Table of Contents

ToggleThe $4,200 Blur: Why I Obsessed Over the Best Time Frame for Trading in the Forex Market

Hunting for the best time frame for trading in the forex market? I lost $4,200 learning the hard way. Here is the honest truth about which time frames actually work.

October 14, 2024. 3:00 AM. I was sitting in my room in Hyderabad, eyes bloodshot, staring at the 1-minute chart of EUR/USD on my MetaTrader 5. I’d been “scalping” for six hours straight. My hands were literally shaking from too much caffeine and too many losses. In one single night, I managed to blow $4,200. It wasn’t just money; it was my entire savings from three months of freelance work.

You know what happened? I thought the 1-minute chart was the “secret.” I saw every tiny wiggle as a massive opportunity. I FOMO’d in at 1.0850, panic sold at 1.0845, then bought again at 1.0848. I was chasing ghosts. By the time the sun came up, my account balance showed exactly $12.74. I felt sick to my stomach. I couldn’t sleep. I just kept replaying those candles in my head.

That disaster forced me to stop and ask: What is actually the best time frame for trading in the forex market? Is it the fast-paced 1-minute madness, or the slow, boring daily charts? Look, I’ve spent the last two years testing everything from the 5-second charts to the monthly candles. I’ve blown accounts on Exness and pulled $5,000 payouts from FTMO.

In this massive breakdown, I’m going to show you the brutal truth. I’ll share my actual trade journals, the math behind my position sizing, and why choosing the wrong time frame is the fastest way to get wrecked. If you’re still trying to figure out your style, you should definitely check out my guide on how to start trading in 2026 to get your basics right first. Let’s get into the weeds of why time frames are the make-or-break factor in your trading career.

The Three Tribes of Time: Which One Are You?

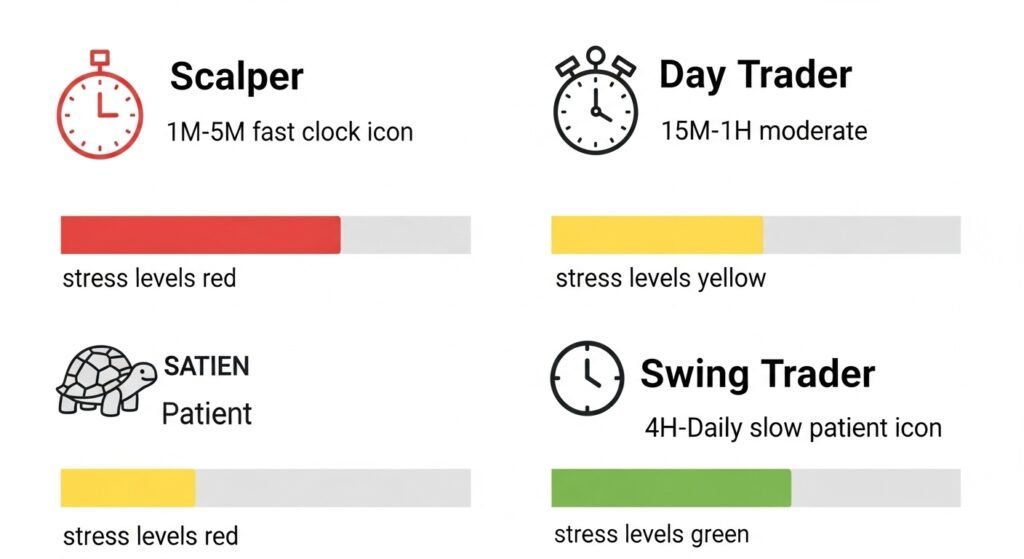

Before you can pick the best time frame for trading in the forex market, you have to know who you are. Traders usually fall into three camps. I’ve tried all of them. I’ve failed at most of them.

The Scalper (The 1-Minute to 5-Minute Junkie)

This was me during the $4,200 disaster. You’re looking for 5-10 pip moves. It sounds easy, right? It’s not. The spreads on brokers like IC Markets or Pepperstone might be thin, but the “noise” is deafening.

- My Experience: I once took 45 trades in one London session. I made $200 and spent $210 on commissions. Total disaster. Not gonna lie, scalping is a full-time job that pays like an intern until you’re a pro.

The Day Trader (The 15-Minute to 1-Hour Sweet Spot)

This is where most people land. You open a trade at the London open and close it before the New York close. No overnight risk.

- Mistakes I Made: I used to ignore the higher-time-frame trend. I’d see a “perfect” 15-minute pin bar and go heavy, only to realize I was trading right into a 4-hour resistance zone. I got wrecked every single time.

The Swing Trader (The 4-Hour to Daily King)

This is the “boring” way. You check charts once or twice a day. Trades last days or weeks.

- The Catch: You need patience. Real patience. I once held a GBP/JPY long for 12 days. I wanted to close it every hour. But it eventually hit my 400-pip target.

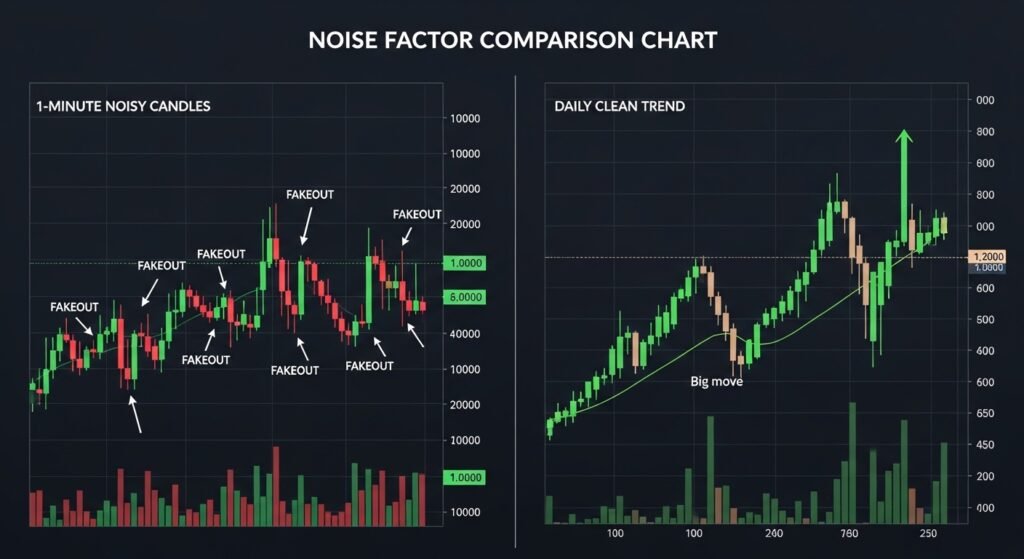

Why the Lower Time Frames Are a Trap for Most

Here’s the thing. The lower the time frame, the more “fake outs” you get. If you’re hunting for the best time frame for trading in the forex market, you need to understand the concept of “Noise.”

The Noise Factor

On a 1-minute chart, a bank moving $50 million can look like a massive trend change. On a Daily chart? It’s just a tiny wick. I learned this the hard way on TradingView. I’d see a “breakout” on the 5-minute, jump in with a huge lot size, and watch it reverse instantly.

What Went Wrong: The News Flash

On January 15, 2025, I was trading the 5-minute chart on Gold (XAU/USD). I saw a bullish engulfing candle. I went in with 2 lots on a $10,000 account. Then, a random Fed member made a hawkish comment. The candle dropped 200 pips in 10 seconds. My stop loss didn’t even trigger because the market skipped my price. I lost $1,800 in a heartbeat.

- Lesson Learned: The lower the time frame, the more vulnerable you are to random news spikes.

Multi-Timeframe Analysis: The Secret Sauce

You don’t just pick one time frame. You use a combination. This is the only way I’ve stayed profitable in 2026. The best time frame for trading in the forex market is actually a “top-down” approach.

My 3-Screen Strategy

- The Higher Time Frame (Daily/4H): This tells me the “Story.” Is the market trending or ranging?

- The Intermediate Time Frame (1H): This is where I look for the “Area of Value.” I wait for the price to hit a support or resistance level here.

- The Execution Time Frame (15M/5M): This is where I find the “Trigger.” I look for a candlestick pattern like a hammer or a train track.

My Experience: The $3,200 Recovery

After losing $4,200, I went back to the drawing board. On February 20, 2025, I spotted a 4-hour resistance level at 1.3600 for USD/CAD. I waited. Instead of FOMO’ing in, I went down to the 15-minute chart. I saw a beautiful head-and-shoulders pattern forming right at that 4-hour level.

- The Entry: 1.3590

- The Stop: 1.3615 (25 pips)

- The Target: 1.3500

- The Result: It took three days, but it hit TP. I made $3,200 on that one trade. Why? Because I used the 4-hour for direction and the 15-minute for precision.

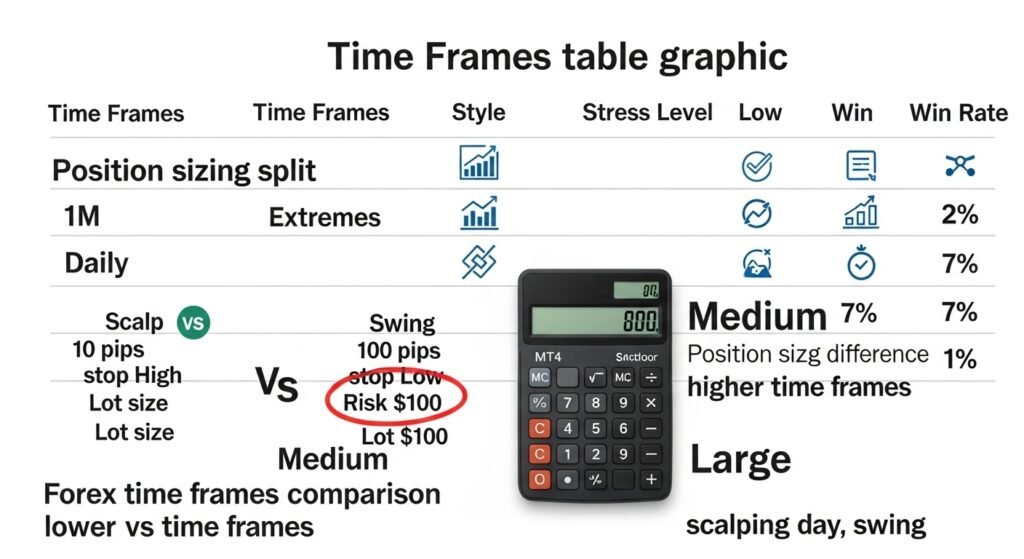

Comparing the Time Frames: A Real-World Table

| 1M – 5M | Scalping | Extreme | 45-50% | High (due to leverage) |

| 15M – 1H | Day Trading | Moderate | 50-60% | Moderate |

| 4H – Daily | Swing Trading | Low | 65-75% | Moderate to Low |

Look at that table. Higher time frames generally have a higher win rate because patterns are more reliable. But you get fewer setups. Are you patient enough to wait for the best time frame for trading in the forex market to give you a signal? Most people aren’t. That’s why they fail.

The Math of Time: Position Sizing and Risks

Your position size changes based on your time frame. If you’re trading the Daily chart, your stop loss might be 100 pips. If you’re on the 5-minute, it might be 10 pips.

The 1% Rule

I never risk more than 1% of my account on any trade, regardless of the time frame.

- Example A (Swing Trade): $10,000 account. 1% risk = $100. Stop loss = 100 pips. Lot size = 0.10.

- Example B (Scalp Trade): $10,000 account. 1% risk = $100. Stop loss = 10 pips. Lot size = 1.00.

Here’s the catch: In Example B, if the market slips by 5 pips, you lose $150 (1.5%). In Example A, a 5-pip slip is only $105 (1.05%). The lower time frame brings much higher “Slippage Risk.” I learned this when Exness slipped my stop on a high-lot scalp. It hurt.

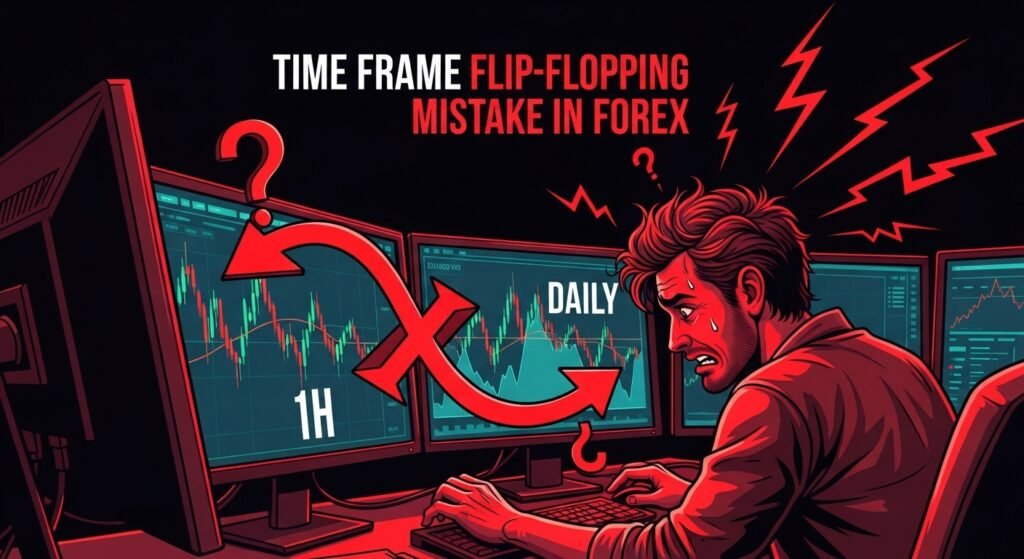

Mistakes I Made: The Time Frame “Flip-Flopping”

This is the most common emotional disaster. You enter a trade on the 15-minute chart. Price starts going against you. You get scared. Then you say, “Oh, I’ll just look at the 1-hour chart, it still looks bullish there.”

You’re lying to yourself. You’re just moving the goalposts to avoid a loss.

- My Personal Disaster: In March 2025, I entered a short on GBP/USD at 1.2500 on the 1-hour chart. My stop was 1.2530. Price hit 1.2530. Instead of closing, I switched to the Daily chart and convinced myself it was a “long-term” reversal. I held that loser until 1.2700. I lost $2,500 on a trade that should have been a $300 loss. Total disaster. Not gonna lie, I cried after that one.

The Psychology of the Best Time Frame For Trading in the Forex Market

Your personality dictates your best time frame for trading in the forex market.

- If you’re impulsive and have a short attention span? The Daily chart will drive you crazy. You’ll over-trade.

- If you’re slow and hate making quick decisions? The 1-minute chart will wreck your mental health.

The “New York Session” Trap

I used to think I had to be there for every second of the New York Open. I’d watch the 1-minute chart like a hawk. Every time Jerome Powell spoke, I’d try to trade the volatility. Big mistake. I realized that “Smart Money” usually waits for the 15-minute or 1-hour candle to close before committing. By trading the 1-minute during news, you’re just gambling.

Practical Example: A Real Trade Breakdown

Let me show you a trade I took on USD/JPY in January 2026. This is how I currently determine the best time frame for trading in the forex market.

- The Setup: A 4-Hour chart showed a strong uptrend. Price pulled back to a previous resistance-turned-support at 145.00.

- The Filter: 1-Hour chart showed a “Bull Flag” forming right at 145.00.

- The Trigger: 15-Minute chart showed a “Morning Star” pattern at 145.10.

- The Entry: Long at 145.15.

- The Stop: 144.85 (30 pips).

- The Target: 146.50.

- Risk/Reward: 1:4.5.

- Outcome: The trade took 18 hours to play out. I made $1,200. No stress. No shaking hands. No staring at every 1-minute candle.

Finding Your “Home” Time Frame

How do you find yours? You have to demo trade. But not for a day. For a month.

- Spend Week 1 only trading the 5-minute.

- Spend Week 2 only trading the 1-hour.

- Spend Week 3 only trading the 4-hour.

- Compare your results and your stress levels.

I found that the 1-hour/4-hour combo is my “Home.” It gives me enough trades to stay interested but not so many that I get overwhelmed. If you’re looking for brokers with the best execution for these time frames, check our top 10 prop firms 2026 list.

Conclusion: There Is No “Holy Grail” Time Frame

Look, I wish I could tell you that the 15-minute chart is the magic answer. It’s not. The best time frame for trading in the forex market is the one that fits your life and your brain.

If you have a 9-to-5 job, stop trying to scalp the 1-minute chart during your lunch break. You’ll get wrecked. Trust me, I tried it and lost $800 while hiding in the office bathroom. Focus on the 4-hour or Daily charts. If you’re a full-time trader with nerves of steel, maybe the 5-minute is for you.

My honest assessment? Higher time frames are safer, more profitable, and better for your soul. Trading should give you freedom, not turn you into a screen-slave with a twitchy eye. Be honest about your failures, learn your math, and pick the time frame that lets you sleep at night.

If you want to see how I combine these time frames with AI tools, read my article on AI tools in crypto trading—the principles are exactly the same.

Trade smart. Stay patient. Don’t blow your account chasing a 1-minute candle.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Forex trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (the $4,200 loss, the $3,200 win, etc.) don’t predict your outcomes.

- Trading on lower time frames increases exposure to market volatility and slippage.

- Only risk money you’re completely prepared to lose.

- Before Trading: Practice on a demo account for at least 3 months, understand multi-timeframe analysis, and start with very small lot sizes.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ Section

1. What is the absolute best time frame for trading in the forex market for beginners?

Look, if you’re just starting, stay the hell away from anything below the 1-hour chart. I’m serious. Beginners get mesmerized by the fast movement of the 1-minute or 5-minute charts, but that’s where the “noise” is highest. I always tell newbies to start with the 4-hour and Daily charts. It forces you to be patient and actually learn how price action works without the distraction of random wiggles. My first year would have been much cheaper if I’d stuck to the 4-hour chart instead of trying to be a “pro scalper” on day one.

2. Can I use the same strategy on all time frames?

Yes and no. While a “Pin Bar” or “Support and Resistance” level works on any chart, the reliability changes. A support level on a Weekly chart is like a brick wall; a support level on a 1-minute chart is like a piece of paper. You can use the same logic, but you have to adjust your expectations. I use the same “Price Action” strategy across all time frames, but I risk much less on lower time frames because I know the failure rate is higher. Don’t assume a 5-minute hammer has the same power as a Daily hammer. It doesn’t.

3. How many time frames should I look at at once?

Don’t overcomplicate it. If you look at 5 different time frames, you’ll get “Analysis Paralysis.” One chart will say buy, another will say sell, and you’ll end up doing nothing or making a mistake. I recommend using exactly three. One for the big picture (Daily), one for the area of interest (1-hour), and one for the entry (15-minute). This is the “Triple Screen” method, and it’s helped me avoid so many fake outs. Anything more than three is just asking for a headache.

4. Does the best time frame for trading in the forex market change for different currency pairs?

Actually, yes. Some pairs are “cleaner” on certain time frames. For example, GBP/JPY is a beast on the 4-hour chart—it trends for thousands of pips. But on the 5-minute chart? It’s a jagged mess that will hunt your stop loss all day. EUR/USD is usually pretty liquid and “clean” on the 15-minute chart during the London session. You have to spend time with each pair to see how it “breathes.” I found out the hard way that scalping CAD/CHF is a waste of time, but swing trading it on the Daily chart is actually quite profitable.

5. Why do pros say the Daily chart is the most important?

Because the Daily chart represents the “Big Money.” Banks, hedge funds, and central banks don’t trade on the 1-minute chart. They make decisions based on daily closes and weekly trends. When you trade the Daily chart, you’re essentially following the “Smart Money.” I spent years fighting the Daily trend because I wanted “quick profits” on the 5-minute. Once I started respecting the Daily candle close, my win rate jumped by 20%. It’s the most honest candle in the market. If the Daily says it’s a sell, stop trying to buy the 5-minute dips.

6. Is “Multi-Timeframe Analysis” necessary for success?

In my honest opinion? Yes. Trading with only one time frame is like trying to drive a car while only looking 2 feet in front of the bumper. You might be okay for a while, but you won’t see the curve in the road coming. Multi-timeframe analysis gives you “Context.” It tells you if that 15-minute buy signal is actually a good idea or if you’re just buying into a massive 4-hour supply zone. It saved my account in 2025, and it’s the only way I trade today. It takes a bit more work, but the results speak for themselves.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 12:44 pm

Financial Disclaimer

Financial Disclaimer