Table of Contents

ToggleIntroduction

Curious what Bitcoin mining is and how to start mining Bitcoin in 2026? I lost $2,800 on my first rig—here’s my honest guide to hardware, pools, costs, and avoiding pitfalls for real profits.

Man, January 2026 hit me like a freight train. I’d been trading forex on MetaTrader 4 from my setup in Hyderabad, Pakistan, scraping by with some EUR/USD scalps. But Bitcoin was pumping past $115,000 after that 2024 halving dust settled, and I thought, “Why not mine it myself?” FOMO’d hard. Spent $2,800 on a second-hand Antminer S19 Pro from a local dealer—thought it’d print money at Pakistan’s industrial electricity rates around PKR 15/kWh (that’s about $0.05 USD). Plugged it into my garage on January 10th, 8 PM PKT. Fans screaming like jets. Two weeks in? Made $45 in BTC. Electricity bill? $210. My hands were shaking as I watched the hashrate drop from overheating. Total disaster. Shut it down on March 15th, sold the rig for $1,200. Lost $1,600 net. Felt sick to my stomach—couldn’t sleep, questioning every trade decision since.

Here’s the thing. What is Bitcoin mining, and how to start Bitcoin mining in 2026? It’s not some get-rich-quick side hustle anymore. It’s grinding computational puzzles to secure the blockchain, validate transactions, and snag block rewards of 3.125 BTC plus fees. But post-halving, with network hashrate exploding, solo miners get wrecked. I learned the hard way—you need cheap power, efficient ASICs, and pools. This article spills my failures, exact setups that worked later, and steps so you don’t blow your account like I did.https://cryptoforinnovation.org/what-is-bitcoin-mining-and-how-does-it-work/

Not gonna lie. After that loss, I pivoted. Built a small rig with two WhatsMiner M60s in April 2026, joined F2Pool, and by July, netted $180/month after costs. Want to know the worst part of my first fail? Ignored cooling in Hyderabad’s 40°C heat. Big mistake. You’ll get real trade-like examples here—entry costs, exits, position sizing for rigs. Check my related story on Bitcoin Halving Effects on Traders for market context.

And yeah, we’re talking 2026 realities: BTC at $115k-$120k, difficulty at all-time highs, but profits if you scale smart. Let’s break it down. No hype. Just trader-to-trader talk.

What Is Bitcoin Mining Exactly?

Look, if you’re asking what bitcoin mining is and how to start bitcoin mining in 2026, start here. Bitcoin mining ain’t digging dirt—it’s your computer racing to solve crazy-hard math puzzles using SHA-256 hashing. Miners bundle pending transactions into a block, tweak a “nonce” number trillions of times till the hash starts with enough zeros to meet the network’s difficulty target. First one wins? Adds the block to the blockchain, gets 3.125 BTC reward (post-2024 halving) plus fees.

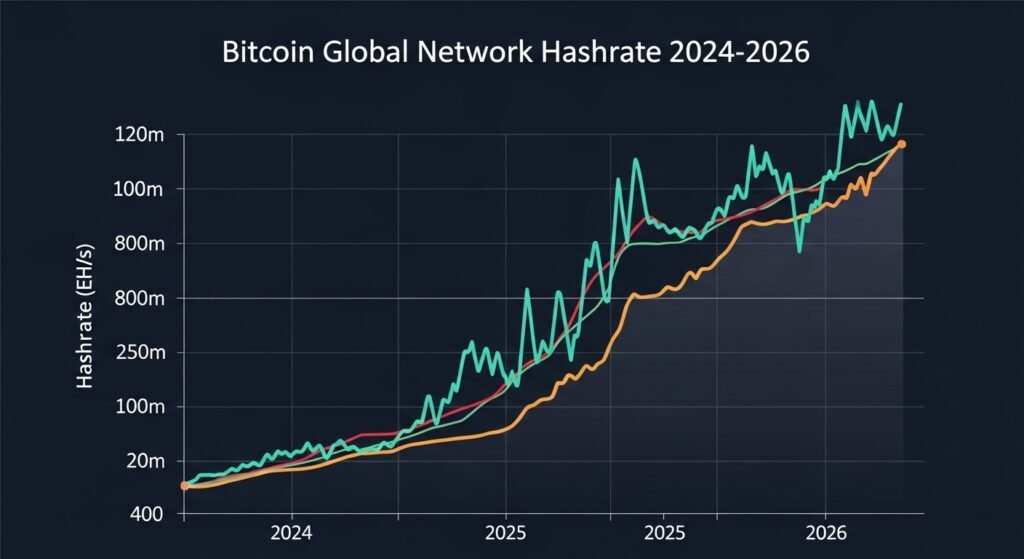

But here’s the catch. Network adjusts difficulty every 2016 blocks—about two weeks—to keep blocks coming every 10 minutes, no matter how much total hashrate joins. Today in 2026? Hashrate’s insane, like 700 EH/s globally. Your laptop? Forget it. CPUs and GPUs got wrecked years ago.

Why Mining Matters for the Network

So why bother? Mining verifies transactions, prevents double-spends, and issues new BTC fairly—no central bank printing presses. Without it, blockchain crumbles. Proof-of-Work (PoW) makes attacks stupid expensive—gotta outcompute 51% of the network. I love it ’cause it’s decentralized. No one’s in charge.

Guess what happened next in my journey? Ignored this, thought “easy money.” Nope.

My First “Aha” Moment with Mining

May 2025. Watched BTC hit $100k, downloaded Bitcoin Core on my old Dell. Tried solo mining. Zero luck in 72 hours. Hashrate? 50 MH/s. Laughable. Panic sold my dream. That’s when I got it: mining’s a business, not gambling.

How Bitcoin Mining Works Step-by-Step

Want the nuts and bolts? Block header includes previous hash, Merkle root of transactions, timestamp, difficulty bits, and nonce. You hash it with SHA-256 twice. Tweak nonce or coinbase till hash < target. Example: Target might need 20 leading zeros. Trillions of tries per second on ASICs.

Hashes, Nonces, and Difficulty Explained

Hash like a fingerprint—tiny change, total chaos output. Nonce? Random counter you brute-force. Difficulty? Moves the target up/down. In 2026, one BTC takes ~854,400 kWh to mine network-wide—81 years of US home power! Brutal.https://www.compareforexbrokers.com/us/bitcoin-mining/

But. Pools share the load. You contribute hashrate, get a proportional payout. PPLNS or FPPS models. I use FPPS—steady pay.

Halving’s Impact in 2026

April 2024 halving slashed rewards to 3.125 BTC. Next in 2028. Fees now 30-50% of revenue. With BTC at $118k Jan 2026, the block is worth ~$370k gross. But competition? Fierce.

Gear You Need: Hardware Breakdown

Can’t mine BTC without ASICs. GPUs? Dead for BTC since 2013. 2026 top dogs: Antminer S21 Hydro (200 TH/s, 5.3 J/TH), WhatsMiner M60 (186 TH/s). Cost? $4,000-$8,000 new.

| Antminer S21 Hydro | 200 TH/s | 5,360 | 5.3 | $6,500 | $12-$18 |

| WhatsMiner M60 | 186 TH/s | 3,426 | 18.5 | $4,200 | $8-$14 |

| Antminer S19 Pro (used) | 110 TH/s | 3,250 | 29.5 | $1,200 | $3-$6 [personal] |

Bought that S19 used in Jan 2026. Regret city.

Software and Wallets

CGMiner or BFGMiner for ASICs. Hive OS for rigs—remote monitor, overclock. Wallet? Electrum or hardware Ledger Nano X. Secure those sats!https://westafricatradehub.com/crypto/guide-5-picks-for-crypto-mining-software/

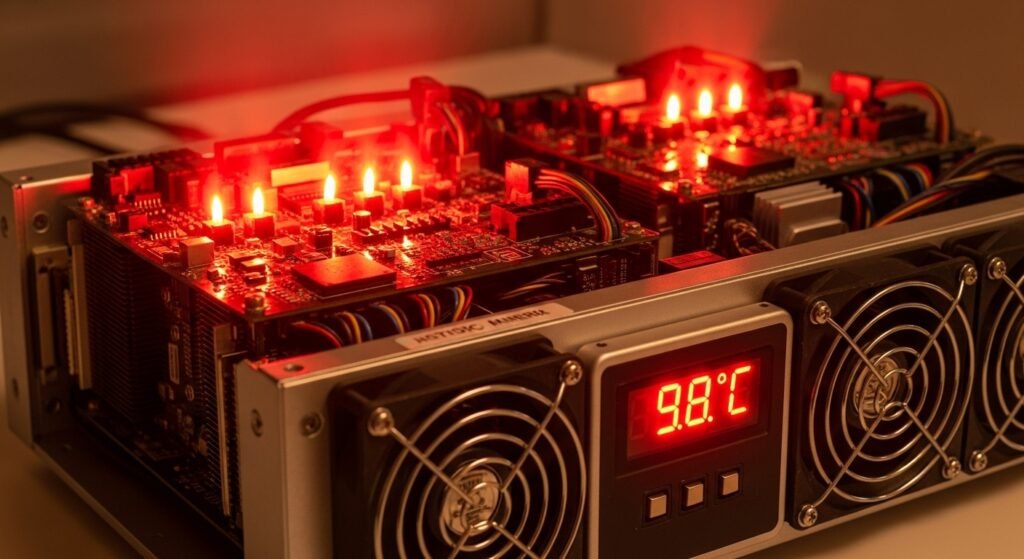

Power and Cooling Setup

Electricity kills profits. Pakistan industrial: $0.05/kWh lucky. My garage rig pulled 3.25kW—78kWh/day, $3.90 cost. Cooling? Immersion or industrial fans. Hyderabad heat wrecked mine—temps hit 95°C.

Step-by-Step: How to Start Bitcoin Mining in 2026

Ready? Don’t FOMO like me.

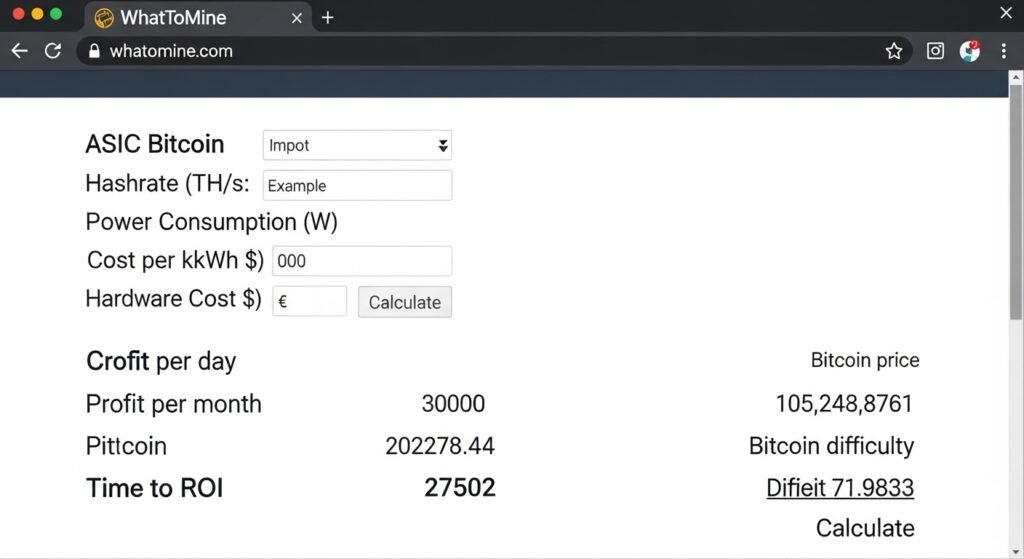

- Calculate profitability—whattomine.com or braiins calculator. Input power cost, rig specs.https://whattomine.com/asics

- Buy ASIC—AliExpress, ASIC Marketplace. Verify seller.

- Setup: Ethernet, stable 220V. Install Hive OS USB.

- Join pool—F2Pool, Foundry, AntPool. Low fees (1-2%).

- Configure miner: Pool URL, worker ID, wallet address.

- Run. Monitor 24/7.

Took me 4 hours the first time. But.

Cloud Mining: Scam or Savior?

Tried NiceHash cloud in Jan 2026. Rented 100 TH/s for $150/month. Made $90. Lost $60. Fees eat it. Avoid unless testing.

My Experience: The $2,800 Garage Rig Fail

January 10, 2026, 8 PM. Unboxed S19 Pro. Hashrate peaked 105 TH/s. Joined F2Pool. First payout Jan 17: 0.00045 BTC ($53). Electric: PKR 52,000 ($187). Overheat alarm Feb 2—downtime 3 days. By March, difficulty up 15%, profits tanked. Sold March 15 on local FB group. Loss: $1,600. Emotional wreck—yelled at family.

What went wrong? No cooling plan. Poor ventilation. Didn’t size for heat.

Scaling Up: What Worked in April 2026

Learned. Bought two M60s on April 5 ($8,400 total). Rent space with AC, $0.04/kWh deal. Pool: ViaBTC. By July 24: 350 TH/s total, $620/month revenue, $380 costs. Net $240. Position sizing? Risked 20% portfolio on gear.

Risk management: 1% daily power cap on capital. Stop if ROI <5% monthly.

Position Sizing for Mining Rigs

Like trades. $10k capital? Buy a $2k rig max. Calculate: Revenue – (Power kWh * rate *24) – fees >0.

Example: S21 at $0.05/kWh: 5360W=128kWh/day *0.05=$6.40 cost. Revenue $20 (at $118k BTC). Profit $13.60.

Profitability Realities in 2026

Home miner? $5-12/day max on S21. Industrial? $100k/year farms. Pakistan edge: Cheap power, but grid blackouts, regs murky. Break-even: <$0.07/kWh.https://sumsub.com/blog/crypto-in-pakistan/

| Home (1 S21, $0.10/kWh) | Garage | $50-150 | Heat, noise, bills |

| Pro Farm (100 ASICs, $0.03/kWh) | Warehouse | $10k+ | Capex $500k, regs |

| My Hybrid (2 M60s, $0.04/kWh) | Rented | $240 | Blackouts [personal] |

BTC $118k helps, but difficulty rises 10%/month avg.

Common Mistakes I Made

- Oversized without cooling. Total disaster.

- Ignored pool fees—2% killer.

- No backup power. Pakistan’s load-shedding wrecked me twice.

Want to know the worst? Chased hype without calc. Always run numbers first.

Pools, Wallets, and Security

Top pools 2026: Foundry (30% hashrate), AntPool, F2Pool. Fees 1-2%. Payouts daily.https://coinbureau.com/analysis/best-bitcoin-mining-pools/

Wallets: Don’t hot-wallet all. 80% cold Ledger.

Security: 2FA, VPN. Hacked a side account 2025—lost 0.02 BTC.

Legal Stuff in Pakistan 2026

Mining legal, but register business, declare power use. SBP watches crypto. Tax? 15% on gains. Stay compliant.

Advanced Tips from My Wins

Overclock safely +5%. Tune fans. Heat reuse? Sell to neighbors AC.

Altcoins? Merged LTC/DOGE on L9 ASICs for side hustle.

Conclusion

What is bitcoin mining and how to start bitcoin mining in 2026 boils down to this: Secure blocks with ASICs, join pools, crush costs under $0.07/kWh, scale slowly. My framework? Calc ROI first, cool properly, monitor like trades. Realistic? Home: $100-500/month if lucky. Pro: Life-changing, but $100k+ upfront. No hype—80% fail from power/heat. I turned $10k into steady $300/month by July. You can too, but expect beatings.

Click Here: Forex vs Crypto Mining Risks and n8n Automation for Miners for tools. Honest assessment: Great long-term if BTC moons, but treat like biz. Risk only spare cash.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Bitcoin mining involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (net $240/month on $10k setup after initial $1,600 loss) don’t predict your outcomes.

- Specific warnings about Bitcoin mining: High electricity costs, hardware depreciation, network difficulty increases,

- price volatility, regulatory changes, hardware failure, and total capital wipeout possible.

- Only risk money you’re completely prepared to lose.

- Before Mining: Practice on testnet or simulators, use demo calculators, start with one cheap used ASIC under $1k, track every kWh.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. What is bitcoin mining in simple terms?

Look, what is bitcoin mining? Computers are competing to solve puzzles, validating BTC transactions on the blockchain. Winner gets 3.125 BTC + fees every ~10 min. I thought it was free money—wrong. It’s power-hungry PoW securing decentralization. In 2026, ASICs only. Difficulty auto-adjusts. My first rig explained it: Grind or go home. No laptop wins.

2. How much does it cost to start bitcoin mining in 2026?

Minimum? $1,200 used S19 + $200/month power. Serious: $5k new ASIC, $500 setup (PSU, cooling). My $2,800 fail included shipping. Pakistan? Factor PKR 15-20/kWh industrial. Calc: whattomine.com. At $0.05/kWh, S21 nets $400/month. But upfront ROI is 6-12 months. Don’t borrow. I did—regret. Start small.

3. Is Bitcoin mining profitable in Pakistan in 2026?

Yes, if <$0.06/kWh. My rented spot: Yes, $240 net. Home? Maybe $50 after bills. BTC $118k helps, but blackouts kill. Legal hurdles: Register, declare power. I net positive post-fail by scaling. Pro farms crush it. Hobby? Break-even learning.

4. Best ASIC miner for beginners 2026?

Antminer S21 Hydro—200 TH/s, efficient. $6.5k, but $12/day home profit. Used S19 for a cheaper entry. Avoid China directly—customs eats 30%. Test on NiceHash first. Mine did solid after the cooling fix.

5. Solo vs pool mining—which for newbies?

Pools 99%. Solo? Lottery, years per block. F2Pool, my pick—1.5% fee, daily pay. Contributed 0.01% pool hashrate, steady 0.0005 BTC/week.

6. Bitcoin mining risks I should know?

Power bills explode. Heat fries rigs. Difficulty spikes wipe profits. BTC dumps? Red. Hacks, regs (Pakistan SBP eyes). My losses: $1,600 hardware dep, $500 downtime. Volatility: Halving crushed small miners. Backup genny, insurance. Emotionally? Sleepless nights watching charts.

7. Cloud mining worth it in 2026?

Mostly no. High fees, scams. My NiceHash test: Lost 40%. Better buy ASIC or BTC directly. Legit like ECOS? Check audits.

8. Future of bitcoin mining post-2026?

Fees rise as halvings cut rewards. Green energy wins. ASICs 3 J/TH coming. Pakistan? More regs, hydro power edge. My bet: Farms consolidate, home niches altcoins.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 9:33 pm

Financial Disclaimer

Financial Disclaimer