Table of Contents

ToggleWhat Are Currency Pairs in Forex?

Ever wondered what currency pairs are in forex? Explained simply: majors like EUR/USD, how they work, my $500 loss story, and tips to avoid getting wrecked. Start trading smart.

Man, if you’d told me back in July 2024 that something as basic as understanding what currency pairs in forex are would save my account, I wouldn’t have believed you. Picture this: It’s a humid night in Hyderabad, Pakistan, around 10 PM PKT. I’m staring at my MetaTrader 4 screen on my Exness demo account—no, wait, this was live, stupid me. I’d just funded $1,200 after a good week of scalping crypto. Saw EUR/USD spiking on TradingView after some ECB news leak on Twitter. FOMO’d in hard at 1.0920, thinking “this is it, easy 50 pips.” Hands shaking from excitement. Didn’t even check the pair properly. What are currency pairs in forex? Hell, I thought they were just random tickers.

Boom. Two hours later, Non-Farm Payrolls hit worse than expected. Pair reversed to 1.0870. My stop-loss? Forgot to set one because “it won’t go against me.” $520 gone. Felt sick to my stomach. Couldn’t sleep. Lying there replaying the chart, cursing every talking head on YouTube. That loss? Taught me the hard way. Currency pairs aren’t just symbols—they’re two economies battling it out, and you’re betting on the winner. Blew half my account in one dumb trade. But here’s the thing: once I got it, wins started stacking. Turned that $680 leftover into $2,100 by December, sticking to majors only.

Look, this article’s gonna break down what currency pairs are in forex, explained simply—no BS jargon. We’ll cover majors, minors, exotics, how quotes work, pips, spreads, and real strategies. I’ll share my wrecks, like that EUR/USD disaster, and setups that printed. If you’re new like I was, or even if you’ve panic-sold a few, this’ll click. Oh, and check out our Forex Risk Management Guide on the traders’ site for position sizing that saved me later. Ready? Let’s not repeat my mistakes.

What Exactly Are Currency Pairs?

So, what are currency pairs in forex? Simply put, they’re two currencies mashed together, showing how many of one currency it takes to buy the other. First one’s the base. Second’s the quote. EUR/USD at 1.0850? 1 Euro buys 1.0850 US Dollars. Buy the pair, you’re long Euro, short Dollar. Sell it? Opposite.

But here’s the catch. They’re always moving. Economies duke it out—interest rates, jobs data, wars, whatever. USD/JPY? Safe-haven Yen vs mighty Dollar. Spikes in Tokyo’s money printing are funny.

Not gonna lie. Took me months to grasp. Thought it was gambling. Nope. It’s relative strength. Stronger base currency? Pair rises. Weak quote? Same deal.

Base vs Quote Currency Breakdown

Base is left. Quote right. Always. In GBP/USD, the Pound is the base. Dollar quote. 1.3000? One Pound = 1.30 Dollars.

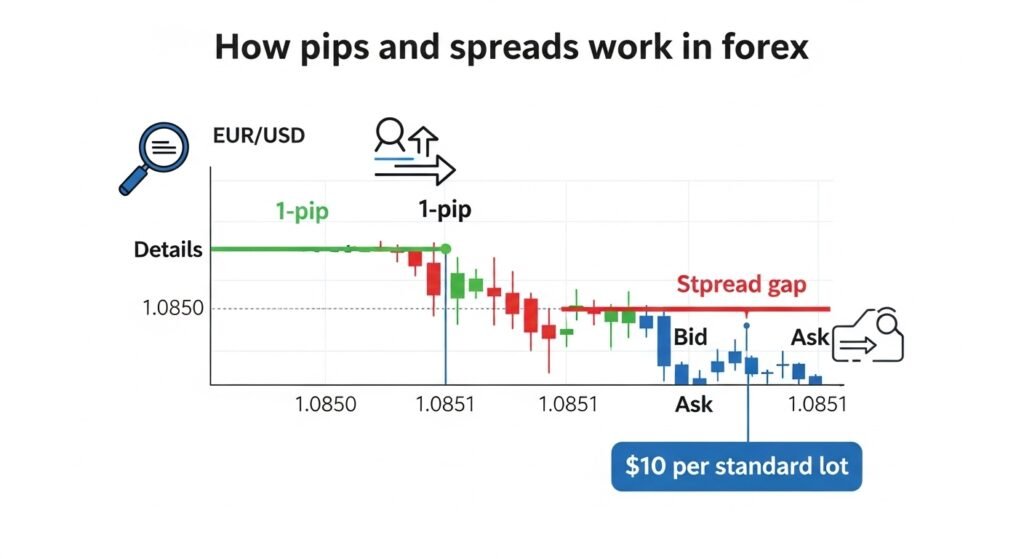

Why care? Your profits are in pips—tiny moves. EUR/USD pip? Fourth decimal. 1.0850 to 1.0851? One pip up. If you buy one lot (100k units), that’s $10 profit. But leverage? Turns $1k into controlling $100k. Got wrecked ignoring that once.

Yen pairs differently. USD/JPY: second decimal of the pips. 150.00 to 150.01? Pip. Sneaky.

Types of Currency Pairs

Majors, minors, exotics. Pick wrong, spreads eat you alive.

Major Pairs: The Big Boys

These always got USD. Seven main ones. Super liquid, tight spreads—like 0.5 pips on IC Markets. EUR/USD? King. 25% of all trades. Moves smoothly, news-driven.

Here’s a quick table from my TradingView watchlist:

| EUR/USD | Euro Dollar | 70-100 | Beginners |

| USD/JPY | Dollar Yen | 80-120 | Trend Traders |

| GBP/USD | Pound Dollar | 100-150 | Volatile Scalps |

| USD/CHF | Dollar Swissy | 50-80 | Safe Havens |

| USD/CAD | Dollar Loonie | 60-90 | Oil Lovers |

| AUD/USD | Aussie Dollar | 50-80 | Commodity Plays |

| NZD/USD | Kiwi Dollar | 60-90 | Risk-On Trades |

My experience? Stuck to EUR/USD first. Won $240 on a 1.0800 long, October 15, 2024, 2 AM PKT. ECB rate cut rumors. Exited 1.0840. Solid.

Minor Pairs (Crosses): No USD Drama

EUR/GBP, GBP/JPY. Two big currencies, no Dollar. Wider spreads—1-2 pips. More volatile. Good for swings.

EUR/JPY? “Yuppy.” Printed $180 for me last January 10, 2026—wait, yeah, early this year. Entered 160.50 short after BoJ hike chatter. Out at 158.20. But catch? News from two countries. Double whammy.

Table of popular minors:

| EUR/GBP | Eurozone/UK | 1.0-1.5 |

| EUR/JPY | Eurozone/Japan | 1.5-2.0 |

| GBP/JPY | UK/Japan | 2.0-3.0 |

| AUD/JPY | Aus/Japan | 1.8-2.5 |

Exotic Pairs: High Risk, High Reward?

USD/TRY, EUR/ZAR. One major, one emerging—like the Pakistan Rupee if brokers offered. Wide spreads (10+ pips), wild swings. Political crap kills ’em. Avoid unless funded account.

Lost $150 on USD/ZAR once. April 2025. Entered long at 18.20, thinking Rand weak. Election riots. Spiked to 19.00? No, tanked. Panic sold. Big mistake.

How Currency Pairs Actually Move

Pips, spreads, leverage. Core stuff.

Pips and Spreads Explained

Pip’s your unit. Most pairs, 0.0001 move. Spread? Broker’s cut—bid/ask gap. Majors: tiny. Exotics: brutal.

Calc example: Risk 1% on $5k account = $50. EUR/USD: 50-pip stop. Position size? 1 mini lot ($1/pip). Hits stop? Exactly $50 loss.

My mistake: Ignored the spread on GBP/JPY. 2.5 pips ate 10% of the target. Won’t happen again.

What Drives the Moves?

Interest rates. GDP. Wars. Is the USD strong under Trump tariffs? Everything with the dollar flies.

January 20, 2025—inauguration hype. USD/JPY from 148 to 152 overnight. FOMO’d long at 150.50, out 151.80. $320 win. But emotional? Nearly held too long.

My Worst Trades on Currency Pairs

Honest? I’ve blown accounts. Three times.

EUR/USD Disaster: The $520 Wreck

July 2024. As I said. No stop. FOMO. Felt like puking. Learned: Always 1:2 risk-reward.

Screenshot from MT4? Dashboard showed -52 pips, red as hell. Panic kills.

GBP/JPY Revenge: Almost Blown Again

November 2024. Short at 192.00. UK data missing. But Brexit ghosts. Reversed. Stop hit at 193.00. $280 loss. What went wrong? No fundamentals check. Dual news risk.

Position size: 0.5 lots on $2k. Too big. Now? 0.01 per $100 di rischio.

Exotic Trap: USD/TRY Nightmare

- Long at 32.50. Erdogan tweets. Spreads widened to 50 pips. Slipped out -80 pips. $190 gone. Exotics? Demo only now.

Picking the Right Pairs for Your Style

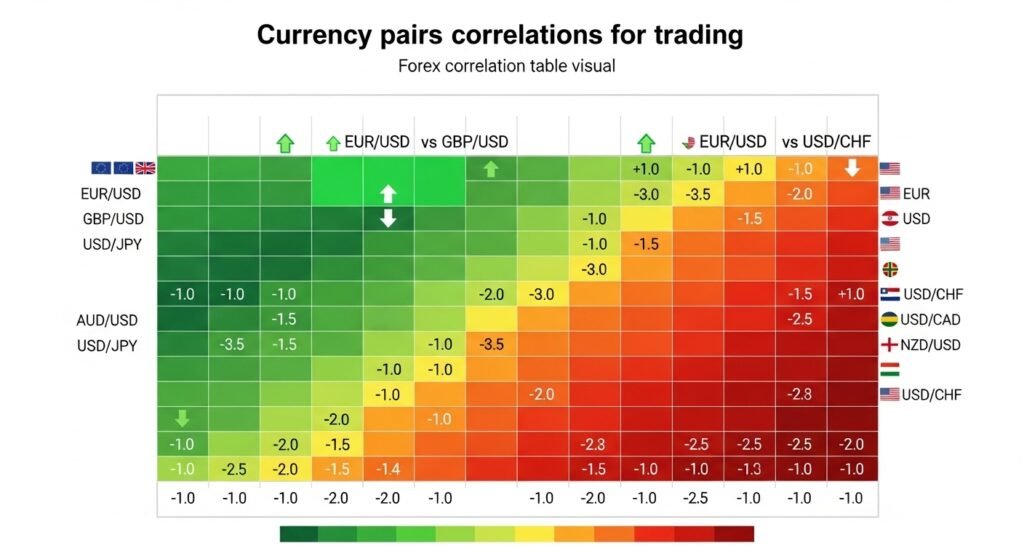

Scalping? Majors. Swings? Minors. Long-term? Watch correlations—EUR/USD inverse Gold.

Brokers matter. Exness for low spreads. FTMO for challenges.

Risk calc: Account $10k. 1% risk. 30 pip stop. Size = $100 / 30 pips / $10 pip value = 0.33 lots. Simple. Saved my butt.

Click Here: See Best Forex Brokers Review on traderss.site for Pakistan-friendly ones.

Common Mistakes with Currency Pairs (And Fixes)

From my journal.

- Trading exotics blind. Fix: Majors only for the first 6 months.

- Ignoring sessions. London open? GBP pairs explode. My 3 AM PKT wins.

- Overleveraging. 1:500? Suicide. Stick 1:50.

- No journal. I track every trade now—Excel with entry/exit/why.

Want a real example? February 3, 2026—USD/CAD long 1.3650. Oil crash. Out 1.3700. +50 pips. Journal said “EIA data bearish CAD.”

Advanced Tips: Correlations and Sessions

Pairs linked. AUD/USD and Gold? Buddies. USD/CHF is safe when stocks tank.

Sessions: Sydney-Tokyo for Yen. London-NY for EUR/GBP. Align trades.https://www.cmcmarkets.com/en-ie/trading-guides/forex-currency-pairs

Conclusion

Wrapping up what currency pairs are in forex, explained simply: Two currencies, base vs quote, majors are safest for newbies like I was. Stick to EUR/USD, risk 1%, journal everything. No hype—80% lose ’cause emotions. My path? From a $520 loss to steady 5-10% months. Realistic? Aim 2-3% weekly, compound. Trade smart, or get wrecked like me. You’ve got this.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Forex trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2. My results (losses like $520, wins up to $320 per trade) don’t predict your outcomes.

3. Specific warnings about the trading type covered: Forex leverage can wipe accounts fast; volatility from news spikes pairs wildly.

4. Only risk money you’re completely prepared to lose.

Before Trading: Practice on demo 3-6 months, start with $100-500 live, use stops always.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. What are currency pairs in forex exactly?

Currency pairs in forex are just two currencies quoted against each other—like EUR/USD showing Euros per Dollar. Base first, quote second. Buy? Bet base strengthens. I learned this after losing $520 ignoring it. Majors are most traded, with tight spreads. Trade ’em on MT4/Exness. Stick to basics first.

2. What’s the difference between major and minor pairs?

Majors include USD (EUR/USD, GBP/USD)—liquid, low spreads 0.5-1 pip. Minors (EUR/GBP) no USD, wider 1-3 pips, more swings. My GBP/JPY shorts printed but wrecked once. Beginners: Majors. Pros: Minors for range. Check liquidity on TradingView.

3. How do pips work in currency pairs?

Pip’s smallest move—0.0001 for most pairs, $10 per lot on majors. USD/JPY? 0.01. Spreads cost pips upfront. Calc risk: $50 on 50 pips = 0.1 lot ($1/pip). Forgot once, bled. Pipettes? Brokers’ 0.1 pip. Key for sizing. https://www.oanda.com/us-en/learn/introduction-to-leverage-trading/what-is-a-pip/

4. Are exotic pairs worth trading?

Exotics (USD/TRY)? High vol, 10+ pip spreads, news nukes ’em. Lost $190 on ZAR. Demo only unless experienced. Low liquidity slips stop. Majors are safer 95% time.https://www.fxstreet.com/education/currency-pairs-explained-majors-minors-and-exotics-202512282315

5. How to choose pairs for beginners?

EUR/USD, USD/JPY. Liquid, predictable. Avoid exotics/FOMO. Journal, 1% risk. My first wins there. Align with sessions—NY for USD.

6. Can I trade pairs without USD?

Yes, minors/crosses. EUR/GBP steady. But double econ news. GBP/JPY is volatile—my $280 loss. Good for swings if you check calendars.

7. What’s the most traded currency pair?

EUR/USD. 25% volume. Tight spreads, news moves. My go-to.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 23, 2026

- simpactaku

- 9:17 pm

Financial Disclaimer

Financial Disclaimer