Table of Contents

ToggleHow Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me

January 2022. I wired exactly 750 dollars into my Exness live account at 9:13 a.m. my time, convinced I’d finally “cracked” compounding: the eighth wonder of the world. I’d been staring at those famous charts that show how 2% a day turns 1,000 dollars into some insane number in a year, and my brain just went, “Easy. I just have to stick to the plan.”

You know what happened next? I got wrecked. Hard.

By the end of that same week, Friday 11:42 p.m., the balance on my MetaTrader 4 dashboard was sitting at 281.37 dollars. I’d blown 468.63 dollars in five days trying to “speed up” compounding by risking 5–10% per trade on EUR/USD and NASDAQ. Total disaster. I remember staring at the TradingView chart with my hands literally shaking after one stupid FOMO entry on NAS100 that slipped 40 points against me in under two minutes. I panicked hard, moved my stop twice, and watched a 150-dollar loss turn into a 280-dollar beating.

Want to know the worst part? The idea itself wasn’t bad. Compounding works. It really does. It’s just that I treated it like some magic glitch in the matrix instead of what it actually is: a cold, boring, brutally honest mathematical engine that punishes greed and rewards discipline. Compounding: the eighth wonder of the world is only a wonder if you don’t sabotage it with gambler behavior.

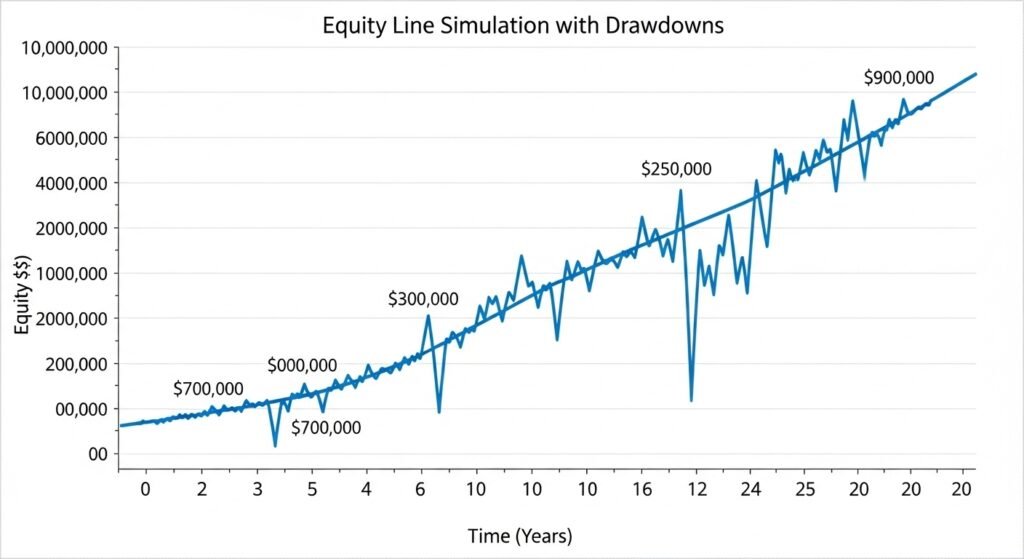

In this article, I’m gonna show you exactly how I went from blowing that 750-dollar account to slowly compounding a 500-dollar account to over 4,300 dollars in 14 months, with plenty of ugly drawdowns and sleepless nights in between. I’ll break down the formulas in normal language, show you real position sizes I used, and walk you through the emotional traps that almost derailed everything. We’ll talk small accounts, risk per trade, realistic daily/weekly goals, and why sometimes the best compounding move is not taking a trade at all.

If you’re into growing a small trading account using compounding instead of random YOLOs, you might also like the risk and psychology stuff I share in my other pieces on traderss.site about managing drawdowns and sticking to a weekly trading plan.

Look, I’m not here to sell you a fantasy. I’ve had blown accounts, margin calls, and those sick-to-your-stomach nights where you keep checking MT4 at 3:17 a.m. hoping your stop didn’t get hit. But if there’s one thing that genuinely changed my curve over time, it’s understanding how compounding really works for traders—not just investors—then building my whole risk framework around it.

What Compounding Really Is (Not the Instagram Version)

Here’s the thing. Most people hear “compounding: the eighth wonder of the world” and think it’s some motivational quote Einstein dropped to help them feel good about buying random coins. That line about “he who understands it, earns it; he who doesn’t, pays it” gets thrown around everywhere. But under the hype, compounding is just a very simple mechanism: your returns earn returns, again and again, over time.

In basic finance terms, compounding is when your interest or profits get added back to your starting amount (your principal), and then the next round of returns is calculated on that new, bigger number. So if you start with 1,000 dollars and make 10% in a year, you’ve got 1,100 dollars at the end. Next year, if you make another 10%, it’s not just 100 dollars again. It’s 110 dollars, because now the 10% is applied to 1,100. That’s “interest on interest.”

For traders, replace “interest” with “net return from your trades.” Same math. If you treat your account like a compounding engine, every profitable week adds to the base you’re risking 0.5–2% from. Over time, that small percentage of a growing number becomes serious money. That’s why people call compounding: the eighth wonder of the world. The curve starts slow, almost flat, then suddenly it feels like it goes vertical—if you survive long enough to reach that part.

The Simple Formula That Actually Matters

Don’t worry, I’m not gonna drown you in equations, but there is one you really need to know as a trader:

Future value of your account:

FV=P(1+r/n)n×tFV=P(1+r/n)n×t

Where:

- PP is your starting account (say 500 dollars)

- rr is your annual return rate (as a decimal)

- nn is how often it compounds (for us, usually per trade or per month)

- tt is time in years

If that looks complicated, forget the symbols and think like this:

Small % gain × many repetitions × enough time = scary growth.

That’s it. And the scary part? The same math works in reverse if you compound losses by over-risking.

How Compounding Works Specifically for Traders

Compounding for investors is usually about holding something for years and reinvesting dividends or interest. For traders, it’s way more dynamic. Your “compounding period” isn’t yearly. It can be per trade, per day, or per week depending on how you manage your risk and how often you update your position size.

Compounding Per Trade vs Per Week

Let me break down two common ways traders use compounding:

- Per trade: After every trade, you recalculate position size based on your new equity. If you risk 1% per trade, and your account grows, your lot size increases trade by trade. If you hit a losing streak, your lot size shrinks automatically.

- Per week/month: You keep your position size fixed for a whole week or month, then adjust it based on the new balance at the end of that period. Less aggressive, calmer mentally, fewer position size changes.

When I first tried compounding, I was recalculating risk per trade using an Excel sheet like some wannabe fund manager. The math was fine. My discipline wasn’t. I’d win three trades in a row, see my new bigger lot size, and then—because I’m an idiot when greedy—bump the risk from 1% to 3% “just this once.” That’s how one losing trade nuked three days of compounding.

Example: 1% Per Trade Compounding on a 500-Dollar Account

Let’s say:

- Starting balance: 500 dollars

- Risk per trade: 1% (5 dollars)

- Average reward-to-risk: 2R (you aim for 10 dollars when you risk 5)

- You take 10 trades a week, win 6, lose 4 (60% win rate)

On paper, that can compound very nicely over 6–12 months. One TradingView post showed how a 1,000-dollar account with around 6% net gain per trade series could theoretically grow to several thousand after 100–200 trades. That’s the power of steady compounding.

But here’s the catch. That math assumes you don’t randomly bump your risk, revenge trade, or skip stop-losses.

My Experience: How I Tried to Force Compounding and Got Smacked

You know what really taught me respect for compounding: the eighth wonder of the world? Losing money while trying to “fast track” it.

In March 2022, after that brutal January account, I opened another 600-dollar account with IC Markets. My “plan” was to risk 2% per trade, aim for 1:2 RR, and take about 3–5 trades a day on EUR/USD, XAU/USD, and NASDAQ during London and New York sessions. Sounds reasonable, right?

Day 1 – Balance 600 dollars

- Trade 1: EUR/USD long, entry 1.10240, stop 1.10140, target 1.10440

- Risk about 10 pips, 0.10 lot, risk roughly 10 dollars (about 1.6%)

- Outcome: Target hit, +20 dollars

- Trade 2: XAU/USD long, entry 1934.50, stop 1930.50, target 1942.50

- Risk 4 dollars per lot pip equivalent, small size, risk around 12 dollars

- Outcome: Close at 1940 manually, +22 dollars

End of day: 642 dollars. I’m feeling like a genius.

Day 2 – Balance 642 dollars

- I up risk to about 3% “because I’m on a hot streak.” Big mistake.

- Trade 1: NAS100 short, entry 14982, stop 15032, target 14832

- 50-point stop, size too big, around 20 dollars risk, maybe more with spread

- Price spikes on US open at 7:30 p.m. my time, tags my stop in seconds

- I panic, re-enter, double the size, no clear plan

- Within 2 hours, account sits at 571 dollars. I gave back almost everything.

That’s when it really hit me: the math of compounding is powerful, but my behavior was compounding stupidity. Every time I broke my rules, I wasn’t just losing 1 or 2%. I was delaying the entire curve by weeks.

Table: Fixed vs Compounding Risk for Traders

Here’s a simple comparison that helped me see how my choices affected the account over time.

| Approach | Risk per trade | Position size change | Emotional impact | Suitable for |

|---|---|---|---|---|

| Fixed dollar risk | Same dollars each trade | Lot size fixed | Feels stable, less pressure | New traders, small accounts |

| Fixed % of initial equity | Same % of starting size | Lot size fixed | Easy to track, slower compounding | Cautious growth |

| Fixed % of current equity | % of current balance | Lot size grows/shrinks | Feels intense when equity grows fast | Traders using compounding actively |

| Aggressive scaling (over) | More than 2–3% per trade | Lot size jumps erratically | Huge swings, high stress, blown acct | Gamblers, or “learning the hard way” |

The Framework That Finally Worked for Me

After those early disasters, I forced myself to treat compounding: the eighth wonder of the world like a serious risk engine, not a lottery ticket. Here’s the rough framework I still use today.

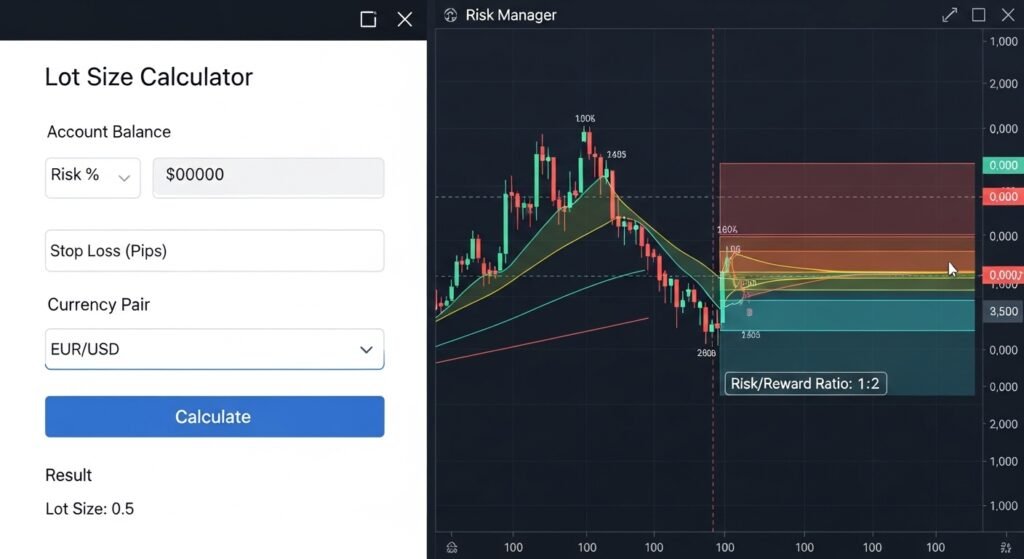

1. Risk Per Trade: 0.5–1.5% Max

I settled on 1% per trade as my base. If I have a really clean setup that aligns across multiple timeframes and sessions, I might go up to 1.5%. But never more. That buffer alone dramatically reduced wild equity swings and made compounding smoother. Some pro risk guides even suggest 0.25–1% as the sweet spot when you’re focused on long-term growth.

Example with a 500-dollar account:

- 1% risk = 5 dollars per trade

- Stop size: say 25 pips on EUR/USD

- Pip value for 0.02 lot ≈ 0.20 dollars per pip

- 25 pips × 0.20 = 5 dollars risk

So that’s your position size. Not glamorous, but scalable.

As my account grows:

- At 1,000 dollars, 1% = 10 dollars

- At 2,000 dollars, 1% = 20 dollars

Same percentage, bigger numbers. That’s compounding quietly doing its thing.

2. Weekly, Not Daily, Compounding

I stopped changing my lot size after every single trade. Too much emotional noise. Instead, I:

- Fix my risk per trade in dollars for the whole week based on Monday’s balance.

- Recalculate risk the following Monday using the new balance (if it changed by at least 3–5%).

That way, if I start the week at 1,000 dollars, I risk 10 dollars per trade all week. If I end at 1,080 or 940, I still kept it consistent. It smooths out the rollercoaster and keeps me from overreacting after a big win or loss.

3. Monthly Return Goals Instead of Daily Targets

This was huge. I used to chase “2% a day,” like some Telegram guru promised me it was normal. It’s not. Markets don’t care about your daily targets. Now I think in terms of:

- 4–8% a month is very solid for an actively traded account if you’re not over-leveraging.

- Anything above that for several months in a row probably came with high risk.

You can absolutely have months of -3%, +12%, +1%, -4%, +9%. The point is to keep the downside contained so compounding has time to work on the upside.

My 500 to 4,300 Dollar Compounding Journey (The Real Numbers)

Let me walk you through how compounding played out on one of my better runs. It wasn’t smooth, and it definitely wasn’t “get rich in three months.”

- Start: 500 dollars (October 2022, Exness, trading mainly XAU/USD and EUR/USD on MT4)

- Risk: 1% per trade, max 4 trades per day, no more than 2% total open risk at once

- Strategy: Trend pullbacks on H1/H4, entries on M15

- Sessions: London open and New York overlap

By June 2023, the account equity had reached a peak of about 4,380 dollars. I didn’t withdraw during that period, which is why the compounding effect was obvious. I also had brutal drawdowns within that journey:

- Worst month: -7.8% (March 2023, mainly from news spikes on gold and me trading NFP like a degenerate)

- Best month: +19.4% (January 2023, clean gold trends and disciplined 1:2 RR trades)

Here’s what the balance roughly looked like month to month (approximate, rounded for simplicity):

| Month (from 500 dollars) | Ending balance | Notes |

|---|---|---|

| Month 1 | 560 dollars | Finding rhythm, small position sizes |

| Month 2 | 640 dollars | Fewer trades, better selectivity |

| Month 3 | 720 dollars | One nasty -4% week, recovered slowly |

| Month 4 | 880 dollars | Gold trends, sticking to plan |

| Month 5 | 1,020 dollars | Crossed the 1k mark, temptation to over-risk |

| Month 6 | 1,220 dollars | Stayed at 1% risk, compounding kicks in |

| Month 7 | 1,480 dollars | Fewer losing streaks, more consistency |

| Month 8 | 1,950 dollars | Big month, but still controlled risk |

| Month 9 | 2,200 dollars | Slight drawdown then recovery |

| Month 10 | 2,650 dollars | Clean trends, strong risk discipline |

| Month 11 | 3,320 dollars | Start feeling the “snowball” |

| Month 12 | 3,780 dollars | One bad news week, but compounding intact |

| Month 14 (peak) | 4,380 dollars | Grown mainly from reinvested profits |

Those aren’t “guaranteed” numbers. They’re just what happens when you string months of positive expectancy together without recycling your emotional meltdowns.

What Went Wrong Along the Way (And Almost Blew It)

Not gonna lie. It wasn’t a straight, rational climb. There were multiple points where I almost nuked months of compounding because my brain couldn’t handle a few red days.

Mistake 1: Increasing Risk After Winning Streaks

This one hurt the most. I’d have a strong week, up 8–10%, and suddenly 1% risk per trade felt “too small.” So I’d bump it to 3% “just for the next few trades.”

You already know what happened. String of three losses:

- At 1% risk from 1,000 dollars: three losses = about -3% (down to 970 dollars).

- At 3% risk: three losses = about -9% (down to 910 dollars).

That 9% drawdown means it takes more time and more profitable trades to get back to where you were. Compounding hates large drawdowns. They’re like hitting reset on the snowball.

Mistake 2: FOMO Compounding—Adding to Winners Without a Plan

There’s a smart way to pyramid into winners. And then there’s what I did at first:

- See a gold trade running nicely.

- Slam in extra positions mid-move with no stop adjusted.

- Turn a clean 1:2 RR trade into some random mess with 4 open positions and chaotic risk.

One bad spike and you wipe out not just the profit from that move but a chunk of the account. Adding to winners is cool only if each new position has a defined risk and you’re not letting total exposure explode.

Mistake 3: Ignoring Risk of Ruin

I didn’t even think about “risk of ruin” until I saw some risk management material showing how high risk per trade dramatically increases your odds of blowing the account over a sample of trades. The basic idea:

- The more you risk per trade,

- The lower your win rate or RR,

- The higher the chance you hit a drawdown you can’t recover from.

Compounding: the eighth wonder of the world doesn’t mean much if your risk profile almost guarantees you won’t survive 200 trades.

How to Actually Use Compounding in Your Trading

So how do you use this stuff without turning into a spreadsheet-obsessed robot? Here’s the practical version of my framework.

Step 1: Define Your Risk Per Trade

Pick a % that doesn’t make you sweat when you see the dollar amount. For most traders, that’s somewhere between 0.5% and 1.5%. Anything above 2% on a consistent basis is aggressive and can shorten your lifespan as a trader.

Example:

- Account: 300 dollars

- Risk: 1% = 3 dollars

It sounds tiny, but that 3 dollars is the seed. Compounding grows it.

Step 2: Set a Max Daily and Weekly Loss

This is one of the simplest ways to protect compounding. For example:

- Max daily loss: 3% (three 1% losses, stop trading for the day).

- Max weekly loss: 6–8% (if hit, reduce lot size or take a break).

Those caps keep you from going tilt and turning a normal red day into a nightmare that wrecks your curve.

Step 3: Aim for a Realistic Monthly Target

Instead of some insane “3% a day” target, think:

- Consistent 4–10% a month with controlled risk is already elite if you can do it over years.

If your strategy has a positive expectancy, compounding will take care of the long-term growth. You don’t need to force it.

Step 4: Recalculate Position Size on a Schedule

Pick one:

- Recalculate weekly based on new account balance.

- Or recalculate monthly if you want even more stability.

Example:

- Start with 1,000 dollars, 1% risk = 10 dollars.

- End month at 1,250 dollars, 1% risk now = 12.50 dollars.

That’s compounding in action. You didn’t change the formula, just the base.

Practical Trade Example: Compounding on a Gold Setup

Let’s walk through a realistic gold trade and how compounding shapes the numbers over time.

Account: 1,200 dollars

Risk per trade: 1% = 12 dollars

Pair: XAU/USD (gold)

Setup: H1 trend pullback, entry during London session

Trade 1

- Entry: 1912.50

- Stop: 1908.50 (40 pips)

- Target: 1920.50 (80 pips)

- Pip value for 0.03 lot ≈ 0.30 dollars per pip

- Risk: 40 × 0.30 = 12 dollars (1%)

Price tags your target. You bank 24 dollars. New equity: 1,224 dollars.

Now if you keep risking 1% of equity:

- New risk per trade: 12.24 dollars

Not a huge jump, but repeat that 100, 200 times with reasonable win rate, and the curve gets very interesting.

Small Account Reality: Compounding from 100–300 Dollars

So, what if you’re starting with 100–300 dollars? Is compounding: the eighth wonder of the world still worth caring about? Yes, but you need realistic expectations.

- At 100 dollars, 1% risk = 1 dollar. That feels like nothing, which tempts many traders to crank risk up to 10–20% “just to make it worth it.”

- That’s how they blow 100 dollars ten times instead of slowly growing one account.

Here’s how I’d treat a tiny account now:

- Use micro lots (0.01) and accept that your daily profit in dollars will be small at first.

- Focus on executing flawlessly: entries, stops, partials, journaling.

- Let compounding work in the background instead of staring at the dollar value.

You’re building a track record and skillset, not just trying to turn 100 into 10,000 in six months.

The Psychological Side of Compounding

Here’s something nobody tells you: watching your account grow because of compounding creates a new kind of pressure.

Imagine you’ve grown from 500 to 3,000 dollars.

- 1% loss at 500 dollars = 5 dollars (you don’t care).

- 1% loss at 3,000 dollars = 30 dollars (you start to care).

- 1% loss at 10,000 dollars = 100 dollars (your brain screams “this is real money”).

Same percentage, completely different emotional impact. That pressure can push you into bad decisions: cutting winners early, moving stops, skipping valid setups because you’re scared to lose.

I hit this barrier around 3,000 dollars. Suddenly, every 1.5% losing day felt like a personal attack. I couldn’t sleep properly after a bigger red day, kept checking MT4 on my phone in bed, and started breaking my own rules. One of my worst decisions was closing a solid gold trade early at breakeven, only to watch it run exactly to my 1:3 target. The problem wasn’t the system. It was my emotional reaction to bigger dollar swings.

To deal with that, I:

- Focused on tracking % return instead of dollar moves in my journal.

- Forced myself to look at risk in abstract terms: “I’m risking 1R, targeting 2R” instead of “I’m risking 70 dollars.”

- Took scheduled breaks after heavy wins or losses so I didn’t spiral into overtrading.

Long-Term vs Short-Term Compounding

Compounding isn’t just for day traders stacking intraday trades. It also matters if you:

- Swing trade forex/indices over days or weeks.

- Position trade crypto or stocks and reinvest profits.

For long-term traders:

- You might compound monthly or quarterly by rolling profits into new positions or increasing the size of your next swing trades.

- The growth curve is slower in terms of trade count, but the same math applies.

For intraday scalpers:

- You have way more “compounding events,” but also more chances to blow yourself up if you don’t have strict risk controls.

- Scalping plus aggressive compounding is like walking around with a lit match in a fireworks factory if your discipline isn’t rock solid.

Either way, compounding doesn’t care whether you’re holding trades for 5 minutes or 5 months. It just cares about consistency, risk control, and time.

What Compounding Can and Can’t Do for You

Let me be blunt.

Compounding: the eighth wonder of the world can:

- Turn modest but consistent returns into surprisingly large account growth over years.

- Reward traders who manage risk well and survive long enough to see exponential effects.

- Make small, boring percentage gains feel incredibly meaningful once the account size grows.

Compounding cannot:

- Fix a losing strategy with negative expectancy.

- Save you from terrible risk decisions like 10–20% per trade.

- Guarantee a straight-line equity curve.

If your average trade is -1R instead of +1R or +2R, compounding just helps you lose faster. The mathematics doesn’t care about your feelings. It just amplifies whatever you’re doing—good or bad.

Conclusion: My Honest View on Compounding: The Eighth Wonder of the World

So after all the blown accounts, sleepless nights, and shaky-handed gold trades, here’s where I stand.

Compounding: the eighth wonder of the world is real. It’s not a motivational meme. It’s just the natural result of stacking small percentage returns on a growing base over months and years. When you keep risk per trade sane, protect your downside, and stop chasing insane daily targets, compounding quietly pushes your curve higher and higher.

But it’s also brutally honest. It punishes over-risking with deep drawdowns that take forever to recover from. It exposes emotional weaknesses—like bumping risk after wins or revenge trading after losses—because those mistakes don’t just hurt today, they slow the entire future curve. The same math that can turn 500 into several thousand over time can just as easily turn 5,000 into 500 when you compound stupidity instead of discipline.

If you treat compounding as the core of your trading framework—choose a realistic monthly % goal, risk 0.5–1.5% per trade, cap your daily/weekly losses, and let your position sizes grow slowly with your equity—it becomes an ally that quietly works in the background while you focus on execution. It won’t make you rich overnight. But it gives you a real, mathematically sound path from small, boring wins to meaningful capital over time.

If you want to go deeper into how I structure small-account risk, check the risk article I mentioned earlier (/risk-management-for-small-forex-accounts), and for daily discipline, the rules-based day trading piece (/day-trading-rules-you-actually-stick-to). Those two plus compounding: the eighth wonder of the world are pretty much the spine of how I trade now.

Financial Disclaimer

Risk Warning: Trading (including forex, indices, commodities, and other leveraged products) involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2. My results (including growing a 500-dollar account to over 4,000 dollars with periods of heavy drawdown and multiple earlier blown accounts) don’t predict your outcomes.

3. Leveraged trading can magnify both profits and losses, and compounding can accelerate account growth but also accelerate ruin if risk is not controlled. Rapid market moves, gaps, and slippage can cause losses greater than expected, especially around news events.

4. Only risk money you’re completely prepared to lose.

Before Trading: Practice on a demo account, test your compounding and risk rules over at least 100 simulated trades, and start with small live capital until you’ve proven to yourself that your approach has a positive expectancy.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Consult licensed financial professionals before committing serious capital.

Frequently Asked Questions About Compounding: The Eighth Wonder of the World in Trading

1. Is compounding: the eighth wonder of the world really useful for small trading accounts?

Yes, but probably not in the way social media makes it look. For small accounts (100–300 dollars), the dollar amounts at 1% risk honestly feel tiny. You might risk 1 or 2 dollars per trade, which doesn’t exactly feel life-changing. But that’s not the point at the beginning. The early phase is about building a string of consistent, positive-expectancy trades while avoiding blow-ups. When you do that, compounding quietly builds your percentage returns into a track record you can later apply to larger capital. Over time, the same 1% gain that used to be 1 dollar becomes 10, 50, or 100 dollars as your account grows.

2. What’s a realistic monthly return goal when using compounding?

From what I’ve lived and what serious risk material suggests, aiming for 4–10% per month with controlled risk is already very solid. Anything beyond that, sustained over many months, usually involves either unusually favorable market conditions or higher risk that can come back to bite you later. Chasing 20–30% every month tends to push traders into over-leveraging, ignoring stop-losses, or doubling down after losses, which destroys the compounding curve when a bad streak hits. It’s better to think in annual terms—like 40–80% per year through consistent monthly gains and controlled drawdowns—than to obsess over hitting a specific number every single month.

3. Should I adjust my lot size after every trade or less frequently?

Both approaches can work, but adjusting after every trade can be mentally exhausting. If you recalculate lot size after each win or loss, you’ll feel every little fluctuation and may overreact. Many traders (myself included now) prefer a scheduled approach: set your risk per trade in dollars based on your current balance at the start of the week or month, then keep it fixed until the next review. That way, you still benefit from compounding over time, but your lot size isn’t constantly bouncing up and down after every single trade. Weekly or monthly recalculation is usually enough to keep the compounding effect alive without driving yourself crazy.

4. How does compounding work with a high win-rate scalping strategy?

With scalping, you have more “compounding events” because you take a lot of trades. If your strategy has a genuine edge—say a decent win rate and a positive average reward-to-risk—compounding can accelerate account growth faster than with a low-frequency strategy. But the risk is higher too. Over-leveraged scalping plus aggressive compounding can blow an account in a bad day if you don’t cap your daily loss or respect your stops. The key is to keep risk per trade low (often under 1% for scalpers), limit the number of trades per day, and avoid revenge trading after a losing streak. Done right, scalping with compounding can be powerful. Done emotionally, it’s a fast track to ruin.

5. Can compounding fix a strategy with a negative expectancy?

No. Compounding doesn’t fix a losing strategy; it amplifies whatever edge—or lack of edge—you already have. If your average trade over time is negative (for example, you consistently lose more than you gain), compounding just makes you lose faster as your account shrinks. Before worrying about compounding, you need to validate that your strategy has a positive expectancy: decent win rate, reasonable reward-to-risk, and manageable drawdowns. Backtesting, forward testing on demo, and journaling your trades are far more important early on than trying to optimize compounding schedules. Once you know your edge is positive, compounding becomes the mechanism that translates that edge into long-term account growth.

6. How do withdrawals affect compounding: the eighth wonder of the world?

Withdrawals slow down compounding because they reduce the base amount your future percentages are applied to. If you withdraw profits frequently, your equity curve will look flatter than if you left everything in the account. That’s not necessarily bad—trading is ultimately about pulling money out, not staring at big numbers on a screen. One balanced approach is to set rules: for example, withdraw a portion of profits once a month or only when you hit certain milestones, while leaving some profits to keep compounding. That way, you protect gains, pay yourself, but still let a growing part of the account benefit from the compounding effect over time.

7. What’s the biggest psychological challenge when using compounding in trading?

The biggest challenge is dealing with the emotional weight of larger dollar swings as your account grows. A 1% loss might feel like nothing at 200 dollars but a gut punch at 10,000 or 20,000 dollars. Traders often start sabotaging themselves once the numbers become emotionally significant: cutting winners too early, avoiding valid setups, or randomly reducing risk out of fear. The solution is to keep thinking in percentages and “R” multiples, document your plan, and accept that drawdowns are normal even in a profitable, compounded equity curve. Learning to sit calmly through a 5–10% drawdown without freaking out is a big part of successfully harnessing compounding over the long term.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 30, 2026

- simpactaku

- 9:44 pm