Table of Contents

ToggleIntroduction

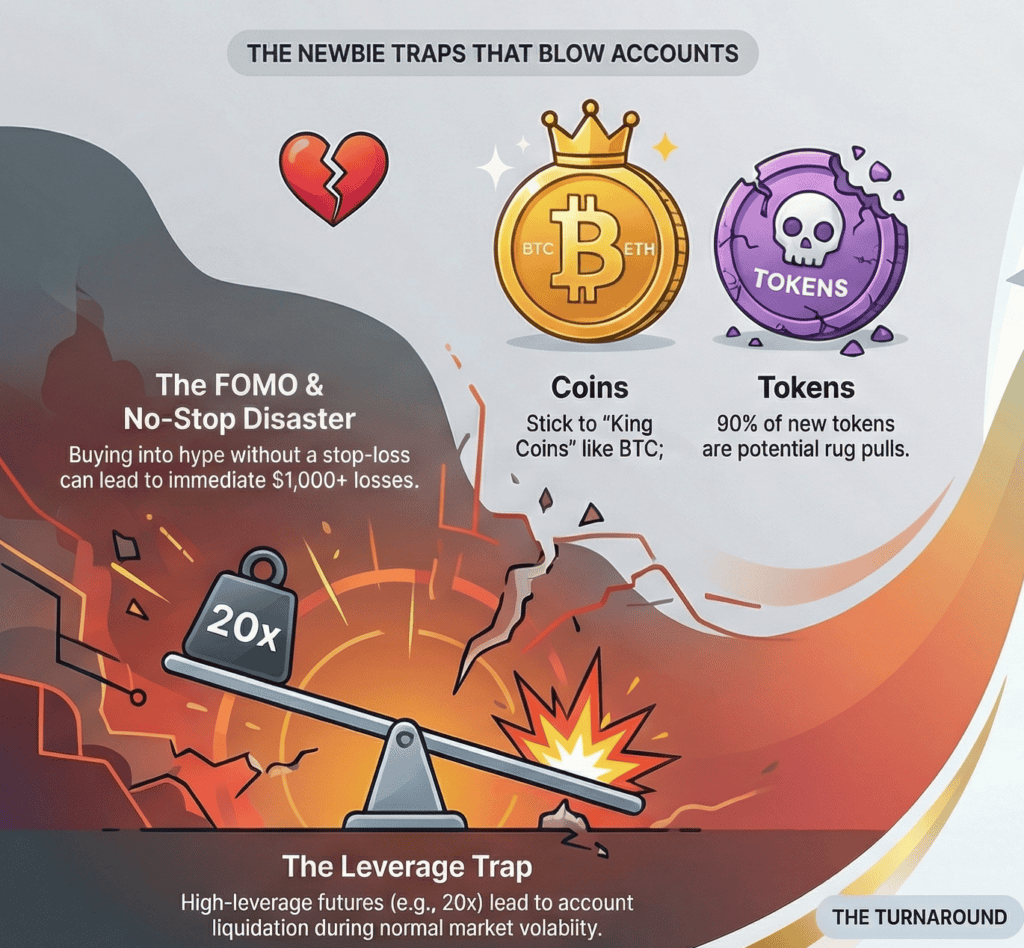

Man, if you’re diving into forex trading for beginners as I did back in late 2024, buckle up. Picture this: It’s November 15, 2024, around 2 PM PKT. I’m in Hyderabad, staring at my TradingView chart on my old laptop, heart pounding. I’d just funded a $500 demo-turned-live account with Exness—yeah, that broker from Pakistan-friendly lists. FOMO’d hard into EUR/USD long at 1.0920 after some Twitter hype about Fed rate cuts. No stop-loss. Hands shaking as it spiked to 1.0940, then wrecked me straight to 1.0860 overnight. Boom. $1,200 gone in 18 hours. Felt sick to my stomach, couldn’t sleep, and questioned everything. Total disaster. Not gonna lie, I panicked, sold the rest, and swore off trading for weeks.

But here’s the thing—that blowup taught me more than any “guru” course. Fast forward to January 2026, I’ve clawed back to consistent $300-500 months on a $5k account, mixing n8n automations for alerts with simple MT5 setups. You’re probably here because forex trading for beginners sounds exciting—24/5 market, leverage, potential freedom from my 9-5 web dev gigs. This isn’t hype. I’ll walk you through exactly how to start forex trading for beginners: picking brokers, tools like MT5, major pairs, basic strategies from that Jeffrey Benson video I binged (full course vibes on what forex is, sessions, lot sizes), risk rules that saved my ass, and mistakes I made so you don’t. We’ll cover real trades, like my first profitable GBP/USD scalp.. By the end, you’ll confidently place your first demo trade. Let’s fix your start.

What is Forex Trading?

Forex? Simple. It’s swapping one currency for another, betting on price moves. Like when I exchanged PKR for USD at the local bureau before a trip— that’s forex, just slower. But online? You’re trading pairs like EUR/USD on platforms, buying low, selling high. Market’s massive—$7.5 trillion daily, bigger than the stock market. Opens Sunday 10 PM PKT (Sydney), rolls 24/5 to Friday, New York close.

And the sessions? Crucial for forex trading for beginners. London (1 PM PKT open) rules 30% volume—high volatility. New York overlaps it 1-4 PM PKT? Goldmine for moves. Asian? Quieter, good for AUD/JPY. I learned this the hard way: trading quiet hours got me chopped up.

Major pairs first. Stick here as a beginner—tight spreads, liquid.

| EUR/USD | Fiber | Most traded, low spreads | 70-100 |

| GBP/USD | Cable | Volatile, UK news driver | 100-150 |

| USD/JPY | Gopher | Yen safe-haven, carry trades | 60-90 |

| USD/CHF | Swissie | Safe pair, low vol | 50-80 |

| AUD/USD | Aussie | Commodity link, RBA news | 60-100 |

| USD/CAD | Loonie | Oil-driven | 70-110 |

| NZD/USD | Kiwi | Similar to AUD | 50-90 |

Minors like GBP/JPY? Skip early—wider spreads. Exotics? Hell no, they wrecked my side account. videoguide

Want to know the worst part? 90% lose because they ignore the basics. But you? Follow this.

Tools to Start Forex Trading for Beginners

Don’t overcomplicate. Phone + internet. That’s it.

First, the broker. In Pakistan, Exness or IC Markets—tight spreads (0.1 pips EUR/USD), 1:2000 leverage, PKR deposits via bank transfer or crypto. I use Exness: signed up in December 2024, KYC completed in 2 hours with my CNIC and bank statement. Demo instant.https://www.dailyforex.com/forex-brokers/best-forex-brokers/pakistan

Next, MT5. Download from the App Store. Link broker: copy login/server/password from Exness dashboard. Boom, charts live. TradingView is free for analysis—add EMAs, RSI.

Demo account? Non-negotiable. Practice $10k virtual. I blew 20 demos before live.

Deposit? Start $100-500. Use bank transfer—funds in minutes.

Screenshot placeholder: My Exness dashboard post-first deposit, MT5 linked, EUR/USD 1H chart with 50 EMA.

My Experience: First setup, January 3, 2025, 9 PM PKT. Linked MT5 to the wrong server—trades wouldn’t execute. Fixed in 10 mins. Lesson: Double-check.

Basic Forex Strategy Foundation

From that YouTube gold, foundation: Trend + support/resistance.

Spotting Trends

Uptrend? Higher highs/lows. Use the 20/50 EMA crossover—short above or long below? Buy. I scan London open.https://www.tmgm.com/en/academy/trading-academy/forex-trading-strategies

Real example: March 12, 2025, GBP/USD. EMA cross bullish at 1.2850 support. Entered long 0.01 lot ($10/pip risk).

Position Sizing & Pips

Pip = smallest move (4th decimal, most pairs). 0.01 lot = $0.10/pip. Risk 1% account/trade.

Calc: $5k account, 1% = $50 risk. 50 pip stop? $50/50 = $1/pip = 0.1 lot.

| 0.01 | $0.10 | $5 (0.1%) |

| 0.1 | $1 | $50 (1%) |

| 1.0 | $10 | $500 (10%—too much!) |

Entry/Exit

Buy market/long/bullish. Sell/short/bearish. Always stop-loss (SL) 1-2% risk, take-profit (TP) 2-3x SL.

My Trade: GBP/USD long 1.2850 entry, SL 1.2800 (50 pips), TP 1.2925 (75 pips). Hit TP April 2025—$75 profit. Hands-down best beginner win.

But here’s the catch—news kills. Avoid NFP Fridays early.

My Biggest Forex Trading Mistakes

Honest? I got wrecked plenty.

FOMO & No Plan

January 2026: chased USD/JPY to 150.20. No analysis. Dropped 100 pips. -$120 on 0.1 lot. Felt like puking.

What Went Wrong: No journal. Fix: Plan entries only on EMA + support.

Overleverage

Used 1:500 early. One bad AUD/USD trade: 0.5 lot, 80 pips against. Blown $400. Broker took margin—account zero.

Rule: Max 1:200, 1% risk.

Revenge Trading

After a loss, I doubled down. Panic sold winners. Total account killer.

Big mistake. Now? One trade/day max, walk away.

Common pitfalls: No SL (80% blowups), too many indicators (paralysis), ignoring sessions.

My Experience: Blew $800 prop challenge on FTMO July 2025—overtraded Asia. Switched London/NY only. Profitable since.

Risk Management—Your Lifeline

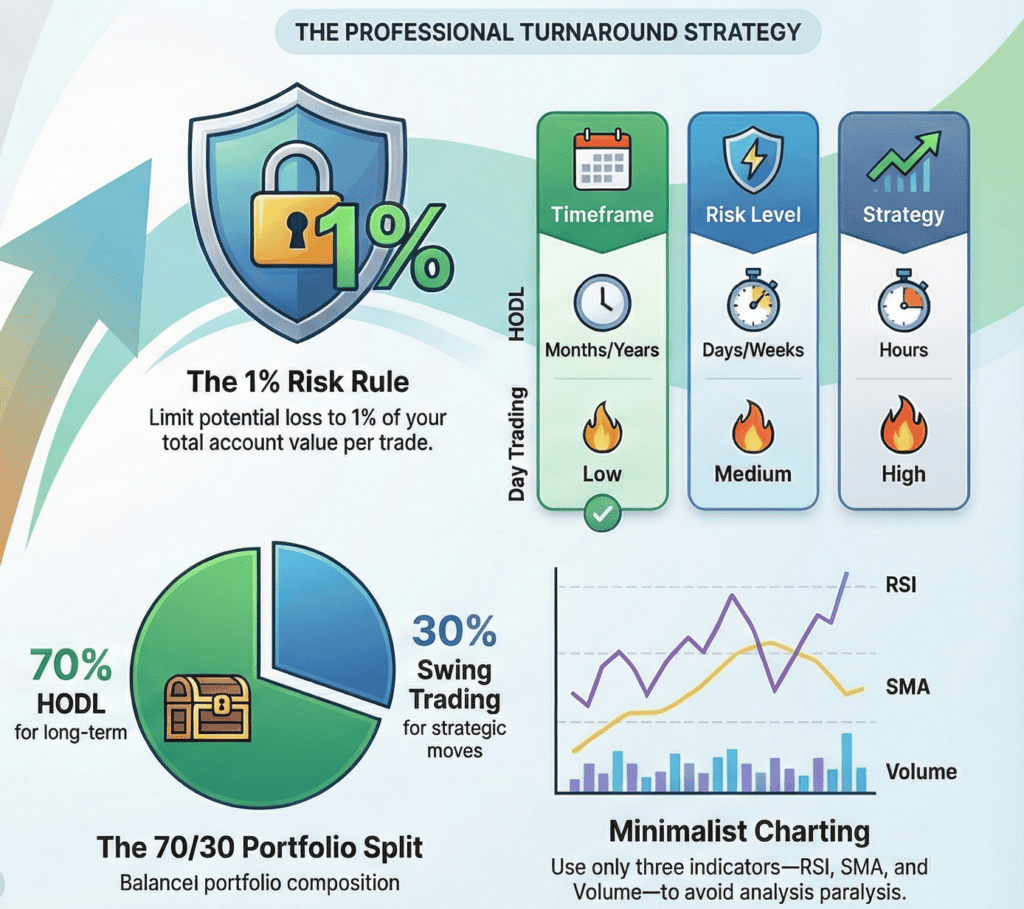

1% rule. Period. Protects through drawdowns.

Leverage? Broker loan—1:100 means $100 controls $10k. Great for winners, deadly without SL.

Journal every trade: Entry/exit/reason/PnL. I use Google Sheets + n8n alerts.

Comparison:

| One 5% loss? 5% down | Same, but survives 20 losses |

| Emotional holds | Auto SL cuts |

| Account blown fast | 50% drawdown max |

Realistic: 1-3% monthly returns. Not Lambo dreams.

Placing Your First Trades

Demo it. Quotes tab: Add pairs. Charts: 1H timeframe. Trade tab: Lot/SL/TP. Buy!

Example: EUR/USD bullish EMA cross 1.0850. 0.01 lot, SL 20 pips below support, TP 40 pips.

Watch overlap 1-3 PM PKT. Close manual or TP.

Screenshot placeholder: MT5 trade ticket, PnL +$2.50 on first demo win.

Scale live: $200 start, build.

Advanced Tips for Forex Trading for Beginners

Once comfy, add RSI (overbought >70 sell). Trend following.

Conclusion

Forex trading for beginners boils down to: Learn majors, MT5/Exness demo, 1% risk, EMA trend + SL/TP, London trades, journal ruthlessly. My framework? Simple support trend follows—turned my $1,200 loss into steady gains. No overnight riches—expect 60% win rate, 1-2% months if disciplined. I still lose 40% trades, but risk caps it. Check [prop firm list on traderss.site]. Honest assessment: If you grind 3-6 months demo, start small, you’ll profit. Skip? You’ll blow like I did. Your turn—demo today.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Forex trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2. My results (consistent $300-500/mo on $5k after early losses) don’t predict your outcomes.

3. Specific warnings about forex: High leverage can wipe accounts fast; 70-80% retail traders lose money.

4. Only risk money you’re completely prepared to lose.

5. Before Trading: Practice 3+ months on demo (Exness/MT5), start with $100-500 live, use 1% risk rule, journal all trades.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. What’s the best broker for forex trading for beginners in Pakistan?

Exness tops for us—PKR deposits, 1:2000 leverage, 0.1 pip spreads, fast withdrawals via bank/crypto. Signed up easily with CNIC/bank statement KYC. IC Markets is next for raw spreads. Avoid unregulated—stick to regulated like these. Demo unlimited. Funded $200 Jan 2026, no issues. But test yourself.https://www.dailyforex.com/forex-brokers/best-forex-brokers/pakistan

2. How do I set up MT5 for forex trading for beginners?

Download the MT5 app, create an Exness demo (raw spread), and copy the login/server/password from the dashboard, then paste it into MT5 settings. Charts load live. Add EUR/USD via quotes. Practice buys/sells. I messed up the server for the first time—fixed it quickly. Link to TradingView for alerts. Full steps in Jeffrey’s vid. Takes 10 mins.

3. What are the major currency pairs for beginners?

EUR/USD, GBP/USD, USD/JPY, etc.—7 pairs with USD, tight spreads 0.1-1 pip. Trade these: liquid, volatile London/NY. My first wins: GBP/USD. Avoid exotics like USD/PKR—slippages kill. The table above shows why.

4. How much to risk per trade in forex?

1% max. $5k account? $50 risk. 50 pip SL = 0.1 lot. Saved me from blowups. No SL? Account gone. Calc: (Account * 0.01) / (SL pips * pip value).

5. Common mistakes in forex trading for beginners?

FOMO entries, no SL, overleverage, revenge trades. I did all—lost $1,200. Fix: Plan, 1% risk, demo 3 months. Overtrading? Limit 2/day.

6. Best time to trade forex from Pakistan?

London open 1 PM PKT; NY overlap 1-4 PM—high vol. Avoid weekends/news. My scalp hits there.

7. Can I make money with forex trading for beginners?

Yes, but realistic: 1-3%/month after practice. I average $400/mo now. 90% lose short-term—grind wins.

Thanks For Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 20, 2026

- simpactaku

- 9:44 pm

Financial Disclaimer

Financial Disclaimer