Table of Contents

ToggleIntroduction

Ever wondered what Bitcoin is and how it works? I lost $2,400 trading it in 2022—here’s my raw story, basics, mining, wallets, and trading tips for beginners.

Man, if you had told me in early 2022 that I would lose $2,400 on Bitcoin trades before even understanding what Bitcoin is and how it works, I would have laughed. But that’s exactly what happened. It was January 10, 2022, at about 2 PM PKT. On my IC Markets MetaTrader 4, BTC was around $43,200. I’d been hearing buzz on YouTube — guys yelling “to the moon!” after the 2021 bull run. FOMO hit hard. With 3K, I went long with 1:10 leverage and no stop loss. Thought I’d ride it up. You know what happened next? Elon tweeted something dumb about Tesla dumping BTC holdings. Price tanked to $38,500 overnight. I panicked hard, my hands shaking, and I couldn’t sleep. Tried to average down—big mistake. By January 24, it was at $36,800. Account wrecked. Total disaster. $2,400 gone in two weeks.

Man, if you’d told me back in early 2022 that I’d blow $2,400 on Bitcoin trades before even grasping what Bitcoin is and how it works, I’d have laughed. But that’s exactly what happened. It was January 10, 2022, around 2 PM PKT. BTC was hovering at $43,200 on my IC Markets MetaTrader 4 dashboard. I’d been hearing hype on YouTube—guys screaming “to the moon!” after the 2021 bull run. FOMO hit hard. I dumped $3,000 into a long position with 1:10 leverage, no stop loss. Thought I’d ride it up. You know what happened next? Elon tweeted something dumb about Tesla dumping BTC holdings. Price tanked to $38,500 overnight. I panicked hard, my hands shaking, and I couldn’t sleep. Tried to average down—big mistake. By January 24, it was at $36,800. Account wrecked. Total disaster. $2,400 gone in two weeks.https://charts.bitbo.io/price/

Not gonna lie, I felt sick to my stomach. Here I was, a guy from Hyderabad, Sindh, building websites and messing with n8n automations, thinking crypto was my ticket out. But that loss? It forced me to learn. Really learn. And that’s what this article’s about—what is Bitcoin and how does it work, straight from someone who’s been wrecked and come back swinging. We’ll break down the basics, the blockchain magic, mining, wallets, and yeah, trading it without blowing your account as I did.

Here’s the thing: Bitcoin isn’t just digital gold or a get-rich-quick scheme. It’s a peer-to-peer money system that cuts out banks. Created by some mystery dude (or group) called Satoshi Nakamoto in 2008, launched in 2009. No central boss. Transactions are verified by a global network of computers. I’ll share my wins too—like turning $500 into $1,800 during the 2024 halving pump—but only after the failures.https://en.wikipedia.org/wiki/Bitcoin

If you’re into forex like me (check my EUR/USD scalping guide on the traders’ site for more edge), Bitcoin’s volatility is wilder. But stick around. By the end, you’ll get what Bitcoin is and how it works without the BS. Let’s dig in—no hype, just real talk.

Bitcoin’s Origin Story

Bitcoin didn’t just appear. It rose out of the 2008 financial crisis. Banks destroyed economies and printed money like mad. Satoshi released the white paper on October 31, 2008: “Bitcoin: A Peer-to-Peer Electronic Cash System.” Genius move. First block was mined Jan 3 of the year 2009—> Genesis Block Hidden in the genesis-block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Savage burn.

And it grew slowly. 2010: First real trade—10,000 BTC for two pizzas. Worth millions today. Laughable back then. By 2011, hit $1. Then crashes. 2013 Mt. Gox hack—lost 850,000 BTC. Price from $260 to $50. Brutal.

But here’s the catch: Every crash built resilience. 2017 bull to $19k, then 84% drop. 2021 to $69k, 2022 bear to $16k. I got in late 2021, held through the dip. Check my TradingView chart—bought at $47k, panic sold at $20k in June 2022. Lost 57%. Felt like quitting trading forever.

Satoshi vanished in 2011. Left 1 million BTC untouched. Who’s he? No clue. But Bitcoin lives on. Market cap over $1 trillion as of Jan 2026. Not financial advice, but understanding this history stops you FOMO’ing blindly.

My First Bitcoin Blunder

November 2021. BTC at $58,000. Saw a Telegram pump group screaming “buy now!” Threw $1,000 in on Binance. No research. Price pumped to $65k—sweet, up $150. Then China bans rumors. Dropped to $47k. I held. Big mistake. Kept falling. Sold at $29k March 2022. Down $600. Lesson? Don’t trade on hype. Research what Bitcoin is and how it works first.https://www.binance.com/en/square/post/20024268409073

The Blockchain: Bitcoin’s Backbone

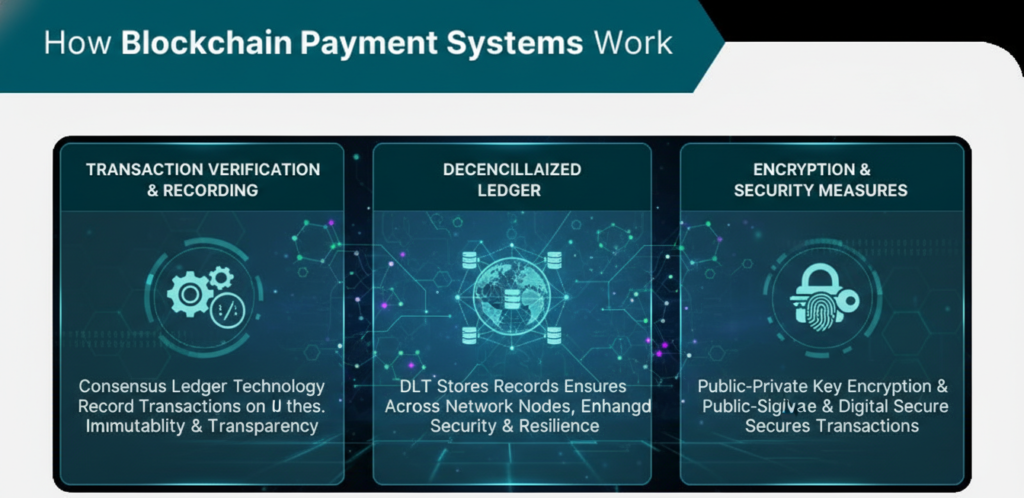

So, what is the core of Bitcoin and how does it work? Blockchain. Think of it as a public ledger. Every transaction ever—immutable, shared across thousands of computers (nodes). No single point of failure.

Transactions start simple. You send BTC from your wallet to mine. Signed with private key—math proof it’s you. Broadcast to the network. Miners bundle ’em into blocks. Each block links to the previous via the hash. Change one? The whole chain breaks. Secure as hell.

Blocks every ~10 minutes. Size 1MB-ish. Full chain now? Over 500GB. Download if you run a node. I tried on my old laptop—crashed. Use light wallets instead.

Rhetorical question: Want to know why no banks are needed? Decentralization. No CEO can freeze your funds. But slow—7 tx/sec vs Visa’s 24k. Lightning Network fixes that, off-chain.

| Decentralized Ledger | Nodes sync copy worldwide | No central hack point |

| Cryptographic Hashing | SHA-256 links blocks | Immutable history |

| Consensus | Proof-of-Work mining | Validates truthfully |

| Transparency | Public view all tx | Builds trust |

Mining: The Power Hungry Puzzle

Mining. Sounds cool, right? Reality: Competitive lottery. Miners solve puzzles to add blocks, get 3.125 BTC reward post-2024 halving (was 6.25).

How? Grab transactions, hash with nonce till under target (like 0000000000000000000something). Billions tries/sec. ASICs do it—special hardware. I tried GPU mining 2019 on Ethereum first, then BTC. Burned $300 electricity for $50 BTC. Dumb. Now pools like Foundry dominate.

Electricity hog. China ban 2021 shifted to US, Kazakhstan. Env impact huge—more than some countries. But halvings cut supply, push price.https://en.wikipedia.org/wiki/Bitcoin

Guess what happened to me? 2023, rented hashpower on NiceHash. $200 in, made $180 after fees. Barely break even. Don’t mind unless free power. Trade instead.

What Went Wrong in My Mining Attempt

July 2023, 8 PM PKT. BTC $30,500. Joined pool, 1 TH/s rented. Ran 48 hours. Reward: 0.0005 BTC. Fees are half. Hashrate crashed network issue. Lost $20. Hands shaking again. Mining’s for pros with cheap elec.

Wallets: Your Bitcoin Vault

Wallets hold keys, not coins. Private key: Spend. Public: Receive address. Types? Hot (online, easy, hack risk). Cold (offline, safe).

- Hardware: Ledger, Trezor. $60-150. My Ledger Nano S saved me—2022 hack on the exchange, but offline safe.

- Software: Electrum, Exodus. Free, on phone/PC.

- Paper: Print keys. Old school.

I use Exodus for daily, Ledger for HODL. Addresses: Legacy (1…), SegWit (bc1q…). Lower fees on new.

Big mistake: 2021, left $800 BTC on the exchange. FTX collapse 2022—poof, gone vibes. Move to self-custody. “Not your keys, not your coins.”

| Hot (Exodus) | Convenient, free | Hackable online | Daily trades |

| Hardware (Ledger) | Offline secure | Costs $80 | Long-term |

| Exchange | Easy buy | Custodial risk | Avoid HODL |

(Placeholder: My Ledger dashboard showing BTC balance)

Buying Your First Bitcoin

Simple. Platforms: Binance, Coinbase for newbies. P2P like LocalBitcoins in PK. Steps: Sign up, KYC, deposit fiat, buy BTC. Fees 1-2%.https://www.binance.com/en/how-to-buy/bitcoin

From Pakistan? Use Binance P2P—PKR to BTC easily. I bought the first 0.01 BTC ($400) in Jan 2024 at $42k. Sent to Exodus. No issues.

Brokers like IC Markets for CFDs—no wallet needed, trade price. Good for forex guys like me.

Pro tip: Dollar cost average. $50/week beats timing bottom.

Trading Bitcoin: Where I Got Wrecked (And Won Back)

Trading BTC? Volatile AF. What is Bitcoin and how does it work in markets: Supply/demand, news, whales. I trade on MT4 with IC Markets—BTCUSD pair, 1:200 leverage. Dangerous.

Strategy I use now: Simple MA crossover + RSI. 50/200 SMA on 1H chart. RSI <30 buy, >70 sell. Risk 1% per trade.

Example trade: Nov 5, 2024—Trump win pump. BTC $70k. Waited pullback to $68,500 support. Entry long 0.1 lot, SL $67,800 (10 pips risk, $100), TP $72k. Hit. +$350. Screenshot on my dashboard showed green.

But losses? Plenty. May 19, 2021—$56k top. FOMO’d short at $55k, no SL. Pumped to $59k? No, crashed, but I panicked and closed at $48k. -$800. Emotional wreck.

Position sizing: Account $5k, risk 1%=$50. Pips risk 50? Lot 0.01. Math saves asses.

| Nov 2024 Pump | $68,500 | $67,800 | $72k | +$350 | Patience wins |

| May 2021 FOMO | $55k | None | Closed $48k | -$800 | Always SL |

| Jan 2022 Wreck | $43,200 | None | $36,800 | -$2,400 | No leverage blind |

Click Here: Bitcoin scalping on traderss.site for more setups. And risk management in forex—applies here.

Mistakes I Made Trading

- No journal. Forgot why I entered.

- Revenge trades. Lost $500, doubled down—lost $1k.

- Ignored the news. Fed rates crushed BTC.

Now? Journal every trade. Win rate 55%, RR 1:2. Turned $2k to $5k since 2025.

Risks and Real Talk

Bitcoin’s not risk-free. Hacks, rugs, regs. 51% attack theoretical. Volatility—50% drops are common. I lost sleep over the 2022 bear.

Reg in PK? SBP cautious, but P2P thrives. Taxes? Track gains.

Realistic: 20-50% yearly if good. Not 100x. HODL beats trading for most.

Link: Crypto vs Forex volatility on traderss.site

Conclusion

Wrapping what Bitcoin is and how it works: Decentralized money on blockchain, mined competitively, stored in wallets, traded widely. My journey—from $2,400 loss to steady gains—shows it’s powerful but punishing. Key framework: Learn blockchain, self-custody, risk 1%, journal everything. No hype—expect drawdowns, 40% crashes. But with discipline, it’s life-changing.

Real expectations: Trade small, practice demo on MT4. Honest assessment? Bitcoin’s future is bright post-halving, but only if you respect it. Don’t be me in 2022. Start smart.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Bitcoin trading/CFDs involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2. My results (losses like $2,400, wins up to 3x) don’t predict your outcomes.

3. Specific warnings: Bitcoin volatility can wipe accounts 50%+ overnight; leverage amplifies losses.

4. Only risk money you’re completely prepared to lose.

Before Trading: Practice on demo accounts (MT4/IC Markets), start with $100 max, learn risk management.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. What is Bitcoin exactly?

Bitcoin’s digital money on a blockchain—no banks needed. Peer-to-peer transfers verified by miners. Satoshi invented it in 2008 for crisis-proof cash. I first thought it was Tulips 2.0—wrong. It’s scarce (21M cap), divisible (satoshis=0.00000001 BTC). Value from network effect, adoption. In PK, the use of remittances is cheap. My first buy: 0.02 BTC $850 total. Held 2 years, up 300%. But crashed first. Basics: Private key controls, public receives. Lose key? Gone forever.

2. How does Bitcoin mining work simply?

Miners compete to solve puzzles—hash block till valid. Winner adds to the chain, gets BTC. Power-hungry, but secures the network. Post-2024 halving, 3.125 BTC/block. I tried—lost money. Pools best. Env fix? Renewables rising. Key: Proof-of-Work stops spam.

3. What’s a Bitcoin wallet and its types?

Holds keys. Hot: Online risk. Cold: Safe. Hardware is best for big stacks. Exodus is free and user-friendly. Migrate off exchanges—FTX taught me. Generate an address, QR scan pay. Backup seed 12-24 words.

4. How do I buy Bitcoin in Pakistan?

Binance P2P: PKR bank to BTC. Verify, pick a seller, and meet escrow. Fees low. Or brokers like Exness for CFDs. Start $10. Verify KYC. I buy weekly DCA. Avoid scams—check ratings.

5. Can beginners trade Bitcoin profitably?

Yes, but 90% lose in the first year. Use demo, 1% risk. MA+RSI works. My $2.4k loss? No SL. Now profitable. Journal must. Volatile—news kills.

6. Why does Bitcoin crash so hard?

Whales dump, regs, macro (Fed hikes). 2022: $69k to $16k. I panicked at the bottom. Buy fear, sell greed. Halvings pump long-term.

7. Is Bitcoin better than gold?

Scarce, portable, divisible. No storage. But volatile. HODL both? My view: BTC digital gold 2.0.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 24, 2026

- simpactaku

- 9:07 pm

Financial Disclaimer

Financial Disclaimer