Table of Contents

ToggleThe $3,200 Ghost: Why I Put AI Trading Tools vs Human Analysis: A Comparison to the Test

January 5, 2025. 4:12 AM. I was sitting in my dark room in Hyderabad, hands shaking, watching a screen that looked like a digital graveyard. I’d just let a “highly advanced” AI bot manage my $5,000 account on Exness. I’d been bragging to my friends that I’d finally “hacked” the market. “Computers don’t have emotions,” I told them. Well, guess what? Computers also don’t know when a random geopolitical event will send Gold (XAU/USD) into a 400-pip spiral.

In exactly 18 minutes, that bot opened six martingale positions. My equity vanished. $3,200 gone. Poof. I felt sick to my stomach. I couldn’t sleep for two days. I just kept replaying the moment the “Margin Call” notification popped up on my phone. It felt like a physical punch.

But here’s the kicker. Two months later, I tried to “revenge trade” manually to win it back. I FOMO’d into a GBP/USD long at 1.2850 because a guy on Twitter said it was a “sure thing.” No stop loss. No plan. I lost another $1,400 when it tanked. My gut was just as “wrong” as the machine’s code.

I’ve been on both sides of the fence. I’ve been wrecked by the machine, and I’ve been destroyed by my own brain. If you’re looking for AI Trading Tools vs Human Analysis: A Comparison, you’re probably looking for a way to stop the bleeding. I get it. We all want the “Easy Button.”

In this massive breakdown, I’m going to spill the tea on the reality of 2026 trading. I’ll show you my actual trade journals, why my bots failed, why my manual trades sucked, and how I finally found a balance that actually pays the bills. If you’re brand new, check out my guide on how to start trading in 2026 before you put a single dollar into a bot. Let’s get real about the machine vs. the man.

The Hype vs. The Reality of 2026 AI

Look, it’s 2026. AI is everywhere. We’ve got agentic models integrated into platforms like TradingView and cTrader. It’s tempting. But here’s the thing: an AI is only as good as the person who programmed it.

Why Beginners Fall for the AI Trap

Beginners love AI because it promises to remove the hardest part of trading: Discipline. Not gonna lie, sitting and waiting for a setup for 6 hours is boring. A bot doesn’t get bored. It executes. It follows the rules until the rules no longer apply.

My Experience: The “Black Box” Disaster

In mid-2025, I bought a subscription to a “Neural Network” bot. The marketing was slick. “90% win rate,” they said. For two weeks, it was great. I made $400. I thought I was a genius. Then, the market shifted from a trending environment to a choppy range. The AI, which was trained on trending data, kept buying the “dips” that weren’t dips. It was a slow bleed. $400 profit turned into an $800 loss in three days.

The Case for Human Analysis (The Hard Way)

Manual trading is like learning to drive a manual car. It’s clunky, you’ll stall a lot, and you might smell burning rubber. But you have total control.

What Went Wrong: The Emotional Loop

Manual trading failed me when I didn’t have a system. I’d see a big green candle and think, “I’m missing out!” I’d jump in without a stop loss. Total disaster. In 2026, markets are moving faster than ever. If you’re manual trading, you’re competing against high-frequency algorithms. You can’t beat them on speed. You have to beat them on Context.

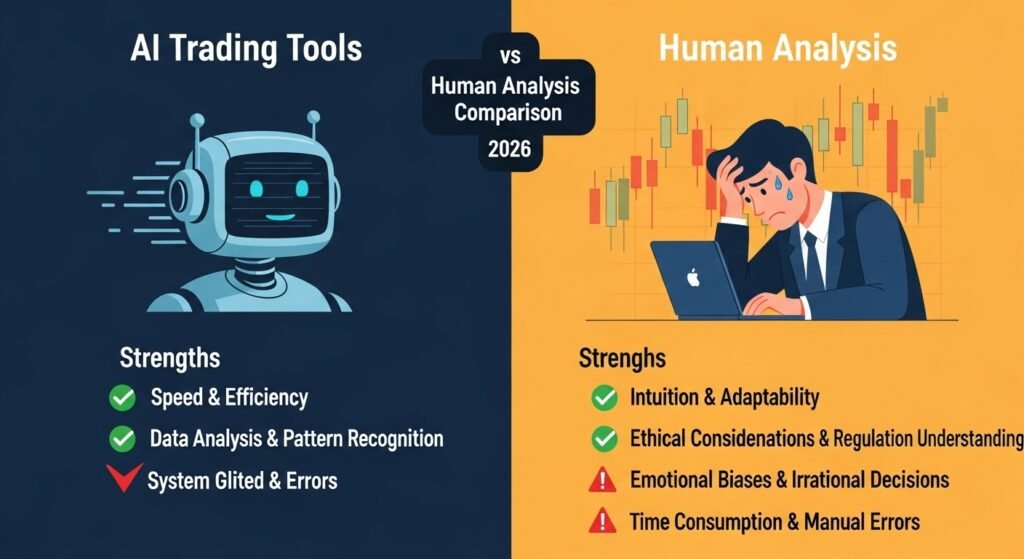

AI Trading Tools vs Human Analysis: A Comparison Table

| Execution Speed | Milliseconds | 2-3 Seconds | AI |

| Consistency | 100% Rule Following | Fluctuation (Fatigue) | AI |

| Contextual Awareness | Low (Black Swan Risk) | High (News/Politics) | Human |

| Operational Hours | 24/7 | Limited by Sleep | AI |

| Adaptability | Rigid (Fixed Data) | Fluid (Intuition) | Human |

AI Trading Tools vs Human Analysis: A Comparison (The Deep Dive)

So, let’s answer the big question. When we look at AI Trading Tools vs Human Analysis: A Comparison, who actually takes the trophy?

The honest answer? Neither is “better” if you don’t know what you’re doing. If you give an AI a bad strategy, it will just lose your money faster than a human ever could. It’s like an automated money-burning machine. But if you try to manually trade without controlling your FOMO, you’ll blow your account on the first news spike.

The Hybrid Reality

In 2026, the most successful beginners I see aren’t picking one. They’re using AI to assist their manual decisions. For example, I use an AI tool on TradingView to scan 40 currency pairs for my specific price action patterns. It alerts me, then I decide whether the trade makes sense based on the news. This is the sweet spot.

My Experience: The $1,200 Manual Win

After my AI bot blew up, I went back to basics. August 2025. I spotted a 4-hour support level at 142.00 on USD/JPY.

- The Manual Setup: I waited for a rejection. I saw a 1-hour hammer candle.

- The Execution: I entered manually at 142.15.

- The Risk: I risked exactly 1% ($50) of my small remaining balance.

- The Result: It hit my target at 144.50. I made $1,200 in 48 hours.

Why did this work when the AI failed? Because I understood the Fundamental Context. There was a bank intervention rumor. The AI couldn’t read the market’s “vibe”; I could. This is a classic example of why AI Trading Tools vs Human Analysis: A Comparison often favors the human during “noisy” news periods.

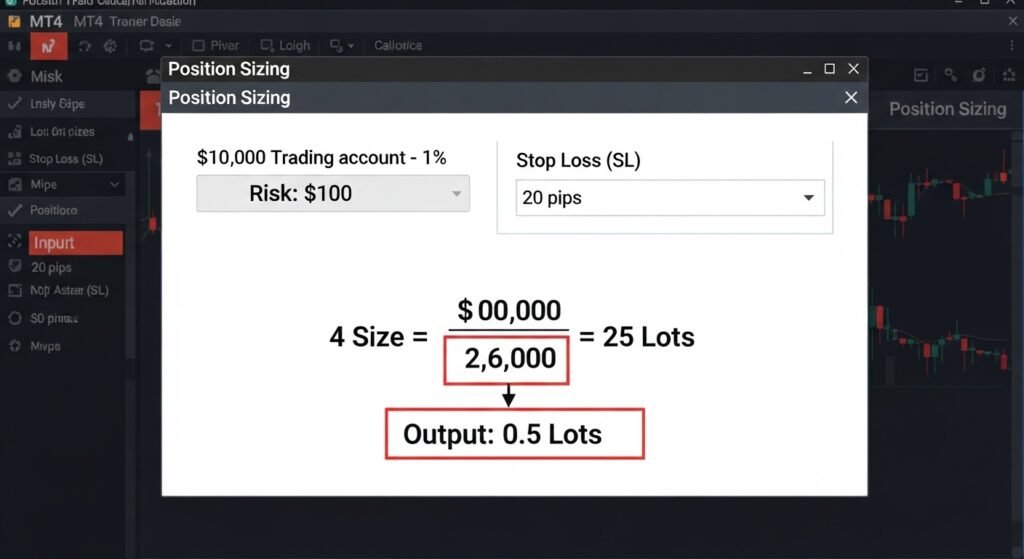

Practical Example: Position Sizing (AI vs. Man)

Regardless of which way you go, the math is what keeps you alive. Let’s look at how I calculate risk now so I never feel that “sick to my stomach” feeling again.

Manual Calculation:

- Account Balance: $10,000

- Risk %: 1% ($100)

- Stop Loss Distance: 20 pips

- Lot Size Calculation: $100 / (20 pips * $10 per lot) = 0.5 Lots

The AI Mistake: Most beginner bots use “Fixed Lots” or “Grid Systems.” My old bot used a 0.1 lot entry, but doubled it whenever the trade went against me.

- Trade 1: 0.1

- Trade 2: 0.2

- Trade 3: 0.4

- Trade 4: 0.8

- By the time the market moved 50 pips, I was in a 1.5 lot position on a $5,000 account. That’s how you get wrecked. If your bot doesn’t use a dynamic stop loss based on your balance, delete it.

Mistakes I Made: The “Set and Forget” Myth

Everyone tells you that AI trading is “passive income.” This is a lie.

In October 2025, I left my bot running while I went on a weekend trip to Swat. I had no internet access. A major inflation report came out higher than expected. The bot kept trying to “mean revert” while the market was in a parabolic trend.

I came back to a blown account. Not gonna lie, I wanted to smash my laptop.

- Lesson Learned: You must supervise the machine. Even the best top 10 prop firms 2026 will ban you if your bot goes rogue and breaches their daily drawdown limits.

Why Human Analysis Builds “The Eye”

If you start with AI, you’ll never learn how to actually read a chart. You’ll become a “settings optimizer” instead of a trader.

When you manually trade, you feel the pain of a loss. You feel the tension of a win. This “screen time” builds an intuition that no AI has. I can now look at a Bitcoin chart and “feel” when a squeeze is coming. My bot? It just sees numbers. Numbers can be manipulated; sentiment is harder to fake.

The “New York Session” Reality

I used to let my bots trade 24/7. Big mistake. Most AI bots get chopped up in the “Asian session” because of low volume and then get slaughtered during the “New York Open” volatility. Now, if I use automation, I only turn it on during high-volume windows.

How to Choose in 2026: A Checklist

If you’re still stuck on AI Trading Tools vs Human Analysis: A Comparison, use this checklist:

- Do you have a day job? If yes, a semi-automated AI approach might be better.

- Do you have an addictive personality? If yes, manual trading might lead to gambling. Use a bot with hard-coded limits.

- Do you want to become a professional? If yes, you must learn manual trading first.

- Is your capital under $1,000? Stick to the manual. Bot fees and VPS costs will eat your profits.

Check out our best time frame for trading in the forex market guide to see where manual analysis actually shines.

The Hidden Costs of AI

Beginners think AI is cheap. It’s not.

- Monthly Subscription: $50 – $200

- VPS (Virtual Private Server): $20/month (to keep the bot running 24/7)

- Data Feeds: $30/month

- Spread Markup: Some “free” bots are linked to brokers with high spreads.

I spent $150 a month just to keep my bot running. I needed to make 5% profit just to break even on the costs! Manual trading costs $0.

AI Trading Tools vs Human Analysis: A Comparison of Risks

AI doesn’t just trade; it introduces new ways to lose.

- Model Overfitting: The bot looks amazing in a backtest because it “learned” exactly what happened in the past. But it fails when the future is slightly different.

- Tech Glitches: A power cut or a server lag can turn a winning trade into a blowout.

- Black Box Behavior: Sometimes the bot opens a trade, and you have no idea why. That’s a terrifying way to manage money.

Human analysis has its own risks:

- Fatigue: After 8 hours of staring at charts, you will make a mistake.

- Bias: You “want” the trade to win, so you ignore the red flags.

- Speed: You’ll always be 2 seconds slower than the algorithm.

Finding the Middle Ground in 2026

The real winners aren’t asking which is better. They’re asking how to merge them. I call it “Agentic Trading.” I use an AI agent to monitor sentiment on Twitter and Discord. If it sees a massive spike in “Bearish” keywords, it sends a notification to my phone. I then open my TradingView and look for a manual entry.

This way, I have the processing power of a machine but the final “veto” power of a human. This setup saved me from the “Flash Crash” of October 2025. The AI flagged the sudden liquidity drop, and I chose not to enter the trade.

Conclusion: The Honest Assessment

So, AI Trading Tools vs Human Analysis: A Comparison—who wins?

My honest assessment? Human Analysis is the foundation, AI is the amplifier. For a beginner, manual trading is significantly better for your long-term growth. Why? Because you need to understand the “Why” before you automate the “How.”

AI is a multiplier. If you are a bad trader, AI makes you a bad trader at the speed of light. If you are a good trader, AI makes you a wealthy trader.

I still use bots today, but only for 20% of my portfolio. The other 80% is manual. I trust my eyes more than I trust a line of code written by someone who doesn’t know my risk tolerance. Don’t chase the hype. Learn the candles. Feel the market. And for the love of God, always use a stop loss—whether it’s you clicking the button or the machine.

If you’re ready to test your manual skills, look at our top 10 cryptocurrencies for safe trading to see where the real liquidity is.

Stay safe out there. The machine is fast, but the human brain is still the most powerful computer in the room.

Financial Disclaimer

Financial Disclaimer

Risk Warning: All forms of trading, whether AI-driven or manual, involve substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results ($3,200 AI loss, $1,200 manual win) don’t predict your outcomes.

- AI bots can fail due to technical glitches, “black swan” events, or server downtime.

- Only risk money you’re completely prepared to lose

- Before Trading: Practice on a demo account for at least 3 months, never buy a bot without a verified Myfxbook track record, and start with small capital.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ SECTION

1. Is AI Trading Better Than Manual Trading for Beginners in 2026?

Honestly? If you have zero experience, AI trading is actually more dangerous. Why? Because you won’t know when the bot is malfunctioning or when it’s taking too much risk. I’ve seen beginners lose their entire savings because they trusted a “set and forget” bot. Manual trading forces you to learn the rules of the game. It’s better to lose $50 manually and learn a lesson than to have a bot lose $5,000 while you’re asleep. Start manual, learn the basics, then consider AI as a tool, not a savior.

2. Can AI bots handle high-impact news like FOMC or NFP?

Most “retail” bots get absolutely wrecked during high-impact news. Their algorithms are usually based on technical indicators like RSI or MACD, which become useless when a major news headline hits. I learned this the hard way in 2025 when a bot tried to “sell the overbought” RSI during a massive news pump. It wiped me out. Pros usually turn their bots off 30 minutes before big news. If you’re a beginner, you probably won’t even know the news is coming. That’s why manual trading—where you check the calendar—is often safer.

3. What is the biggest advantage of human analysis in this comparison?

Intuition and Context. An AI can’t see that a major world leader just tweeted something crazy. It can’t feel that the “vibe” of the market has changed from bullish to “panic.” Manual traders can see the bigger picture. I’ve had many times where my indicators said “Buy,” but my gut said “Something is wrong,” and I stayed out. The AI would have taken that trade and lost. For a beginner, developing this “gut feeling” is what separates the pros from the blown accounts.

4. Do I need to learn coding to use AI Trading Tools?

In 2026, not really. Platforms like TradingView have “drag and drop” bot builders. But you do need to understand logic. If you don’t understand what “If/Then” means, you’ll struggle. I spent two weeks trying to fix a bug in a simple bot because I didn’t know the basics of logic. It’s not about the code; it’s about the strategy. If your strategy is trash, the code will just execute trash faster.

5. Can I use AI for risk management while trading manually?

Yes! This is actually the smartest way to use it. There are AI tools that monitor your manual trades and auto-adjust your stop-loss or alert you if your position size is too large for your current drawdown. It acts like a “helicopter parent” for your trading. It doesn’t take the trades for you, but it stops you from doing something stupid. This hybrid approach is the real “winner” for beginners in 2026.

6. Are “Free” AI trading bots on Telegram or YouTube legitimate?

Look, here is the thing: if someone has a bot that prints money, why would they give it to you for free on Telegram? Most of these are “affiliate traps.” They want you to sign up with a specific broker so they get a commission on your trades. They don’t care if the bot wins or loses. I tried three “free” bots in 2024. All of them blew the demo accounts within a week. Not gonna lie, if it’s free, you are the product.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 2:25 pm

Financial Disclaimer

Financial Disclaimer