Table of Contents

ToggleThe Night I Got Wrecked By My “Safe” Crypto Wallet

Confused about crypto wallets and scared of getting hacked? I break down wallet types, real risks, and practical safety tips from trades that actually cost me money.

January 12, 2022. Around 2:40 a.m., Karachi time. I was half-asleep, watching BTC chop around 42,300 on my phone. I thought my funds were “safe” sitting in an exchange wallet. Not gonna lie. I wasn’t even thinking about security. I was thinking about entries, liquidations, and that one more scalp I “needed” before bed.

Guess what happened next?

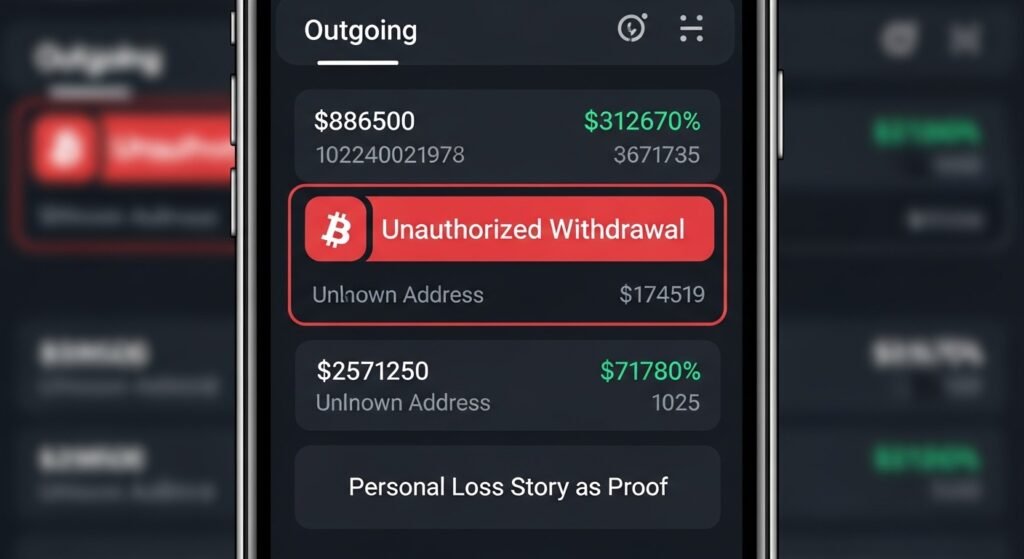

I woke up at 7:15 a.m. and checked my Binance app. My spot balance looked off. Not by a little. By a lot. Around 0.27 BTC was missing. At that price, it was roughly 11,000 dollars down the drain. Just like that. I remember staring at the screen, thinking it was a glitch. I refreshed three times. Nope. Still gone.

My hands started shaking. I dug into the transaction history. There it was: a withdrawal I definitely didn’t make, going to some random address I’d never seen in my life. No SMS. No email that I noticed. No 2FA prompt. I’d stupidly disabled it a week earlier while “fixing an issue” and never turned it back on. Big mistake.

That’s when it smashed into my skull: I didn’t really understand what a crypto wallet was. I knew how to send and receive coins. I knew how to trade perpetuals on Bybit. I could scalp altcoins on KuCoin. But I had zero clue about private keys, custodial vs non‑custodial, hot vs cold, or why leaving my stack on an exchange was basically begging to get wrecked.

Look, if you’re trading crypto and all your coins sit on one exchange, you’re playing Russian roulette with your balance. I learned that the ugliest way possible, staring at my phone at 7:18 a.m., feeling sick to my stomach, doing the math on how long it took me to earn that 0.27 BTC in the first place.

In this article, I’m going to walk you through exactly what a crypto wallet really is, the main wallet types, the real-world risks most traders ignore, and the safety tips I actually use now after losing real money. I’ll show you how hot wallets, cold wallets, hardware devices, and custodial wallets really work in practice, not just on paper. And if you’re totally new to wallets, you might also want to check another guide on traderss.site about getting started with crypto trading basics

If you’ve ever thought, “I’ll secure everything later, after I 3x my account,” this is for you. Because later might never come.

What Is a Crypto Wallet, Really?

Most people think a crypto wallet “stores your coins”. It doesn’t. That’s the first trap I fell into.https://www.coinbase.com/learn/crypto-basics/what-is-a-crypto-wallet

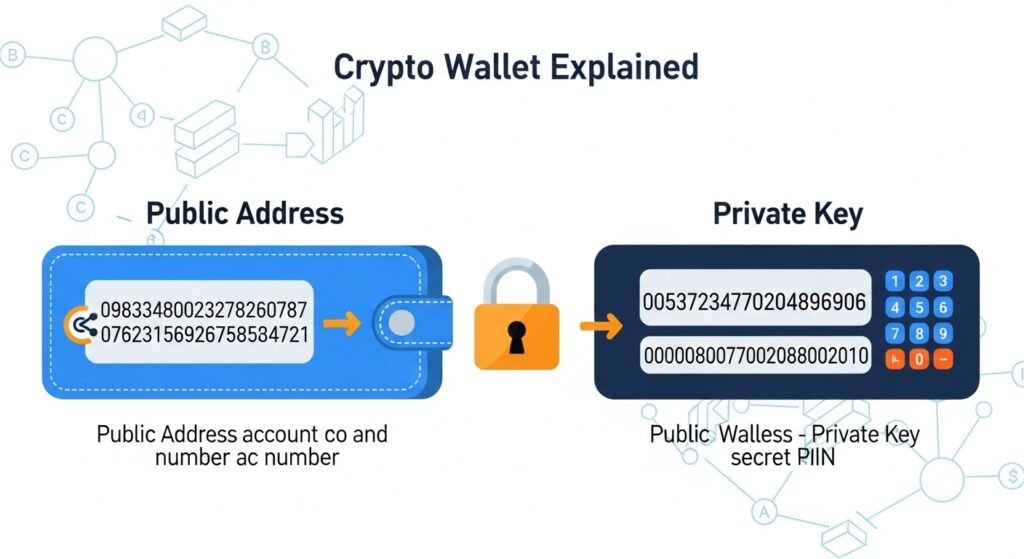

A crypto wallet is basically a tool—an app, a device, or a web service. It stores your private keys and helps you interact with the blockchain. Your coins never live inside the wallet. They live on the blockchain. The wallet just holds the keys that prove you own them. It lets you send, receive, and manage your assets.

Your public key, or wallet address, is like your bank account number. You can share it. People can send money to it, no problem. Your private key is like the master password or PIN. It lets you move those funds. If someone else gets that private key, it’s game over. They’re you, as far as the blockchain is concerned.

So when you ask, “What Is a Crypto Wallet? Types, Risks & Safety Tips,” what you’re really asking is:

How do I store and protect my private keys in a way that fits how I trade, without getting hacked, losing access, or panicking every time the market pumps while my hardware wallet is in another room?

And here’s the thing: not all wallets handle your keys the same way. Some keep the keys on your device, others on a hardware device, others on a company’s servers. Some are always online (hot), some stay offline (cold). That difference matters more than any indicator you’re using on TradingView.

My First Confusion About Wallets

When I started, I thought my Binance “wallet” and my Trust Wallet app were basically the same. Both showed balances. Both had send/receive buttons. Both let me paste addresses and scan QR codes. So I treated them the same way.

But one was custodial (exchange). The other was non‑custodial (I held the keys). I didn’t care. Until that January 2022 morning, when the custodial one got drained. I realized I never really “owned” anything there; I just had an IOU with a nice UI.

That’s when I started actually digging into the different types, and honestly, I wish I’d done it on day one.

Main Types of Crypto Wallets

Let me break down the main wallet types in the same way I explain them to friends who DM me after getting into crypto.

Hot vs Cold Wallets (Online vs Offline)

Hot wallets are connected to the internet. They’re apps on your phone, browser extensions, or exchange wallets. Convenient, fast, and great for daily trading. But they are more exposed to hacks, malware, and phishing.

Cold wallets are offline storage methods, like hardware wallets or paper wallets. They’re slower and less convenient for active scalping. But they offer better long-term security because your private keys stay off the internet.

Here’s a simple breakdown.

Hot vs Cold Wallets Overview

| Internet connection | Always or frequently connected to internet | Kept offline most of the time |

| Typical forms | Mobile apps, desktop apps, web wallets, exchange wallets | Hardware devices, paper wallets, air‑gapped setups |

| Best use case | Daily trading, small spending balances | Long‑term storage, larger holdings |

| Main risk | Online hacks, malware, phishing | Physical loss, damage, forgotten seed phrase |

| Security level | Lower, depends heavily on device security | Higher, immune to online attacks when offline |

So if you’re scalping altcoins all day, you’ll probably need at least one hot wallet. If you’re holding a serious stack, you absolutely need some kind of cold storage, or you’re just hoping nothing goes wrong. Hope is not risk management.

Custodial vs Non‑Custodial Wallets

Custodial wallets mean someone else, usually an exchange or platform, controls the private keys. You log in with an email and password, maybe 2FA. They handle the rest. It feels easy until someone gets hacked, freezes withdrawals, or disappears.

Non‑custodial wallets mean you control the private keys or seed phrase. There’s no “forgot password” button for your funds. If you mess up the backup, you’re done. But you’re also free from the “not your keys, not your coins” nightmare.

Both have their place. But they’re not the same game.

Software Wallets (Mobile, Desktop, Web)

Software wallets are apps or programs, like MetaMask, Trust Wallet, Phantom, and Exodus. They run on your phone or PC. These wallets store private keys locally, usually encrypted with a password or PIN.

They’re hot wallets by default because your device is connected to the internet. That means:

- Super convenient for DeFi, NFTs, and frequent transfers

- But vulnerable if your phone or PC gets malware, keyloggers, or you fall for a phishing site that tricks you into signing a bad transactionhttps://transak.com/blog/software-crypto-wallets-vs-hardware-crypto-wallets

Hardware Wallets

Hardware wallets are physical devices—Ledger, Trezor, SecuX, etc.—designed to keep your private keys offline and sign transactions securely on the device itself. You typically connect them via USB or Bluetooth, confirm transactions on a small screen, and protect them with a PIN and a seed phrase backup.

Key points:

- Private keys never leave the device.

- Transactions are confirmed on the hardware screen, not just your PC or phone.

- Great for long‑term storage and bigger balances, but less convenient for high‑frequency tradinghttps://komodoplatform.com/en/academy/hardware-wallet-vs-software/

Paper Wallets

Paper wallets are just your keys or seed phrase written or printed on paper and stored somewhere safe. Completely offline, but easy to mess up.

- Paper can be lost, burned, or damaged.

- If someone finds it and it’s not well protected, they own your coins.

- Generating them securely without exposing keys can be tricky for beginners.

I don’t use pure paper wallets anymore. But I still write down seed phrases and store them like they’re gold, because they basically are.

How Crypto Wallets Actually Work (Without The Tech Jargon)

Let me keep this simple. When you send crypto, your wallet isn’t pushing coins out of some vault. It’s signing a transaction with your private key and broadcasting it to the network. The blockchain checks that signature and updates its global ledger. Now, the coins are associated with a new address.

So:

- Wallet = A tool that holds keys and signs transactions

- Blockchain = Huge shared database that tracks who owns what

- Public key/address = Where funds can be sent

- Private key/seed phrase = What proves those funds are yourshttps://trustwallet.com/blog/cryptocurrency/what-is-a-crypto-wallet

Your entire “ownership” of any coin boils down to one thing: nobody else has your private key or seed phrase. That’s it. Lose that, or share that, and your ownership is dead.

Seed Phrases: The 12–24 Words That Can Ruin You

Most modern wallets use a seed phrase (12 or 24 words) that can regenerate all your keys if you ever lose the device or app. Sounds nice. Until you realize that anyone who sees those words can also regenerate your wallet on their device and move everything out of it.

Want to know the worst part?

A lot of traders casually write their seed phrase on a sticky note and leave it near their desk. Or in a random screenshot in their gallery. Or in a Google Drive file called “crypto stuff”.

The seed phrase is more important than your wallet app, phone, hardware device, email, or password. It’s the single point of failure you absolutely cannot treat casually.

My Experience With Different Wallet Types

I didn’t figure this stuff out from reading documentation. I learned it by messing up repeatedly.

Exchange Wallets: Where I Got Wrecked

I used Binance, Bybit, and KuCoin heavily in 2021 and early 2022. I treated the exchange wallets as my main “storage”, especially for coins I wasn’t actively trading that week. I’d have 4,000 to 15,000 dollars sitting there at various times, depending on the market.

- I used weak passwords on one exchange.

- I often disabled 2FA during “issues” and forgot to turn it back on.

- I reused email/password combos on random crypto tools.

At some point, one of those habits caught up with me. One morning, I found that the 0.27 BTC withdrawal I mentioned earlier had been sent to an address I’d never used. There was no way to reverse it.

What went wrong?

- I treated an exchange like a bank, not like a high‑risk online service.

- I kept too much there, way more than I needed for trading that week.

- I didn’t respect the difference between “owning coins” and “having a balance in someone else’s system”.

That single hit changed my entire approach.

Mobile Wallets: FOMO Trades On The Go

After that incident, I shifted a lot of my assets to Trust Wallet and MetaMask on my phone. It felt safer because I had the seed phrases written down and knew the funds weren’t sitting on an exchange. But new problems showed up.

One day in March 2022, I FOMO’d into a low‑cap token on PancakeSwap at like 1:10 a.m., buying around 3,200 dollars worth because the chart on my phone looked like a rocket. I didn’t properly double‑check the contract address. Turned out to be some sketchy clone. Devs started dumping, liquidity got yanked, and I watched my 3,200 go to under 400 dollars in a few hours.

Technically, that’s not a “wallet” problem, but the mobile wallet made it way too easy to ape in half‑asleep. Convenience cuts both ways.

Hardware Wallet: Going Paranoid (In a Good Way)

In mid‑2022, I finally bought a hardware wallet. I moved most of my long‑term BTC, ETH, and some stablecoins there. At first, it felt annoying:

- Plugging it in every time

- Confirming each transaction on a tiny screen

- Keeping the device and seed phrase safe but separate.

But after a while, that friction became a feature. If I wanted to panic‑sell my long‑term bag because BTC dropped 12% in a day, I had to physically get up, grab the device, connect it, and confirm the sale. That pause literally saved me from a few emotional exits.

I still use hot wallets for trading and DeFi, but my “sleep at night” stack now lives on hardware. And I treat that seed phrase like it’s the key to my house, car, and bank account combined.

Comparing Wallet Types For Real Traders

Here’s how I look at it now when deciding where to keep what.

Wallet Types Side‑By‑Side

| Exchange wallet | Custodial | Hot | Active trading, quick access | Exchange hacks, withdrawal freezes, no key control |

| Mobile software wallet | Non‑custodial | Hot | Daily use, small balances, DeFi | Phone malware, phishing, seed compromise |

| Desktop software wallet | Non‑custodial | Hot | Larger balances if PC is secure | PC malware, keyloggers, local hacks |

| Hardware wallet | Non‑custodial | Cold | Long‑term storage, larger stacks | Physical loss, damage, seed mismanagement |

| Web wallet | Custodial/mixed | Hot | Quick browser access, beginners | Phishing, credential theft, platform breaches |

| Paper wallet | Non‑custodial | Cold | Simple offline backup | Physical damage, theft, generation mistakes |

Key Risks Of Crypto Wallets Traders Ignore

You can have the best hardware wallet in the world and still get wrecked if your habits suck.

Online Attacks: Phishing, Malware, Fake Sites

Hot wallets—especially exchange, mobile, and browser wallets—are magnets for online attacks.

Common traps I’ve seen or personally almost fallen for:

- Fake login pages that look exactly like Binance or MetaMask, stealing your credentials

- Wallet Connect pop‑ups on shady sites that trick you into signing malicious transactions.

- Telegram/Discord “support” asking for your seed phrase “to help recover your funds”

I nearly approved a malicious MetaMask transaction once at 3 a.m. just because I clicked too fast on a DeFi site that looked legit. One more tap and my whole hot wallet would’ve been drained.

Custodial Risk: Not Your Keys, Not Your Coins

Any wallet where you don’t control the private keys comes with platform risk. We’ve seen exchanges freeze withdrawals, get hacked, or collapse. When that happens, your “wallet” is just numbers in their database.

If you’re using an exchange wallet, you’re trusting:

- Their security practices

- Their solvency

- Their honesty

Sometimes that works. Sometimes people wake up to “withdrawals temporarily paused” banners.

Human Error: Forgotten Seeds, Wrong Addresses, No Backups

Honestly, human error is the biggest killer.

- Sending coins to the wrong network or wrong address

- Forgetting to back up the seed phrase

- Storing the seed in a picture on your phone

- Losing a hardware wallet with no recovery phrase saved anywhere.

I once sent 600 USDT to a BTC address on an exchange because I was rushing and copied and pasted the wrong thing. Support couldn’t recover it. That was another “feel sick to my stomach” moment.

Device Loss & Damage

If your mobile or desktop wallet is the only place your keys exist, and the device gets:

- Lost

- Stolen

- Wiped

- Water damaged

…you’re done unless you have that seed phrase. No seed, no coins.

What Went Wrong In My Own Wallet Setup

Let me be brutally honest about the main mistakes I made.

Mistakes I Made

- I kept too much on exchanges, way above what I needed for weekly trading.

- I reused passwords across different crypto services.

- I sometimes disabled 2FA for convenience and forgot to re‑enable it

- I didn’t separate “trading funds” from “long‑term holdings”.

- I underestimated phishing and overestimated my own “I’m careful” mindset.

The result wasn’t just one bad day. It was months of rebuilding, mentally and financially.

How I Fixed It (Gradually)

I didn’t flip a switch and become super secure overnight. It took multiple small changes.

- Started using a password manager with unique, long passwords for every exchange and wallet‑related email.

- Enabled 2FA everywhere it was offered, using apps instead of SMS when possible.

- Bought a hardware wallet and moved my long‑term stack there.

- Kept a small hot wallet balance dedicated to trading and DeFi.

- Treated every “support” DM as a scam by default.

It’s not perfect. Nothing in crypto is. But I’m not casually risking five‑figure amounts on a single point of failure anymore.

Practical Wallet Safety Framework For Traders

Here’s the framework I actually use now when setting up my wallets for trading and investing.

1. Split Your Funds By Purpose

I basically think in three buckets now:

- Trading wallet (hot, exchange, or mobile)

- Spending/DeFi wallet (hot, mobile/desktop)

- Long‑term storage (cold, hardware)

If I’m actively trading futures, I only keep what I need for the week on that exchange. If my trading account balance goes way above that, I withdraw some to safer storage. No exceptions, even if the market looks “too good”.

2. Use Strong Authentication On Anything Hot

For any wallet or account that can send funds while you’re connected to the internet:

- Unique, long password

- 2FA via an authenticator app, not SMS

- No sharing login details across multiple platforms.

If a site or service doesn’t support decent security, I don’t park serious money there. Simple as that.

3. Seed Phrase Rules I Live By

I treat my seed phrases like nuclear launch codes:

- Never store them in plain text on any internet‑connected device.

- Never type them into any website, even if it looks official.

- Handwritten backup in at least two secure locations.

- If I suspect a seed phrase is compromised, I move funds to a new wallet and retire the old one.

Want to know the worst part?

Most traders don’t even test their recovery process. They assume that if something happens, they’ll “figure it out”. That’s not a plan.

4. Verify Every Transaction Twice

Before every send:

- Check the address first and the last 4–6 characters.

- Check the network (ERC‑20, BEP‑20, etc.)

- Send a small test amount if I’m moving a large sum or using a new address.

Yes, it’s slower. Yes, it’s annoying. But it’s a lot less annoying than losing a month’s profit because you pasted the wrong address.

Real Trade Example: Wallet Setup vs Emotion

Here’s a simple example of how my wallet setup actually calmed me down during a nasty dump.

In June 2022, BTC dropped from around 31,000 to 28,000 faster than I was ready for. My trading wallet on Bybit had about 1,800 dollars in USDT and some BTC I was using for hedging. My hardware wallet held the majority of my BTC, around 0.9 BTC at the time.

If I’d had everything on the exchange, I’d probably have panic‑sold something. Because I’d be staring at one big red number. But because my long‑term stack was tucked away in the hardware wallet, I mentally categorized it as “not to be touched right now”.

So I only managed the trading wallet. I took a loss on a bad long, around 350 dollars, but I didn’t nuke my portfolio out of fear. The wallet separation literally changed my behavior. That’s the overlooked side of wallet management: it’s not just tech; it’s psychology.

Position Sizing & Wallet Risk: A Simple Breakdown

Let’s say you have 10,000 dollars total in crypto value.

Here’s how I might break that down, purely as an example of structure, not advice:

- 6,000 dollars in long‑term holdings on a hardware wallet

- 3,000 dollars on an exchange for active trading

- 1,000 dollars in a mobile wallet for DeFi or on‑chain plays.

Then, inside that 3,000 trading chunk, I’d still do risk management per trade. For example, if I risk 1% of total capital per trade, that’s a max loss of $100 per trade. Even if a black swan hits and something happens to the entire exchange, I’ve only lost the 3,000 trading bucket, not the entire 10,000.

Is that still painful? Absolutely. But it’s survivable. That’s the difference.

Screenshots & Proof (How I Think About It)

I’m not attaching images here, but this is exactly what I’d show a friend:

- Screenshot of my Binance/Bybit “Funding” and “Spot” wallets, showing smaller balances used only for active trading and frequent withdrawals.

- Screenshot from my hardware wallet dashboard showing BTC and ETH balances that barely move, except for occasional top‑ups and rare rebalancing.

- Screenshot of a small mobile wallet, maybe on MetaMask or Trust Wallet, with only what I’m comfortable losing in DeFi experiments.

That kind of structure isn’t sexy. But it’s the difference between “I got hacked and lost everything” and “I got hit, but I’m still in the game.”

Safety Tips You Should Actually Use

Here’s the stuff I’d force my younger self to do if I could.

For Hot Wallets

- Always enable 2FA and strong passwords on exchanges and web wallets.

- Keep trading balances lean; withdraw profits regularly.

- Bookmark official sites; never click login links from emails or DMs.

- Double‑check browser extensions; remove ones you don’t use.

For Hardware & Cold Storage

- Buy only from official vendors, not random resellers.

- Initialize and generate the seed phrase yourself, never use pre‑printed ones.

- Store the seed phrase offline in multiple secure locations.

- Test restoring from the seed phrase with a small amount before trusting it with your entire stack.

For Everyday Behavior

- Treat every unexpected DM, email, or pop-up about your wallet as a scam until proven otherwise.

- Slow down when moving funds; triple‑check addresses and networks.

- Assume that one day, something will go wrong—and design your wallet setup so it doesn’t wipe you out.

What Is a Crypto Wallet? Types, Risks & Safety Tips – Pulling It All Together

So, What Is a Crypto Wallet? Types, Risks & Safety Tips isn’t just a neat SEO phrase. It’s literally the checklist that decides whether you survive in this market when shit hits the fan.

A crypto wallet is simply the way you store and manage your private keys so you can send, receive, and hold your coins on the blockchain. You’ve got hot wallets (mobile, desktop, exchange, web) that give you speed and convenience but increase your attack surface. Then you’ve got cold wallets (hardware, paper) that trade convenience for security and are better for bigger or long‑term holdings.https://en.wikipedia.org/wiki/Cryptocurrency_wallet

The biggest risks aren’t just hackers and malware. They’re your own habits: reusing passwords, skipping backups, falling for FOMO trades on your phone at 2 a.m., and trusting platforms you don’t control. The good news? A solid wallet framework—splitting funds by purpose, using strong authentication, guarding your seed phrases, and not overloading any single wallet—can dramatically reduce your chances of waking up to a drained balance.

If you want to go deeper into risk management and not just wallets, you should check other traderss.site articles on crypto risk management and exchange safety . None of this guarantees profit. But it massively increases the odds that when you finally start winning, you actually get to keep what you earn.

And that, honestly, is the whole point.

Risk Warning: Crypto trading and cryptocurrency investing involve substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (including losses like the BTC I mentioned and other trades that didn’t work out) don’t predict your outcomes.

- Crypto assets and wallets can be affected by hacks, technical failures, regulatory changes, exchange closures, and extreme volatility.

- Only risk money you’re completely prepared to lose.

- Before Trading: Practice with demo accounts where possible, start small with real funds, and test your wallet setup and recovery process before depositing larger amounts

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ: What Is a Crypto Wallet? Types, Risks & Safety Tips

1. Do I really need a crypto wallet if I just trade on exchanges?

If you’re only doing small, occasional trades, you can technically survive using just exchange wallets. But you’re accepting full platform and custodial risk. If the exchange gets hacked, freezes withdrawals, or collapses, your coins can get locked or lost with zero guarantee of recovery. A separate non‑custodial wallet (software or hardware) gives you a place to store funds you’re not actively trading, where you actually control the keys. A lot of traders keep only a “working balance” on exchanges and move profits out regularly, precisely to avoid waking up to sudden withdrawal bans. It’s not mandatory, but if you care about long‑term security, it’s smart.

2. What’s the safest type of crypto wallet?

There’s no 100% safe option, but for most people, a well‑set‑up hardware wallet is the best balance of strong security and usability. Hardware wallets store your private keys offline, sign transactions on the device, and are immune to most online attacks when kept disconnected. The main risks shift from hackers to you: losing the device, damaging it, or mismanaging the seed phrase backup. That’s why it’s crucial to buy only from official sources, initialize the device yourself, write down the seed phrase by hand, and store it securely in at least two places. Combine that with a small hot wallet for day‑to‑day use, and you’re in a much better position than using only exchange wallets.

3. How much should I keep in a hot wallet vs a cold wallet?

There’s no universal ratio, but a simple rule of thumb I use is: only keep what you actively need in hot wallets, and move everything else to cold storage. For example, if your total crypto stack is 10,000 dollars, you might keep 1,500–3,000 in exchange and mobile wallets for trading and on‑chain activity, and 7,000–8,500 in a hardware wallet you rarely touch. The exact numbers depend on how much you trade and your risk tolerance, but the principle is the same—never leave your entire net worth exposed to one hackable device or platform. If losing everything in one hot wallet would ruin you, you’re overexposed.

4. What’s the difference between a seed phrase and a private key?

A private key is a long, secret number that controls a specific address on the blockchain, while a seed phrase is a human‑readable set of words that can generate multiple private keys for a wallet. Modern wallets use seed phrases (usually 12 or 24 words) as a backup method so you don’t have to store every single private key individually. If someone gets your seed phrase, they can recreate your entire wallet, with all its addresses and balances, on their own device. So in practice, your seed phrase is even more powerful (and dangerous) than any single private key. Protect it as if it were your entire portfolio, because it is.

5. What happens if my wallet app or hardware wallet breaks?

If your wallet breaks but you still have your seed phrase, you can recover your funds on a new device or compatible wallet app. That’s the whole point of the seed: it’s the master backup. You simply install a new wallet (software or hardware), choose “restore from seed”, enter those words carefully, and your addresses and balances reappear. However, if you lose both the device and the seed phrase, there’s no central support to rescue you; your funds are effectively gone forever. That’s why I always advise testing your recovery process with a small amount before trusting a wallet setup with serious money. Don’t wait for disaster to find out you wrote one word wrong.

6. Are mobile wallets safe enough for daily use?

Mobile wallets can be safe enough for daily use if you treat your phone like a financial device, not just a social media gadget. That means locking it with a strong passcode or biometrics, avoiding app sideloading from sketchy sources, keeping the OS updated, and not installing random “free” crypto apps from unknown developers. You should also avoid storing large amounts on mobile wallets; use them for spending, DeFi, and smaller balances, not your entire long‑term bag. Combined with a secure hardware wallet for larger amounts, mobile wallets become a useful and relatively safe part of your overall setup, rather than a single point of catastrophic failure.

7. How can I avoid common wallet scams?

The simplest filter is to assume anyone asking for your seed phrase or private key is a scammer, no matter what logo or name they use. Official support from exchanges and wallet providers will never ask for that information. Always double‑check URLs, bookmark official sites, and ignore login links sent via email or DMs. When interacting with DeFi sites, verify the domain and contract addresses from trusted sources before connecting your wallet. And whenever you feel rushed—“limited time airdrop”, “urgent security update”—slow down. Scams rely on panic and urgency. If you remove those, you remove most of their power.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 25, 2026

- simpactaku

- 11:11 am