: $50.

The Lesson? I didn’t give the trade “room to breathe” because I was trying to be too precise with pips without accounting for the cost of entry. I was being greedy, plain and simple. Not gonna lie, I almost threw my mouse at the wall. But that’s trading. You pay your “market tuition” until you learn.

Advanced Pip Concepts for 2026

As we move through 2026, things are getting a bit more technical. You’ll hear people talk about “Average Daily Range” (ADR) in terms of pips.

ADR and Pips

The ADR tells you how many pips a pair moves on average in a day. For example, if EUR/USD has an ADR of 80 pips, and it’s already moved 75 pips today, the chances of it moving another 40 pips in the same direction are slim. I used to FOMO in at the end of a move, not realizing the pair had already “exhausted” its pips for the day.

Cross Pairs and Pip Volatility

Pairs like GBP/JPY (The “Dragon”) can move 150-200 pips in a single day. Comparing that to EUR/CHF, which might move 30 pips, is like comparing a Ferrari to a bicycle. You cannot use the same risk settings for both.

Comparison Table: Volatility by Pair (2026 Estimates)

| EUR/USD | 70-90 | The “Reliable” One |

| GBP/JPY | 140-180 | The “Beast” (High Risk) |

| USD/CAD | 80-100 | Choppy, News Driven |

| AUD/NZD | 50-70 | Slow, Ranging |

Want to see how I handle high-volatility pairs? Read my GBP/JPY Survival Guide for some hard-won tips.

How to Check Pips in MetaTrader 4 (MT4)

If you’re using MT4 or MT5, there’s a handy tool called the “Crosshair.”

- Click the middle mouse button or the crosshair icon.

- Click and drag from point A to point B.

- You’ll see three numbers (e.g., 10 / 150 / 1.0850).

- The first number is the number of bars.

- The second number is the points (pipettes). To get pips, just drop the last digit. So, 150 points = 15 pips.

- The third number is the price.

I spent my first three months manually subtracting prices on a calculator like an idiot. Use the crosshair. It saves time and prevents math errors when you’re stressed.

Conclusion: Mastering the Measurement

At the end of the day, understanding what is a pip in Forex trading beginners should understand in 2026 is about one thing: Control. The market is a chaotic, emotional place. Pips are the only objective way to measure that chaos.

Don’t be the trader who asks, “How much money can I make?” Be the trader who asks, “How many pips am I risking, and what is each one worth?”

Look, I’m not some guru with a 100% win rate. I still take pips to the face sometimes. I still get slippage. But I don’t blow accounts anymore. I don’t feel sick when I lose a trade because I know exactly how much those pips cost me. It’s a business expense, not a personal failure.

Start small. Use micro-lots. Count your pips. Focus on the process, and the dollars will eventually take care of themselves.

If you’re ready to move past pips and into actual setups, check out my breakdown on Price Action Secrets or learn how I manage my Daily Trading Routine.

Stay disciplined. Don’t FOMO. And for the love of everything, do your pip math before you hit that “Buy” button.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Forex trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (losing $1,200 in a single session, regular 20-30 pip losses) don’t predict your outcomes.

- Currency trading involves high leverage, which can result in losses exceeding your initial deposit.

- Only risk money you’re completely prepared to lose.

- Before Trading: Always practice on a demo account for at least 3-6 months and start with small “cent” accounts before committing significant capital.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ: Everything You’re Still Wondering About Pips

1. Can pip values change during a trade?

Yes, they actually can, though for major pairs the change is usually negligible. Since the pip value is often tied to the exchange rate of the “quote” currency against the USD, if that rate moves drastically while you’re in a long-term trade, your pip value fluctuates. For example, if you’re trading a “cross” pair like EUR/GBP and you have a USD account, the value of those pips depends on the GBP/USD exchange rate. If GBP/USD crashes, your EUR/GBP pips are actually worth less in dollar terms. It’s a bit “Inception-style” math, but for most day traders, the change is so small it won’t break your strategy. Just be aware of it if you’re holding positions for weeks.

2. Why do some brokers show 5 decimals instead of 4?

This is the difference between “4-digit” and “5-digit” brokers. Back in the day, everything was 4 digits. But as technology improved, brokers wanted to offer tighter spreads to attract traders. By adding a 5th decimal (the pipette), they can offer a spread of 1.2 pips instead of just 1 or 2. It’s actually better for you because it reduces your transaction costs. However, it’s a nightmare for beginners’ eyes. Just remember: the 4th digit is the pip, and the 5th digit is just a “fraction.” If your screen shows 1.08505, and it moves to 1.08515, you just gained exactly 1.0 pips.

3. Is a pip the same thing as a “point”?

In the Forex world, they are often used interchangeably, but technically, they aren’t the same. Usually, a “point” refers to the smallest possible price change a broker can show. On a 5-digit broker, a point is a pipette (the 5th decimal). On a 4-digit broker, a point is a pip. However, when you move into indices like the S&P 500 or Gold, people almost always use the term “points.” For example, if the S&P 500 moves from 4500 to 4501, that’s a 1-point move. Don’t let the terminology trip you up; just ask your broker what the “minimum tick size” is for whatever asset you’re trading.

4. What is the highest value a pip can have?

Technically, there’s no “limit,” because it depends entirely on your lot size. If you’re a hedge fund manager trading 1,000 standard lots, a single pip is worth $10,000. For us retail traders, the “highest” value usually comes when you’re over-leveraged. If you use 100:1 leverage on a $1,000 account and go “all in” with 1.0 lot, a pip is worth $10. That means a 100-pip move (which happens every day) can either double your money or delete your entire account. The “value” isn’t what matters—it’s the percentage of your account that the value represents.

5. How do I know my pip value for “exotic” pairs?

Exotic pairs like USD/TRY (Turkish Lira) or USD/ZAR (South African Rand) have wild exchange rates. Trying to do the math manually is a recipe for a headache. The best way is to use a “Pip Calculator.” Most big sites, like Myfxbook or BabyPips, offer them for free. You just plug in your account currency, the pair, and your lot size. I always check this before trading a pair I’ve never touched before. I remember trying to trade the Mexican Peso (USD/MXN) once and being shocked a how different the pip value was. Save yourself the stress—use a calculator.

6. Do pips matter in Crypto trading?

Not really. In Crypto, people usually talk in terms of percentages or “points/dollars.” If Bitcoin moves from $60,000 to $61,000, that’s a $1,000 move or a 1.6% move. You won’t hear many people saying “Bitcoin went up 10,000 pips.” However, some Forex brokers offer Crypto pairs (like BTC/USD) on MT4, and they will display them in a pip-like format. In those cases, the “pip” is usually the last whole dollar or the first decimal. It’s confusing, which is why most crypto-native traders just stick to percentages.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 5:26 pm

Financial Disclaimer

Financial Disclaimer