Table of Contents

ToggleWhat Is AI Trading? (From Someone Who Got Burned First)

September 18, 2024. 2:37 AM. London session about to open, coffee gone cold next to my laptop. I’d just turned on an AI trading bot I’d built around EUR/USD and BTC/USDT on MetaTrader 4 and Binance Futures, thinking I was a genius. It had backtested a 63% win rate and a smooth-looking equity curve. I was convinced this thing would print money while I slept.

So I funded the account with exactly 2,000 dollars. Gave the bot permission to trade 0.5 lot on EUR/USD and up to 0.01 BTC on BTC/USDT. Look, I knew that was aggressive. But greed whispered, “It’s AI. It’s smarter than you.”

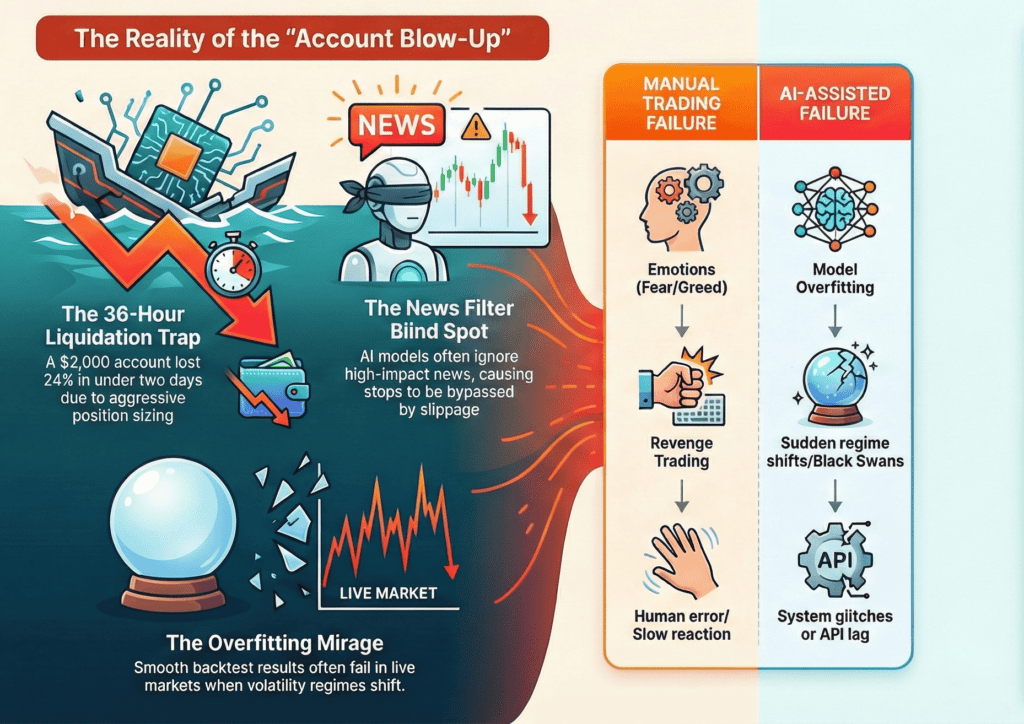

You know what happened next? In less than 36 hours, the bot took six trades. Four losses, two wins. Net result: minus 486 dollars. One EUR/USD position slipped during high volatility around 3:12 PM, turning a planned 35-dollar risk into almost 80. Another BTC trade didn’t close when the stop should’ve triggered because my VPS lagged. I watched the unrealized loss push past 210 dollars. Hands shaking. Felt sick to my stomach.

That’s when it finally hit me: AI in trading isn’t some magical autopilot that only goes up. It’s just another tool. A powerful one, sure, but just as capable of blowing your account if you don’t respect risk, execution, and your own emotions.

In this article, you’re getting the version nobody wants to say out loud:

- What AI trading actually is, in plain language.

- The exact ways it can help you and the exact ways it can wreck you.

- The real trades (with entries, exits, and mistakes) taught me the hard lessons.

- A simple framework for using AI safely instead of gambling with fancy code.

If you’re new to algorithmic stuff, you might also want to read a basic risk management article on traderss.site first to avoid making my early mistakes.

Not gonna lie. This is the guide younger me desperately needed.

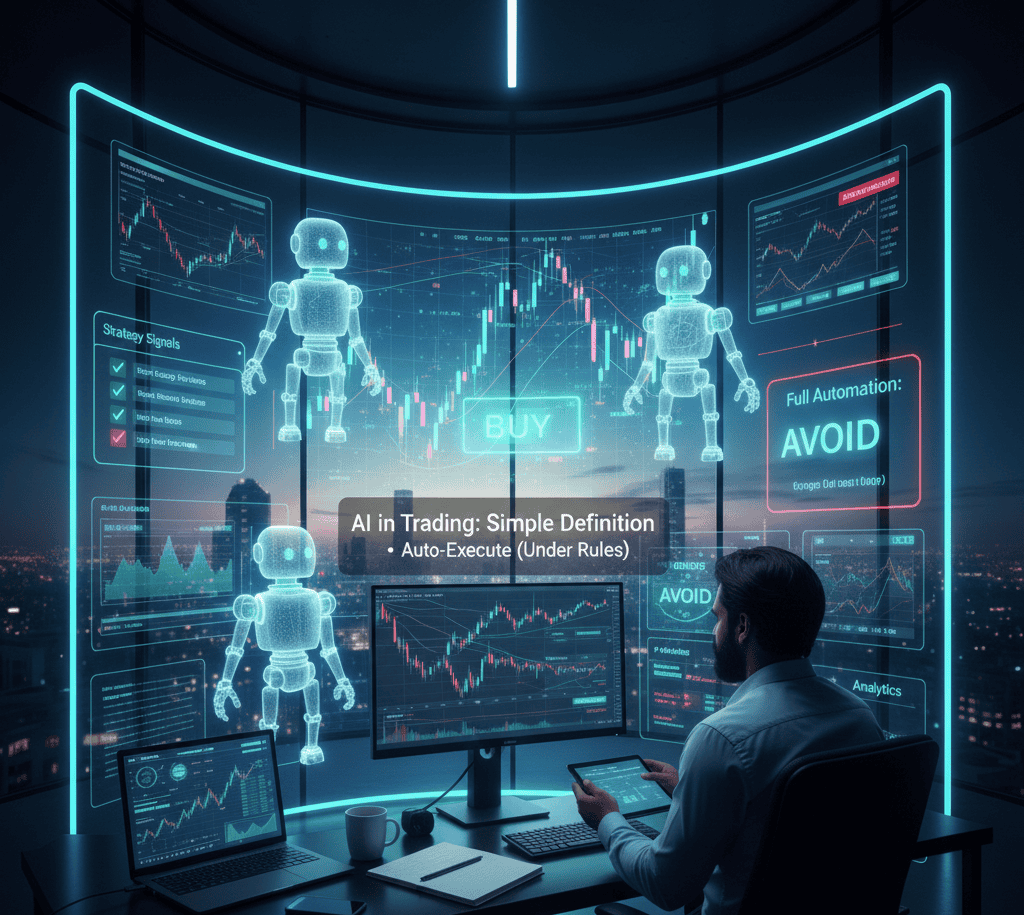

AI in Trading: Simple Definition

Here’s the thing. People overcomplicate this.

AI trading is just using artificial intelligence models and algorithms to help make, manage, or execute your trades. That’s it.

Instead of you:

- staring at charts all day,

- checking indicators one by one,

- trying to read news and social media manually,

The AI system:

- scans price, volume, and order book data in real time,

- looks for patterns it was trained to recognize,

- and either sends you signals or auto-executes trades under your rules.

So, AI in trading usually shows up in four main ways:

- Strategy signals: “Buy here, sell there” suggestions based on data.

- Full automation: Bots that open and close trades for you.

- Risk management: Systems adjust position size or stop losses as volatility changes.

- Analytics: Journals and tools that dissect your trades and behavior.

Sounds beautiful on paper. But there’s always a catch.

How AI in Trading Actually Works (Without the Buzzwords)

Forget the buzz. Under the hood, most AI trading setups use a mix of:

- Machine learning models that learn from historical price data, news, or sentiment.

- Technical indicators like RSI, MACD, moving averages, and volume-based tools.

- Rule-based logic to turn predictions into concrete entries, exits, and position sizes.

One basic flow looks like this:

- Data comes in (prices, volumes, maybe news).

- The AI model predicts something like: “Next 30 minutes: 60% chance EUR/USD goes up 15 pips.”

- Your strategy rules translate that into a trade: “If probability > 55% and spread < 1 pip, go long with 0.25% risk.”

- The bot executes through your broker platform (IC Markets, Exness, etc.) via APIs or terminals like MetaTrader 4, MetaTrader 5, cTrader, or Trade Ideas–style platforms.

AI doesn’t “know” the market. It just finds statistical edges — patterns that, historically, paid off more often than not. And when the regime changes (like crazy macro news or random black swans), those patterns can stop working instantly. That’s exactly how I got slapped.

My First AI Bot That Blew Up

Setup Details

This wasn’t a demo. This was real money.

- Date: Live start on September 18, 2024.

- Broker: IC Markets for EUR/USD, Binance Futures for BTC/USDT.

- Platforms: MetaTrader 4 for forex, exchange API for crypto.

- Starting balance: 2,000 dollars.

- Max risk per trade (on paper): 2%.

- Actual risk in practice: closer to 4–5% because of slippage and my greed.

The bot logic:

- Trade London and New York overlap only (12:00–18:00 GMT).

- Look for short-term trends and momentum using moving averages, RSI, and volatility filters tuned by a machine learning model trained on 3 years of data.

- Target 1.5R on winners, cut losers at 1R.

One Trade That Still Annoys Me

- Pair: EUR/USD

- Date: September 19, 2024

- Time: 14:06 GMT entry

- Direction: Long

- Entry: 1.06940

- Stop loss: 1.06820 (12 pips)

- Take profit: 1.07120 (18 pips)

- Position size: 0.5 lot

The idea was simple: short-term pullback in an intraday uptrend, with momentum ticking back up. The AI model tagged this type of pattern as “high probability” based on past sessions.

Position sizing math:

- Account: 2,000 dollars.

- Planned risk: 2% → 40 dollars.

- Pip value for a 0.5-lot EUR/USD trade: around $ 5 per pip.

- 12-pip stop × 5 dollars = 60 dollars risk.

Big mistake. I let the system overshoot my planned risk. That one choice alone meant I was effectively risking 3% instead of 2%.

Price pushed up maybe 5 pips in my favor, stalled, and then NFP-related headlines hit the feed earlier than usual. Spread widened, liquidity thinned, and the bot didn’t have news filters. Price spiked down, slipped through my stop, and I took almost a 78-dollar hit instead of the planned 60.

Want to know the worst part?

The model had no clue it was NFP week. It just saw the pattern it “liked” and fired.

What Went Wrong (And Why It Wasn’t Just The AI)

Here’s where it gets uncomfortable. The AI system wasn’t the real villain. I was.

My mistakes:

- I overestimated the backtest. The model performed well on historical data, but I didn’t test it on enough high-volatility news events.

- I underestimated slippage and execution risk. I treated my stops as exact numbers rather than ranges.

- I gave it too much size too fast. Running 0.5 lots on 2,000 dollars for an intraday bot that hadn’t seen a month of live trading yet? Reckless.

- I had no kill switch. No rule like “If three consecutive losses or 4% drawdown in a day, shut the bot down.”

Emotionally?

- After the second loss, I felt attacked.

- After the fourth, I was hovering over the “disable” button but still hoping for a hero win.

- That’s not “rational trader with AI support”. That’s basically a gambler hiding behind code.

So yeah, AI in trading didn’t blow my account. My lack of discipline did.

Pros and Cons of AI in Trading

Realistic Overview

Here’s a simple way to think about it if you’re considering using AI tools.

AI Trading Upsides

- Processes insane amounts of data faster than you ever could.

- Trades with perfect discipline (no fear, greed, or boredom) as long as rules hold.

- Can run 24/7, especially useful in crypto.

- Great for backtesting and quickly refining strategies.

AI Trading Downsides

- Breaks hard during regime shifts (flash crashes, black swan events, major news).

- Can amplify bad strategies at scale. Lose faster, not slower.

- Needs constant monitoring and updates. It’s not “set and forget”.

- Psychological trap: easier to trust the bot more than to stick to your risk limits.

Quick Comparison: Manual vs AI-Assisted Trading

| Speed | Slow, limited to what you can watch | Blazing fast, scans multiple markets at once |

| Discipline | Easily broken by emotions | Executes rules consistently (until conditions change) |

| Data depth | Few pairs, few timeframes | Many pairs, many indicators, news, sentiment |

| Setup complexity | Lower, just platform and strategy | Higher, needs data, models, infrastructure |

| Failure mode | Overtrading, revenge trading | Model overfitting, sudden blowups in new regimes |

| Best use case | Discretionary swing, news trading | Systematic, repetitive patterns and execution |

Types of AI Trading Systems You’ll See

Not all AI-based tools are the same. And it matters, because you’ll use them differently.

Signal-Only AI Tools

These tools analyze the market and give you trade ideas, but don’t execute them. Think of AI-powered scanners or trade signal platforms that plug into TradingView or proprietary dashboards.

They may:

- Highlight chart patterns (breakouts, head and shoulders, trends).

- Flag sentiment shifts on news or social media.

- Give probability estimates for moves.

You still press the button. You still set the size. You still manage exits.

Fully Automated AI Bots

These are the ones that can wreck you quickest if you’re not careful.

They:

- Take signals from AI models and auto-open trades on your broker via APIs.

- Manage stop losses, take profits, and sometimes trailing stops.

- Can hedge, scale in, or scale out based on rules.

On crypto, you’ll see these running 24/7, scalping tiny moves on BTC, ETH, or altcoins. In forex, they often focus on high-liquidity pairs such as EUR/USD, GBP/USD, and XAU/USD.

AI Trading Journals and Analytics

This is the underrated category.

Tools like AI-powered trading journals analyze your own history:

- Which setups do you consistently win?

- What time of day do you trade best?

- Which pairs should you probably stop touching?

They can tag trades, spot behavioral patterns, and give you insights you didn’t notice yourself.https://tradersage.ai/

Honestly, this kind of AI in trading has helped me more than any aggressive “money printer” bot.

My Second Attempt: Using AI As a Trading Assistant, Not a Pilot

After getting smacked, I took a break. No live AI bots for almost two months.

In November 2024, I restarted with a different approach:

- AI helps with analysis and journaling.

- I stay in charge of executing trades.

The Setup

- Broker: Exness (forex) and Bybit (crypto).

- Platform: TradingView for charts, a separate AI scanner plugged into my watchlist via alerts, plus an AI-powered journal (connected to my accounts via read-only API).

- Account size: 1,500 dollars.

- Risk per trade: 0.5–1%.

AI tools did:

- Pattern recognition (flags, triangles, breakouts) on EUR/USD, GBP/USD, XAU/USD.

- Volatility and momentum scoring, so I knew when the market was “hot” or “dead”.

- Post-trade analysis in the journal: what time, what pattern, what result.https://tradersage.ai/

My job:

- Pick which signals to trade.

- Decide the exact entry refinement.

- Place orders and manage exits.

One Trade That Actually Worked

- Pair: XAU/USD (gold)

- Date: November 14, 2024

- Time: 09:22 GMT entry

- Direction: Long

- Entry: 1946.20

- Stop loss: 1941.70 (4.5 dollars, 45 pips depending on your tick view)

- Take profit: 1954.70

Account: 1,500 dollars.

Risk per trade: 1% → 15 dollars.

Pip value estimation:

- Trading 0.03 lots on XAU/USD.

- Approximately 1 dollar per 10-cent move.

- 4.5-dollar stop ≈ 45 dollars risk at 0.03? Too high.

So I cut the size down:

- Final position size: 0.01 lots.

- Risk: around 15 dollars if the stop is hit.

The AI scanner flagged a strong breakout pattern with rising volume plus a sentiment boost from positive risk-on news. I checked it manually, liked the structure, and waited for a small pullback before entering.

Result:

- Price reached TP in about 2 hours and 40 minutes.

- Profit: around 85 dollars on 0.01 lots.

- R multiple: roughly 5R on paper because I tightened the stop once the move started.

You know what was different this time?

The AI wasn’t “in control”. It was just the sharp friend whispering suggestions while I stayed on the wheel.

Building a Safer AI Trading Framework

If you want to experiment with AI in trading without nuking your account as I did, here’s a simple structure that actually held up for me.

Step 1: Clarify What You Want AI To Do

Don’t just say “I want AI to trade for me.” Too vague.

Pick one clear goal first:

- Generate better watchlist ideas.

- Automate entries and exits of a strategy you already understand.

- Analyze your trade history and behavior.

For example, if you’re mainly a forex day trader, you might start by letting AI flag high-probability breakouts on EUR/USD and GBP/USD around London open, without giving it trade execution permissions yet.

Step 2: Start on Demo or Tiny Size

Everyone says this. Almost nobody listens. I didn’t either.

But here’s the catch: AI makes bad ideas blow up faster.

So:

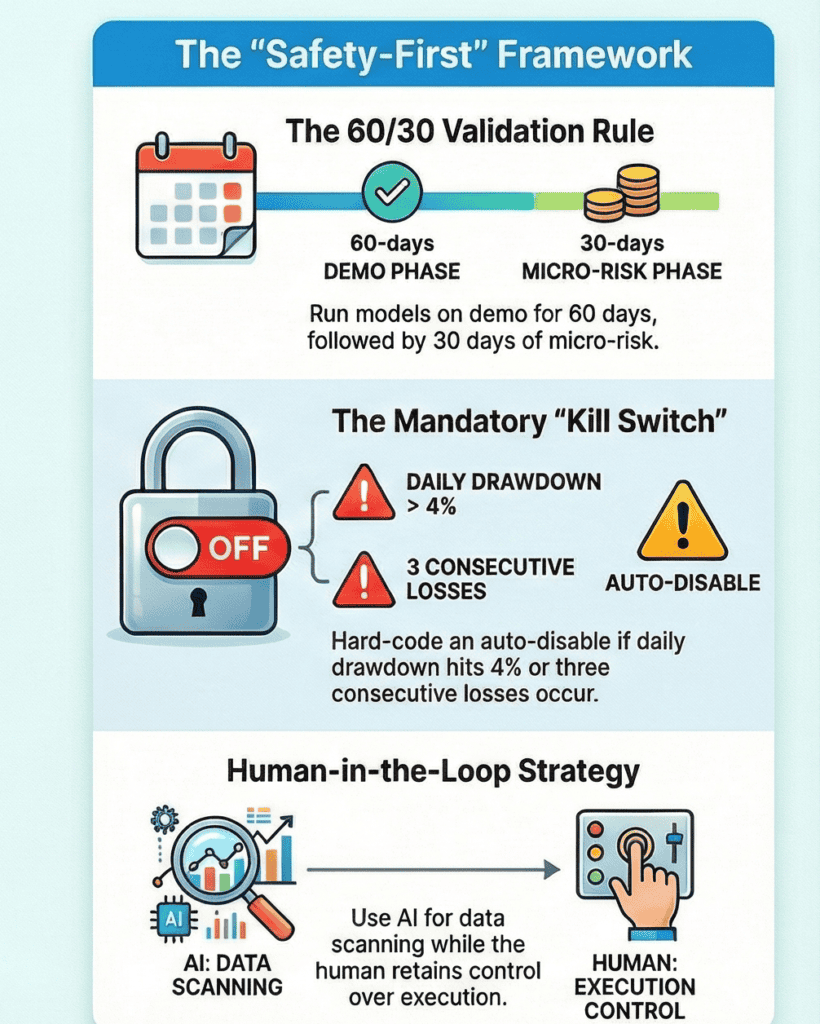

- Run the bot or system on demo for at least 30–60 trading days.

- Track wins, losses, max drawdown, and what happens around big news.

- If you must go live early, risk 0.25–0.5% per trade, not 2–3%.

A lot of AI trading systems look incredible in backtests, but wobble badly when spreads widen or data feeds glitch.

Step 3: Put Hard Risk Rules Above the Bot

You need guardrails that even you can’t override without friction.

For example:

- Daily max drawdown: If equity drops by 3% in a single day, the system automatically disables trading.

- Max trades per day: No more than 5–7 trades, even if signals keep firing.

- Per-trade risk: Hard-coded 0.5–1% max of account balance.

On my newer setups, I hard-coded stop trading if:

- 3 consecutive losing trades, or

- 4% equity drawdown in 24 hours.

That alone has saved me from multiple “death spirals” where the model was clearly out of sync with the market.

Step 4: Use AI to Study Yourself, Not Just the Market

One surprising win from all this has been AI-powered journaling.

The journal I use tags:

- Time of day I trade.

- Asset type (forex, crypto, gold).

- Set up pattern type.

- Outcome (win, loss, break-even).

After 90 days, it showed:

- I made most of my profits on XAU/USD around 08:00–11:00 GMT.

- I consistently lost on late New York crypto scalps.

- Short breakout trades performed worse than pullback entries for my personality.

So I cut night-time crypto trades, doubled down on morning gold and major FX pairs, and results steadied. That had more impact than any fancy “AI stock predictor” I tried.https://tradersage.ai/

Common AI Trading Mistakes (That Cost Me Real Money)

Mistake 1: Blindly Trusting Backtests

Backtests can lie. Or more accurately, your interpretation of them can.

My first AI bot looked smooth because:

- It was overfit to past data. Too many parameters tuned to “perfectly” match history.

- It didn’t account for real spreads and slippage.

- It ignored news periods completely.

So when the market moved differently in live conditions, the edge vanished.

Mistake 2: Overleveraging Because “It’s AI”

This one’s painful.

I’d never trade 0.5 lots manually on a 2,000-dollar account with a new strategy. But because a “model” suggested it, I let it happen.

AI can’t protect you from basic math:

- Big size × small account = high probability of blown account.

- No matter how smart the code looks.

Mistake 3: Turning Off the Bot at the Worst Time

Here’s a psychological trap:

- Three losers in a row, you panic and shut it down.

- The next three trades — which would’ve recovered the drawdown — never get taken.

So your “discretion” destroys the stats the AI was built around.

Solution? Define rules for when to pause the system that are based on data, not feelings. Then stick to them unless something is structurally broken (like a bug or news filter issue).

AI in Trading vs Traditional Algo Trading

You’ll see both terms thrown around. They’re related but not identical.

Traditional algo trading:

- Uses fixed rules like “Buy when 50 EMA crosses above 200 EMA and RSI is below 60.”

- Behaves the same way every time those conditions appear.

AI-based trading:

- Uses machine learning models that can update or adapt as new data comes in.

- Might change which patterns it “likes” over time.

Comparison: Fixed-Rule Algos vs AI-Based Systems

| Adaptability | Low, static rules | Higher, can adjust weights or patterns |

| Transparency | High, logic is explicit | Lower, model decisions can be opaque |

| Complexity | Lower | Higher (needs data, training, validation) |

| Maintenance | Occasional | Ongoing tuning and monitoring |

| Failure mode | Predictable under known conditions | Can fail silently if data or regime changes |

Honestly, for a lot of retail traders, a hybrid model works best:

- Use AI to generate ideas and refine parameters.

- Keep a simple core strategy you actually understand.

Where AI in Trading Actually Shines

From everything I’ve lived through and seen, there are a few places where AI in trading genuinely shines.

- Scanning: Monitoring dozens of pairs, stocks, or coins for your exact setups.

- Execution: Getting in and out faster and more consistently than your manual clicking.

- Risk monitoring: Watching total exposure, correlations, and drawdowns in real time.

- Journaling and review: Showing you the real patterns in your own behavior.

It’s not about giving up responsibility. It’s about letting the machine handle the boring, repetitive, data-heavy stuff while you focus on big decisions and risk.

My Current AI-In-Tading Rules (As of 2025–2026)

By early 2025, I’d settled on a few hard rules for myself when it comes to AI-based systems:

- AI can suggest trades, but doesn’t size them above 1% risk per position.

- New models run on demo for at least 60 days, then there is a tiny real risk for another 30.

- If total drawdown from peak hits 10%, I pause everything and review.

- I only automate strategies I could explain to a friend on a whiteboard in 10 minutes.

No black-box magic. No “trust me, bro” bots from Telegram. No paid signals where I don’t know the underlying logic. If I can’t explain how it roughly works, I don’t let it touch my capital.

Conclusion: The Real Role of AI in Trading

AI isn’t the hero or the villain in your trading story. It’s just an amplifier.

If your risk management sucks, AI in trading will help you blow up faster and more efficiently. If your discipline is weak, a “smart” bot will just give you more excuses to avoid responsibility. But if you already have a basic edge, clear risk rules, and a willingness to track data honestly, AI can absolutely help you trade more consistently, with less screen time and fewer emotional decisions.

Right now, the way I use it is simple:

- AI tools scan, filter, and journal.

- I choose when to step in, how much to risk, and when to step away.

If you want to go deeper, the trader’s site should have other resources on risk management, day-trading routines, and maybe a step-by-step guide to building your first basic algo before you even touch AI.

No hype here: you’re not going to turn 500 dollars into 50,000 overnight because of a bot. But you can avoid the kind of 486-dollar slap I took in 36 hours and build something that grows slowly, with fewer stupid mistakes. That’s the real win.

Financial Disclaimer

Financial Disclaimer

Risk Warning: AI-based trading and algorithmic trading involve substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (including account drawdowns, losing streaks, and occasional profitable periods) don’t predict your outcomes.

- AI-supported trading can fail during market regime changes, black swan events, data feed errors, execution delays, or poor model design, and may cause rapid, unexpected losses.

- Only risk money you’re completely prepared to lose.

Before Trading:

- Practice with demo accounts first, collect 30–60 days of data, start with very small position sizes, and gradually scale risk only after you’ve validated both the strategy and the AI’s behavior in live conditions.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ: AI in Trading

1. Is AI trading really profitable for retail traders?

Sometimes, but not in the effortless way marketing suggests. AI can help you find edges and execute more consistently, yet it doesn’t magically fix bad strategies or emotional decision-making. Many traders lose money with AI bots because they over-leverage or trust untested systems. The traders who tend to do better use AI as a support tool: for scanning markets, backtesting ideas, and journaling performance. They still keep risk per trade small, monitor drawdown closely, and shut systems down when conditions change. If you treat AI as a helper rather than a guaranteed profit engine, your odds improve a lot.

2. What’s the difference between AI trading bots and regular EAs or algos?

Traditional Expert Advisors (EAs) and algos usually follow fixed if-then rules that never change unless you manually update them. For example, “Buy when RSI crosses below 30 then back above.” AI bots, on the other hand, use models that can learn from data and adapt weights over time, potentially shifting which setups they prioritize as markets evolve. That flexibility can be powerful, but it also introduces complexity and opacity. You may not always know exactly why an AI bot took a specific trade. For most retail traders, a hybrid approach—simple core rules plus AI-driven filters or scoring—offers a more understandable and manageable path.

3. How much money do I need to start using AI in trading?

Technically, you can start experimenting with AI in trading on demo accounts with zero real capital. That’s actually the smartest move at first. When you switch to live trading, the required amount depends on your broker’s minimums and the asset class. For forex, traders often begin with 500–1,000 dollars, but they keep risk per trade at 0.25–1%, so each loss is small. In crypto, where volatility is wild, many start even smaller and use micro-position sizes. The key isn’t the starting balance; it’s whether your risk per trade is tiny enough that a losing streak doesn’t emotionally or financially destroy you.

4. Can AI remove emotions from my trading?

AI can remove emotions from execution, but not from you. Bots don’t feel fear or greed; they just follow logic. However, you still decide when to turn them on or off, how much capital to allocate, and whether to override trades. Many traders panic after a string of losses and disable a system right before it recovers, which is still an emotional decision. The healthier mindset is to use AI to automate consistent behavior you’ve already validated while keeping strict rules for pausing or adjusting systems. Emotions never disappear completely; the goal is to stop them from dictating your worst decisions.

5. Are AI trading bots safe?

“Safe” is a dangerous word here. AI bots are tools, not guarantees. They can misfire during extreme volatility, crash because of data feed issues, or act unpredictably if the underlying model isn’t robust. Safety comes from your risk management, not the bot itself. That means limiting per-trade risk, capping daily drawdowns, testing on demo first, and never connecting more money than you’re willing to see swing up and down. Also, beware of opaque third-party bots promising unrealistic returns with no transparency. If you can’t see the logic or track record, treat them as high risk.

6. Do I need to know coding to use AI in trading?

Not necessarily. There are now platforms that let you build and automate strategies using plain language or visual interfaces, often integrated with brokers and exchanges. Some AI tools come as charting plugins, scanners, or journals that require zero coding—just configuration. That said, knowing at least the basics of how models work, what overfitting is, and how to interpret backtests will massively reduce your chances of getting wrecked. If you can’t code, focus on reputable no-code or low-code solutions and spend extra time understanding the risk side.

7. Which markets are best for AI-based trading?

AI systems are most commonly used in liquid, data-rich markets, such as major forex pairs, large-cap stocks, stock indices, and top crypto assets like BTC and ETH. Liquidity and tighter spreads make it easier for models to exploit patterns without slippage destroying the edge. Thin, illiquid markets or obscure altcoins can be dangerous because a sudden lack of buyers or sellers can cause massive gaps that blow through stops. If you’re starting out, it’s usually smarter to focus AI efforts on highly traded instruments where execution is more predictable and historical data is plentiful.

Thanks For The Reading!

Financial Disclaimer

Financial Disclaimer