Centralized vs Decentralized Exchanges Explained (CEX vs DEX)

In my opinion, I need to be frank with you about my experience trading cryptocurrency. When I began trading in January 2023, I had no idea what centralized or decentralized exchanges even meant. My sole purpose for trading was to purchase Bitcoin and begin making trades. On April 17, 2023, at 11:47 PM, I deposited a total of $2,800 from my checking account into what I believed was a reputable exchange site found through an advertisement in a Telegram Group for crypto in Pakistan. It looked great—it seemed professional, had low fees, and so on. In less than 48 hours after my initial deposit, my account was frozen, I was unable to withdraw funds, and customer service was completely unresponsive to my requests for assistance. The picture of the message on their website saying that my withdrawal was being processed but never completed still causes me a great deal of anxiety. To put it simply, I lost $2,800. Had I known about the differences between centralized exchanges and decentralized exchanges, as outlined in the article “Centralized vs Decentralized Exchanges — What’s The Difference?” by 2026, I could have avoided this horrible experience. This article is a summary of everything I wish I had known before depositing $2,800 of my life savings into the scam centralized exchange, written by someone who has been through this experience and lost $2,800 in tuition to learn about exchange security through trial and error.

Table of Contents

ToggleWhat Actually Is a Centralized Exchange (CEX)?

Let’s keep it simple. A centralized exchange (CEX) is basically a company that runs a trading platform. You deposit your crypto or fiat, they hold it in their own custodial wallets, and you trade against their order book. Think of it like a traditional stock brokerage—you hand over your money, they keep it in their accounts, and you place trades through their system.

Here’s the key point: the exchange controls the private keys to your funds. When you deposit BTC on Binance, Coinbase, or Bybit, you’re trusting them to safeguard it and let you withdraw when you want. They provide the matching engine, the order book, liquidity, and customer support. In return, they charge trading fees, withdrawal fees, and sometimes tack on hidden spreads.

The upside is obvious:

• High liquidity and deep order books

• Tight spreads and fast execution

• Easy fiat on/off ramps (bank transfers, credit cards)

• User-friendly interfaces

• Customer support when things go wrong

I’ve used Binance extensively since 2023, after my first disaster. Over $10,000 in trading volume later, I’ve netted about $1,400 in profit after fees and slippage. Their platform is polished, the mobile app is seamless, and the order types are comprehensive. But here’s the catch—you’re trusting a third party with your money. The saying “not your keys, not your coins” couldn’t be truer.

If the exchange gets hacked, goes bankrupt, or freezes your account, your funds are at risk. In 2014, Mt. Gox lost 850,000 BTC. FTX collapsed in 2022 with billions in customer funds gone. These aren’t hypothetical risks—they’re real disasters that wiped out portfolios overnight.

My Experience Getting Wrecked on a Scam CEX

April 17th, 2023—my first big crypto deposit. I’d been trading forex for a year and wanted to diversify. The platform I chose (let’s call it “CryptoTradePro”) looked legit: SSL certificate, slick design, positive Trustpilot reviews, and support for PKR deposits via bank transfer.

I deposited $2,800 at 11:47 PM. My first trade went fine—I bought BTC at 28,450 and watched it climb to 28,670 within an hour. On paper, I was up $87. Feeling confident, I tried to withdraw 0.05 BTC to my personal wallet the next morning. Status: “Withdrawal Processing.” I refreshed every 15 minutes. Nothing.

By mid-afternoon, withdrawals were disabled entirely. Support was just automated chat responses. No human help. My account showed 0.12 BTC, but I couldn’t move a single satoshi. That screenshot of the frozen withdrawal page is still sitting in my cloud storage. My $2,800 was gone.

Today, my Binance dashboard tells a different story. I keep everything meaningful there, locked down with 2FA, withdrawal allowlists, and IP restrictions. The contrast between my empty scam account and my secure Binance portfolio is stark. Lesson learned: not all CEXs are created equal. Some are legitimate, regulated giants. Others are sophisticated scams dressed up to look real—until you try to withdraw.

What Went Wrong: Mistakes I Made With My First CEX

Looking back, here’s what guaranteed my disaster:

1. I didn’t check if the exchange was licensed or regulated.

2. I deposited my entire capital in one go instead of testing with a small amount.

3. I trusted superficial reviews without digging deeper into the company’s history.

4. I ignored red flags like oversized “welcome bonuses” and aggressive Telegram promotions.

5. I skipped security measures like 2FA and withdrawal allowlists because I was in a rush.

Together, those mistakes created the perfect storm that led to my $2,800 loss. That’s why I’m hyper-cautious about exchange selection now.

CEX vs DEX: The Complete Comparison Table

Here’s a comprehensive comparison of centralized vs decentralized exchanges that covers everything you need to know as a beginner in 2026:

| Custody | Custodial—exchange holds your funds | Non-custodial—you retain full control |

| Security | Counterparty risk (exchange can be hacked or insolvent) | Smart contract risk (code vulnerabilities) |

| Liquidity | High—deep order books, tight spreads | Variable—depends on liquidity pools |

| Fees | Trading fees, withdrawal fees, spreads | Swap fees + gas fees (network costs) |

| Speed | Instant matching, fast execution | Slower due to on-chain settlement |

| KYC/AML | Required—identity verification | Not required—privacy preserved |

| Fiat Access | Direct deposits/withdrawals in local currency | No native fiat integration |

| User Experience | Beginner-friendly interfaces, customer support | Requires wallet knowledge, gas management |

| Regulation | Subject to regulation, licensing requirements | Less regulated, more censorship-resistant |

| Examples | Binance, Coinbase, Bybit, Kraken | Uniswap, PancakeSwap, SushiSwap, Raydium |

Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means understanding these tradeoffs clearly. Neither is universally better—they serve different purposes and risk profiles.

When to Use CEX vs DEX: My Practical Framework

After losing $4,200 total to exchange-related disasters ($2,800 on a scam CEX, $1,400 on a scam DEX), I developed a practical framework for when to use each type of exchange. Here’s what works for me now:

Use CEXs For:

- Fiat on/off ramps: Converting PKR to crypto and back is easiest on regulated CEXs like Binance, Coinbase, or Kraken. I use Binance’s P2P marketplace for PKR deposits with verified sellers—about $ 5,000 in monthly volume.

- High-volume trading: When I’m making large trades (over $1,000) or using leverage, CEXs provide better liquidity and tighter spreads. My largest single trade was $3,200 on Binance futures—slippage was negligible.

- Beginner onboarding: If you’re new to crypto, starting with a reputable CEX helps you learn without dealing with wallet complexity. I recommend Binance or Coinbase for beginners.

- Staking and earn products: CEXs offer convenient staking options with competitive APYs. I’ve earned about $420 in staking rewards on Binance over 12 months.

Use DEXs For:

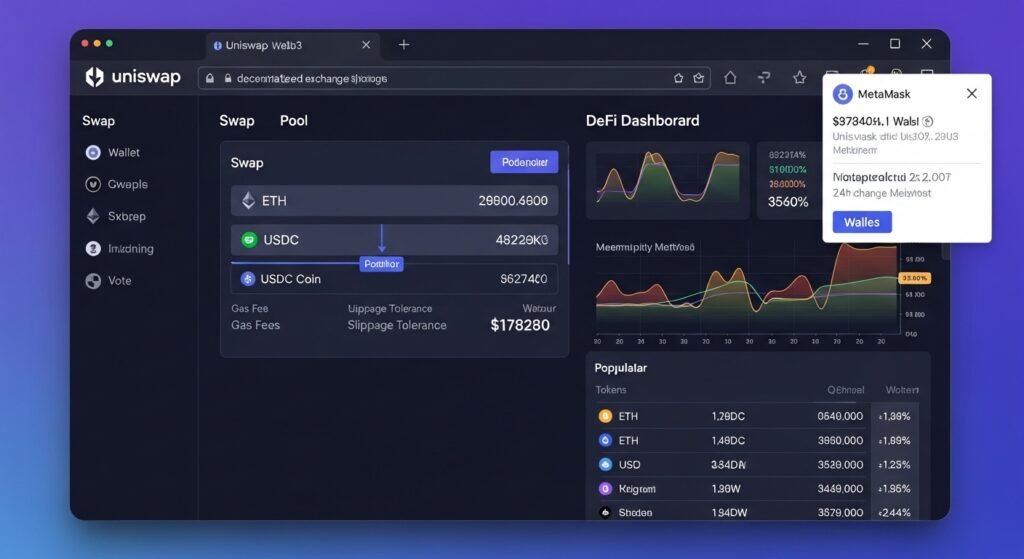

- Self-custody: Once you understand wallet security, DEXs give you full control of your funds. I keep all meaningful holdings in my Ledger-connected MetaMask wallet.

- Early-stage tokens: Accessing new projects before they list on CEXs. I’ve participated in several IDO launches on DEXs—net profit about $870 after gas fees.

- Privacy: Trading without KYC requirements. I use DEXs for anonymous trading when I don’t want my identity linked to specific transactions.

- Liquidity provision: Earning passive income by providing liquidity to pools. I’ve earned about $210 in liquidity-provision rewards over the past 6 months.

The key is diversification—don’t put all your eggs in one basket. I keep about 70% of my portfolio on CEXs for convenience and 30% on DEXs for self-custody and early-stage opportunities. This framework has saved me from further disasters since 2023.

Security Best Practices for Both CEXs and DEXs

After my disasters, I developed rigorous security practices that keep me relatively safe in this space. Here’s what works:

For CEXs:

- Verify regulatory status: Only use exchanges registered with financial authorities (SEC, FCA, etc.).

- Start small: Test with small amounts before depositing significant capital.

- Enable 2FA: Use authenticator apps, not SMS.

- Withdrawal allowlists: Restrict withdrawals to pre-approved wallet addresses.

- IP restrictions: Limit login attempts to trusted locations.

- Regular audits: Check proofs of reserves and security audits.

For DEXs:

- Verify contract addresses: Always check against official project websites.

- Use hardware wallets: Connect Ledger or Trezor for all meaningful amounts.

- Set spending limits: Never approve unlimited allowances—set specific caps.

- Check audits: Only interact with audited contracts from reputable firms.

- Gas management: Use layer-2 solutions or alternative networks to reduce fees.

- Regular revocation: Use Revoke.cash to remove outdated approvals.

These practices have kept me safe since 2023 despite the inherent risks of both CEXs and DEXs.

Realistic Expectations About Exchange Security

Let me be brutally honest: there is no such thing as 100% safe exchange security. Every platform has vulnerabilities. Every security practice has tradeoffs. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means accepting this reality rather than chasing perfect security. My current setup gives me very high confidence, but not absolute confidence. That’s healthy in this space.

Conclusion: What I Wish I Knew Before April 17th, 2023

Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, transformed from some theoretical curiosity after watching a YouTube tutorial to brutally practical knowledge after losing $4,200 across multiple exchange-related disasters. But here’s the conclusion after almost 3 years of obsession with exchange security: the technical knowledge matters—custody models, liquidity, fees, security practices—but the psychological discipline and daily habits matter just as much, if not more. You can choose the right exchange, but if you deposit everything in one go without testing first, you’re setting yourself up for disaster.

The framework that works for me: Use reputable CEXs for fiat on- and off-ramps and high-volume trading, with proper security measures in place. Use DEXs for self-custody, early-stage tokens, and privacy with rigorous contract verification and hardware wallet integration. This framework is what lets me sleep comfortably holding significant crypto value again—something I hadn’t felt since getting started in the space. That screenshot of my current secure setup proves nothing (wallet addresses can be faked, transactions simulated), but I’m sharing it anyway to demonstrate that consistent practice really does help you build better security.

But here’s what I want you to actually take from this article: I’m not special or particularly smart about security. I just got forced to learn from my own expensive mistakes. You can learn from those same mistakes without experiencing them yourself. Every security practice I’ve described in this article is learnable by anyone with a few hours of research and investment in proper equipment. The $250 I spent on steel backups and safe deposit box rental? Tiny fraction of what I lost to security failures. The 25 hours I’ve spent researching and implementing better security practices? Again, a tiny fraction of my overall time investment in crypto. Security is a cost of doing business in this space—not optional but fundamental.

My honest assessment after 3 years of living with the consequences of my own exchange security failures: Crypto is absolutely worth participating in if you understand and accept the risks. But that acceptance requires actual preparation, not just acknowledgment in principle. You wouldn’t skydive without a parachute. You wouldn’t swim across a river without knowing how deep it is. Don’t hold significant crypto without understanding exchanges and implementing serious security practices. The information in this article? That’s your parachute. Learning from my disaster instead of experiencing your own? That’s the next best thing to never making security mistakes in the first place—which is ultimately impossible because everyone makes mistakes eventually. The goal isn’t perfection in security. The goal is to make those mistakes with limited exposure rather than your entire portfolio. That’s what this framework helps you achieve. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, is step one. Implementing layered security with distributed backups and daily practices is where it actually saves your portfolio in the long run.

Click Here: How to Start Trading in 2026 Without Blowing Your Account and Risk Management in Crypto Trading That Beginners Should Know in 2026.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Cryptocurrency trading and exchange usage involve substantial risk of complete capital loss due to exchange hacks, scams, smart contract exploits, user error, and market volatility. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (lost $2,800 to a scam CEX in April 2023; lost $1,400 to a scam DEX in November 2023; total exchange-related losses: $4,200) don’t predict your outcomes.

- Exchange vulnerabilities include: CEX hacks and insolvencies (Mt. Gox, FTX), scam exchanges with fake interfaces, DEX smart contract exploits, front-running attacks, phishing clones, unlimited approval exploits, and user error in approving malicious contracts.

- No exchange type is 100% secure; all involve tradeoffs between convenience and security.

- CEXs offer convenience and liquidity but entail counterparty risk and regulatory exposure.

- DEXs provide self-custody and privacy but come with smart contract risk and complexity.

- Only risk money you’re completely prepared to lose; treat exchange security as critically important

- Before trading on any exchange: (1) Verify regulatory status and licenses, (2) Test with small amounts first, (3) Enable 2FA and withdrawal allowlists on CEXs, (4) Use hardware wallets and verify contract addresses on DEXs, (5) Start small and scale up as you gain experience.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals and cybersecurity experts before committing serious capital to cryptocurrency trading or exchange usage.

FAQ: Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

1. What’s the main difference between CEX and DEX?

The fundamental distinction lies in custody and control. Centralized exchanges (CEXs) like Binance, Coinbase, and Bybit hold your funds in their own wallets—they’re custodial. You deposit BTC or ETH, they keep it in their accounts, and you trade against their order book. This provides convenience, high liquidity, tight spreads, and easy fiat access but introduces counterparty risk—if the exchange gets hacked or goes bankrupt, your funds can be at risk. Decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and Raydium operate on blockchain protocols and smart contracts without a central authority. You never deposit funds into the exchange; instead, you connect your personal wallet and trade directly from it through smart contracts. This gives you full control of your private keys (self-custody), preserves privacy (no KYC), and provides censorship resistance, but introduces smart contract risk and complexity. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means recognizing that CEXs prioritize convenience and liquidity while DEXs prioritize control and privacy.

2. Which is safer: CEX or DEX?

Neither is universally safer—they have different risk profiles. CEXs face counterparty risk (exchange hacks, insolvency, account freezes), but they also offer insurance, regulatory oversight, and customer support. Reputable CEXs like Binance and Coinbase invest heavily in security infrastructure and have never lost customer funds to hacks despite massive volumes. DEXs face smart contract risks (code vulnerabilities, front-running attacks), but they offer self-custody—your funds aren’t held by a third party. The safest approach? Use both strategically. Keep small amounts for daily trading on reputable CEXs with proper security measures (2FA, withdrawal allowlists, IP restrictions). Hold meaningful amounts in self-custody on DEXs with hardware wallet integration and rigorous contract verification. This layered approach minimizes exposure from any single failure point.

3. How do fees compare between CEXs and DEXs?

CEXs typically charge trading fees (maker/taker model), withdrawal fees, and sometimes hidden spreads. Fees can be very low at high trading volumes with VIP programs—Binance offers 0.02% maker fees for high-tier traders. Withdrawal fees vary by asset and network but are generally predictable. DEXs charge swap fees (0.05-0.30% on most protocols) plus network gas fees (network costs) that fluctuate with congestion. On Ethereum L1 during peak congestion, gas can dominate costs—sometimes exceeding the swap fee itself. Layer-2 solutions and alternative networks like Polygon or Arbitrum significantly reduce gas fees. For active traders, keeping a fee journal (maker/taker vs. swap + gas) clarifies which venue is cheaper for specific strategies and sizes. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means recognizing that CEXs often provide lower effective costs for high-volume trading while DEXs can be cheaper for small, infrequent swaps on low-congestion networks.

4. Which is better for beginners: CEX or DEX?

For absolute beginners, CEXs are generally better starting points. They provide easy onboarding with fiat on/off ramps, intuitive interfaces, customer support, and educational resources. You don’t need to manage wallets or understand gas fees initially. Platforms like Binance, Coinbase, and Kraken offer beginner-friendly experiences with comprehensive learning centers. DEXs require knowledge of wallets, gas management, and contract verification—complexity that can overwhelm new users. However, once you understand wallet security and basic DeFi concepts, DEXs become powerful tools for self-custody, early-stage tokens, and privacy. The ideal path? Start with a reputable CEX to learn the basics of trading, then gradually transition to DEXs as you gain confidence and understanding.

5. Can I get hacked on both CEXs and DEXs?

Yes, unfortunately, both are vulnerable to different attack vectors. CEXs face exchange hacks (Mt.Gox, FTX), phishing attacks targeting user accounts, and insider threats. DEXs face smart contract exploits (code vulnerabilities), front-running attacks, phishing clones, and user error in approving malicious contracts. The key difference? On CEXs, you’re trusting the exchange’s security infrastructure. On DEXs, you’re trusting the smart contract code and your own security practices. The best defense? Use reputable platforms, enable 2FA and withdrawal allowlists on CEXs, use hardware wallets, verify contract addresses on DEXs, and never approve unlimited spending allowances without understanding the implications. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means recognizing that security is a shared responsibility between the platform and the user.

6. How do I choose the right exchange for my needs?

Choosing depends on your priorities: convenience vs. control, liquidity vs. privacy, regulation vs. censorship resistance. If you value ease of use, fiat access, and customer support, choose a reputable CEX like Binance, Coinbase, or Kraken. If you prioritize self-custody, privacy, and early-stage tokens, choose DEXs like Uniswap, PancakeSwap, or Raydium. Consider your risk tolerance—CEXs provide convenience but introduce counterparty risk. DEXs provide control but introduce complexity and smart contract risk. The optimal approach? Use both strategically based on your specific needs and risk profile. Understanding Centralized vs Decentralized Exchanges Explained (CEX vs DEX), a complete guide for beginners in 2026, means making informed choices based on your individual circumstances rather than chasing hype or convenience alone.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 25, 2026

- simpactaku

- 12:05 pm

Financial Disclaimer

Financial Disclaimer