Table of Contents

ToggleWhat Is Blockchain Technology?

What is blockchain technology? Real trader explains blockchain in simple words, with honest wins, losses, and practical crypto trading examples you can actually use.

September 18th, 2021, 11:42 pm. I remember the time because I was staring at my Binance futures screen like a zombie, watching my BTC long get absolutely wrecked. I’d loaded up a 10x leveraged position on Bitcoin at 47,850 dollars, thinking the “on-chain data” and “blockchain metrics” Twitter guys knew something I didn’t. Fifteen minutes later, price nuked to 45,900. Liquidation. Account down 1,120 dollars in one candle. Felt sick to my stomach. Hands literally shaking.

Back then, everyone kept saying “trust the blockchain” like it was some magic shield that would protect you from bad trades. It doesn’t. It just records your stupidity permanently on a public ledger so anyone can go back and see where you FOMO’d in, and panic sold. Not gonna lie. That night was brutal. But it forced me to slow down and actually learn what blockchain technology is instead of just parroting buzzwords in Discord.

So here’s the thing. If you’re trading crypto, you’re already betting your money on blockchain, whether you understand it or not. Every BTC order you place, every USDT transfer you send, every DeFi farm you ape into lives on some blockchain underneath. If you don’t get the basics, you’re basically flying blind in a market that moves 10% in an hour and doesn’t close on weekends.

In this article, you’re gonna get a simple, no-nonsense answer to one question: What is Blockchain Technology? You’ll see it explained like you’re sitting next to another trader, not in a university lecture. You’ll see how blocks work, how transactions get confirmed, why your fees spike, and where traders (including me) get blown up when they misunderstand what blockchains can and can’t do. And along the way, I’ll walk you through real trade examples, like the time I sent 7,500 dollars in USDT to the wrong network and had a full-on panic attack watching it disappear for 35 minutes.

If you want to go deeper into trading foundations after this, you should also read the risk management post on traderss.site once you’re done, because understanding tech without managing risk is how accounts die fast.

Simple Answer: What Is Blockchain Technology?

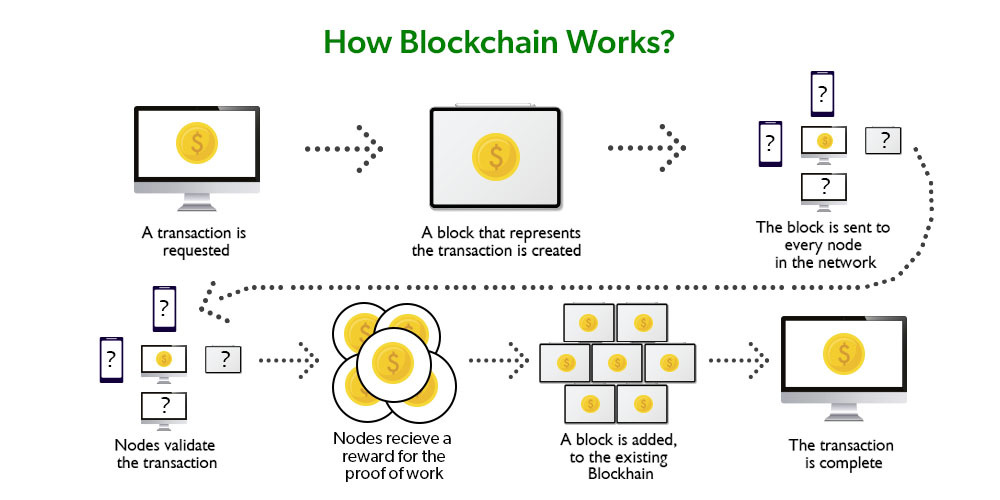

Blockchain technology is basically a special kind of digital notebook that lives on thousands of computers at the same time instead of one central server. Every time someone sends crypto or records some data, a new “line” is added to that notebook, and once it’s written, you pretty much can’t erase it without everyone noticing.

Think of it as a shared history of who did what, when, and with how much money, stored in “blocks” that are chained together with cryptographic fingerprints called hashes. Each new block includes the fingerprint of the previous one, so if you try to change something in an old block, every later fingerprint breaks and the network screams “something’s wrong”. That’s why people say the blockchain is “immutable” and “tamper-evident” — not magic, just smart math and a lot of computers checking each other’s homework.

How A Blockchain Actually Works (In Trader Language)

The Ledger: Who Owes What To Whom

At its core, a blockchain is just a ledger, like your trading journal, but shared across a network of computers called nodes. Everyone can verify the records, even if they don’t know who you are personally, because the system uses wallet addresses instead of real names.https://aws.amazon.com/what-is/blockchain/

Every time you send crypto, the network doesn’t move “coins” in the physical sense. It just updates the ledger to say “Address A now has less, Address B now has more” and stores that change in a block. The power comes from the fact that thousands of nodes keep a copy of this ledger, so it’s incredibly hard for someone to fake balances without being caught by the majority.

Blocks: Bundles Of Transactions

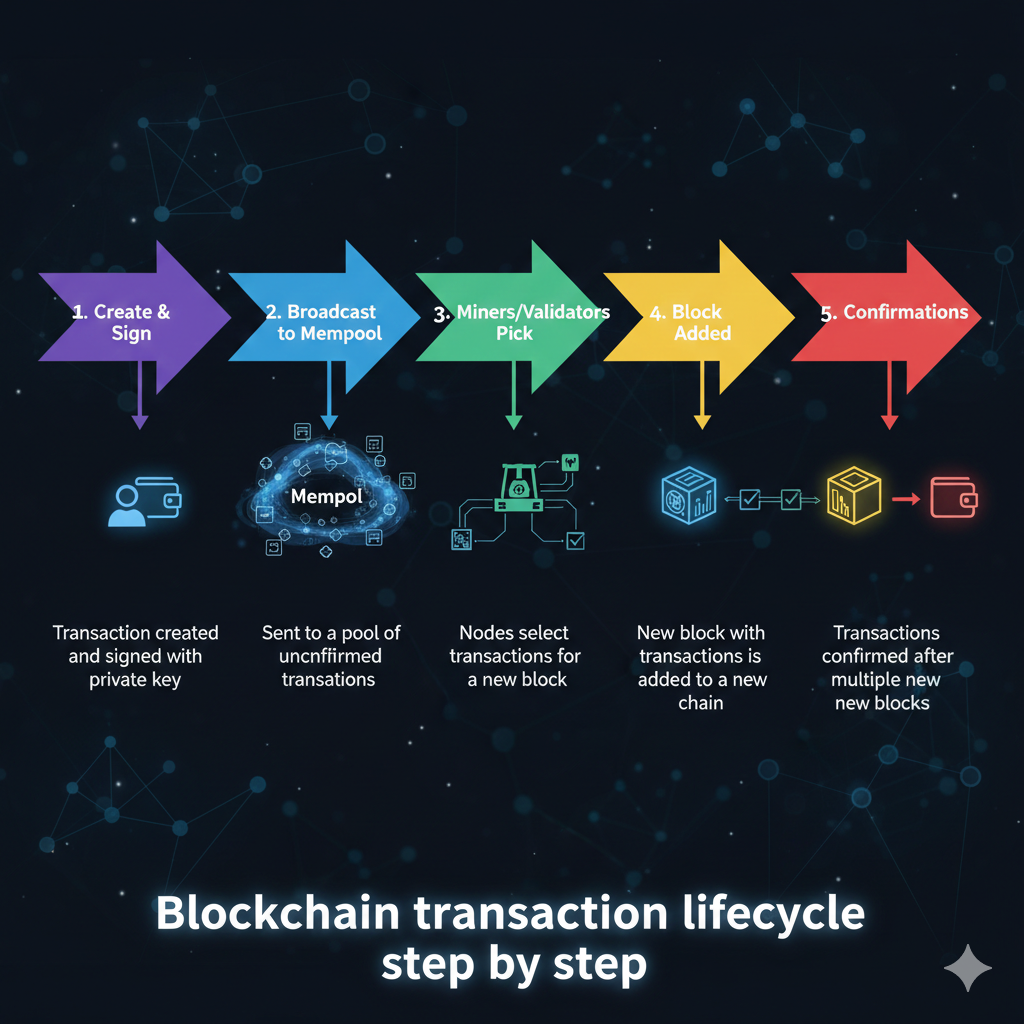

When you click “Send” on MetaMask or place a spot trade on Binance that ends up on-chain, your transaction goes into a waiting area called the mempool. Nodes and validators pick transactions from this pool, bundle them into a block, and then try to add that block to the chain according to the rules of the network.

Each block contains a batch of transactions, a timestamp, and a hash — a unique fingerprint generated by cryptographic algorithms — plus the hash of the previous block. That link between hashes is what creates the “chain” in blockchain and makes the history hard to tamper with because changing any detail changes the hash and breaks the entire sequence after it.

Consensus: How The Network Agrees

Here’s the part most new traders ignore. For a block to be accepted, the network has to reach consensus — basically, the majority of nodes have to agree that the block is valid according to the protocol rules. In proof-of-work chains like Bitcoin, miners compete to solve a difficult puzzle, and the first to solve it earns the right to add the next block and receive block rewards and fees.

In proof-of-stake chains like Ethereum now, validators lock up their coins as “stake” and get randomly chosen (with some weighting) to propose and validate blocks, earning rewards if they behave honestly and risking losing part of their stake if they cheat. For traders, this consensus mechanism affects confirmation times, fees, and how secure your funds are against attacks.

My Experience: When I Ignored How Blockchain Works

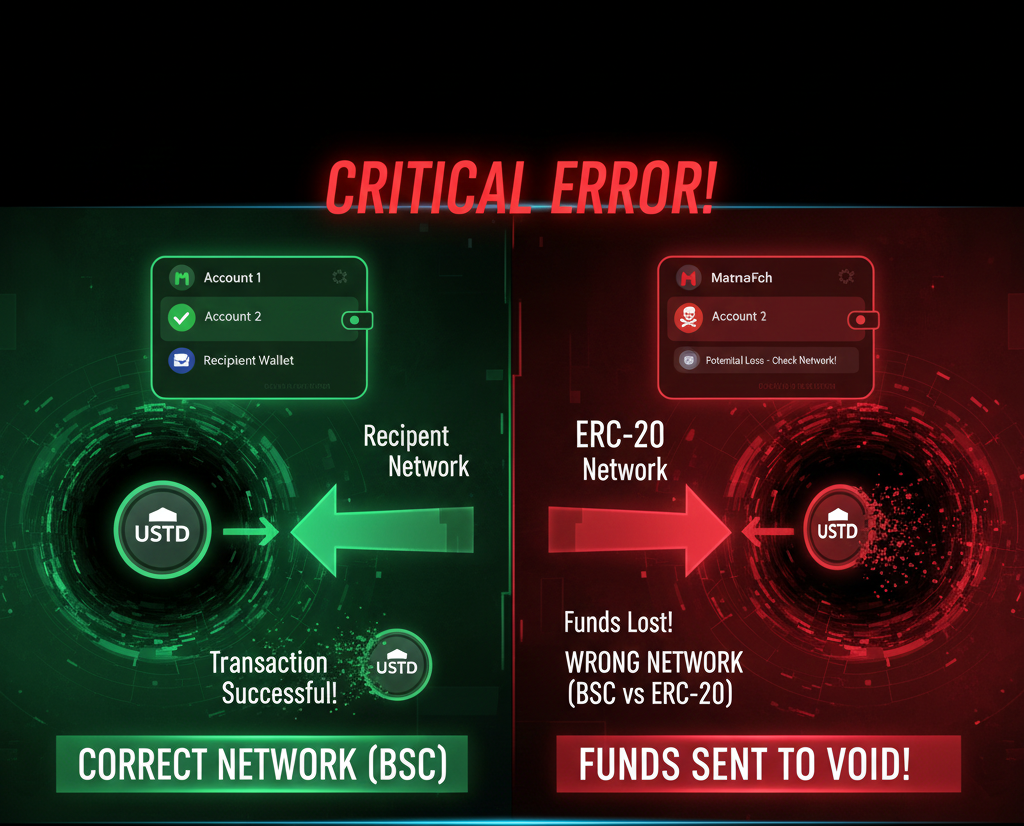

Back in May 2022, I was trading late, around 1:30 am, after a rough day. I’d just closed a 420-dollar loss on an ETH scalp and wanted to move some leftover USDT from Binance to a DeFi platform on Polygon to hunt yield. Tired. Emotional. Bad combo.

I withdrew 7,500 USDT from Binance on the wrong network. Clicked ERC-20 while my wallet was set up for BSC. The transaction hash showed as “success” on Etherscan, but the funds weren’t showing in my wallet at all. For 35 minutes, I thought I’d wiped 7,500 dollars by being too lazy to double-check the network.

What went wrong? I didn’t respect how networks and blockchains actually store and represent balances. I assumed “USDT is USDT” and ignored that each network maintains its own ledger, contracts, and token mappings. The money didn’t vanish — it just lived on Ethereum, and I had to manually import the right token contract into my wallet to see it. But those 35 minutes taught me more about blockchain reality than a hundred hype posts ever did.

Key Parts Of Blockchain (In Simple Words)

Nodes

Nodes are just computers running the blockchain software and keeping a full or partial copy of the ledger. Some nodes validate transactions, some relay data, and some act as “light” clients that rely on others for full history.

For traders, more nodes usually means more decentralization and resilience, which translates to less risk of one party freezing or censoring your transactions, especially on public networks like Bitcoin and Ethereum.

Hashing

Hashing is like turning any message into a fixed-length fingerprint using a mathematical function. The same input always gives the same hash, but even a tiny change in the input creates a completely different hash, making tampering obvious.

Every block stores its own hash plus the hash of the previous block, so the entire chain becomes a linked set of fingerprints that prove no one has secretly edited old transactions without being caught. That’s part of what gives traders confidence that previous transactions really happened the way the ledger says they did.

Public And Private Keys

Your private key is the secret that proves you’re allowed to move funds from a specific wallet address, while your public key (and derived address) is what others use to send you funds. The blockchain itself doesn’t know your name; it just sees signed messages that can be mathematically verified as coming from someone who knows the correct private key.

Lose your private key and the blockchain won’t “reset” it — the network will still show your coins sitting at that address, but you’ll be locked out forever. For traders, this is why exchanges, hardware wallets, and security practices matter way more in crypto than in traditional brokerage accounts.

Why Blockchain Matters For Traders

Transparency You Can Actually Check

All major blockchains keep a public history of transactions that anyone can inspect using block explorers like Etherscan or Blockchain.com. You can see when coins moved, what addresses interacted, and how much gas was paid, even if you don’t know who’s behind the wallets.

This transparency lets traders audit exchange wallets, track whale movements, and verify that a protocol is really doing what it claims, instead of trusting a glossy landing page or a Twitter thread.

Reduced Reliance On Middlemen

Traditional brokers and banks hold your assets and decide when to process withdrawals or transfers. With blockchain-based assets, once a transaction is confirmed on-chain, it’s final and doesn’t need a central authority’s approval.

For traders, that means you can move capital between exchanges, DeFi protocols, or wallets without waiting for bank hours, especially if you’re using stablecoins or layer 2 networks built on top of base chains.

New Trading Opportunities

Blockchains enable things like decentralized exchanges (DEXs), perpetual futures on-chain, lending and borrowing protocols, and tokenization of real-world assets. These open up arbitrage, yield strategies, and niche markets that don’t exist in classic forex or stock trading.

But here’s the catch. With new opportunities come new ways to get blown up: smart contract exploits, rug pulls, impermanent loss, and weird liquidation mechanisms that don’t look anything like your MetaTrader 4 margin rules.

Comparing Blockchains: Trader-Focused View

| Main purpose | Digital money, store of value | Smart contracts, DeFi, NFTs | High-speed transactions, dApps |

| Consensus (original) | Proof-of-work mining | Now proof-of-stake validating | Usually proof-of-stake variants |

| Typical speed | Minutes per confirmation | Seconds to minutes | Often sub-second to seconds |

| Fees | Can spike in bull runs | Highly variable gas fees | Often cheaper, but not always in stress |

| Main trading use | Long-term holding, on/off ramp | DeFi, DEXs, NFT markets | Speculation, cheap transfers, ecosystem plays |

For a trader, choosing which chain to use affects cost, speed, and risk — not just price direction. If you scalp on a chain with slow confirmations and high fees, you’re basically fighting the tech as well as the market.

What Went Wrong In My Early Blockchain Trades

Mistake 1: Trusting “Blockchain = Safe” Too Much

In 2020, when DeFi summer mania kicked off, I piled 4,000 dollars into a random yield farm on a chain I barely understood, just because everyone said “the smart contract is audited” and “it’s all on the blockchain.” Two weeks later, the token price dumped 90%, and the dev team disappeared. The blockchain faithfully recorded my losses. Nothing more.

The technology made settlement trustless, but it didn’t magically make the project honest or the token valuable. I learned the hard way that “transparent” and “profitable” are not the same thing.

Mistake 2: Ignoring Fees And Confirmation Time

On January 12th, 2022, I tried to snipe a low-cap token on a DEX during a hyped Twitter thread. I set up a 2,000-dollar swap, but gas fees spiked mid-move. The transaction sat pending for 7 minutes, got front-run, and eventually failed. I paid around 110 dollars in gas for nothing.

If I had respected that blockchain capacity is limited and fees adjust in real time based on demand, I wouldn’t have tried to day trade like it was a centralized exchange with instant order matching.https://aws.amazon.com/what-is/blockchain/

Mistake 3: Overcomplicating Wallet Setups

At one point, I had funds spread across MetaMask, Trust Wallet, a hardware wallet, and three centralized exchanges. Each one is connected to different networks: Ethereum, BSC, Polygon, and Avalanche. I kept mixing up networks and contract addresses. Twice, I almost sent coins to a contract instead of a wallet.

The blockchain did exactly what I told it to do, not what I meant to do. And that’s the brutal part. There’s no “undo” button once a transaction is confirmed by the network and included in a block.https://cardanofoundation.org/blog/blockchain-basics-simple-guide-beginners

How A Blockchain Transaction Flows (Step By Step)

1. You Create A Transaction

You open your wallet or exchange interface, enter the recipient address, choose the amount, set a fee or gas setting, and click confirm. Your wallet then signs this transaction with your private key to prove it’s actually you requesting the transfer.

The signed data is broadcast to the network and sits in the mempool, waiting for a validator or miner to pick it up.

2. Nodes Check The Rules

Nodes verify that:

- The signature is valid.

- Your address has enough balance.

- The transaction format is correct.

If anything doesn’t match the protocol rules, nodes reject it, and it never makes it into a block. If it passes, it’s eligible for inclusion once a block is built.

3. Block Creation And Confirmation

Miners or validators pick a batch of valid transactions, create a candidate block, and then either solve a puzzle (proof-of-work) or go through the staking process (proof-of-stake) to propose it to the network. If the rest of the network agrees, that block is added to the chain and propagated across all the nodes.

Your wallet then shows a certain number of confirmations — one block, two blocks, ten blocks deep — which is just the chain growing on top of the block where your transaction lives.

My Experience: BTC Trade Backed By On-Chain Data

In March 2023, I tried something different. Instead of blindly following influencers, I started watching on-chain data like exchange inflows and big wallet movements. One night around 10:15 pm, I saw a noticeable amount of BTC flow off major exchanges into self-custody wallets over a 24-hour window. That’s often interpreted as whales planning to hold rather than sell.

I opened a swing long on BTC at 23,420 dollars with a 0.75 BTC size (roughly 17,565 dollars notional) and set my stop at 22,600 dollars, risking around 615 dollars. Over the next five days, the price climbed to 26,100 dollars, and I closed the position manually. Net profit: about 2,010 dollars after fees. Not life-changing. But it was the first time I used blockchain data as context, not just a buzzword to justify a random trade.

Did on-chain data “predict” the move? No. It just gave extra confirmation that the flows behind the price looked more bullish than bearish. That’s where blockchain really helps traders — not in guaranteeing outcomes, but in giving more transparent information about what’s happening under the hood.

Blockchain Use Cases That Actually Affect Traders

Crypto Currencies (BTC, ETH, Stablecoins)

Most trading action you see on exchanges is ultimately settled on blockchains like Bitcoin and Ethereum, even if the order matching happens in centralized order books. Every deposit, withdrawal, and on-chain transfer is a transaction written into a block.

Stablecoins like USDT and USDC use blockchains as rails to move dollar-pegged value around the world with relatively low friction compared to banks, and that’s what allows many traders to switch exchanges, hedge, or park capital quickly.

DeFi: On-Chain Trading, Lending, And Yield

Decentralized exchanges (DEXs) like Uniswap or on-chain perpetual platforms rely on smart contracts — pieces of code running on blockchains — to manage liquidity pools, swaps, and positions without a central matching engine. Your interactions with these protocols are all on-chain and visible, from opening a position to getting liquidated.

For traders, this creates opportunities like arbitrage between DEX prices and centralized exchange prices, plus access to leverage or yield without a traditional broker — but it also introduces protocol risk and smart contract risk that don’t exist in the same way on MetaTrader 4 or cTrader.

Tokenization And 24/7 Markets

Some projects use blockchain to tokenize real-world assets like stocks, bonds, or property shares, making them tradable as digital tokens on-chain. These tokens can, in theory, trade 24/7 with fractional ownership, opening access to markets that used to be restricted by geography and minimum size.

Traders who understand these structures can sometimes catch early liquidity or price inefficiencies, but they also have to factor in regulatory risk and the reliability of whoever bridges the real asset to the chain.

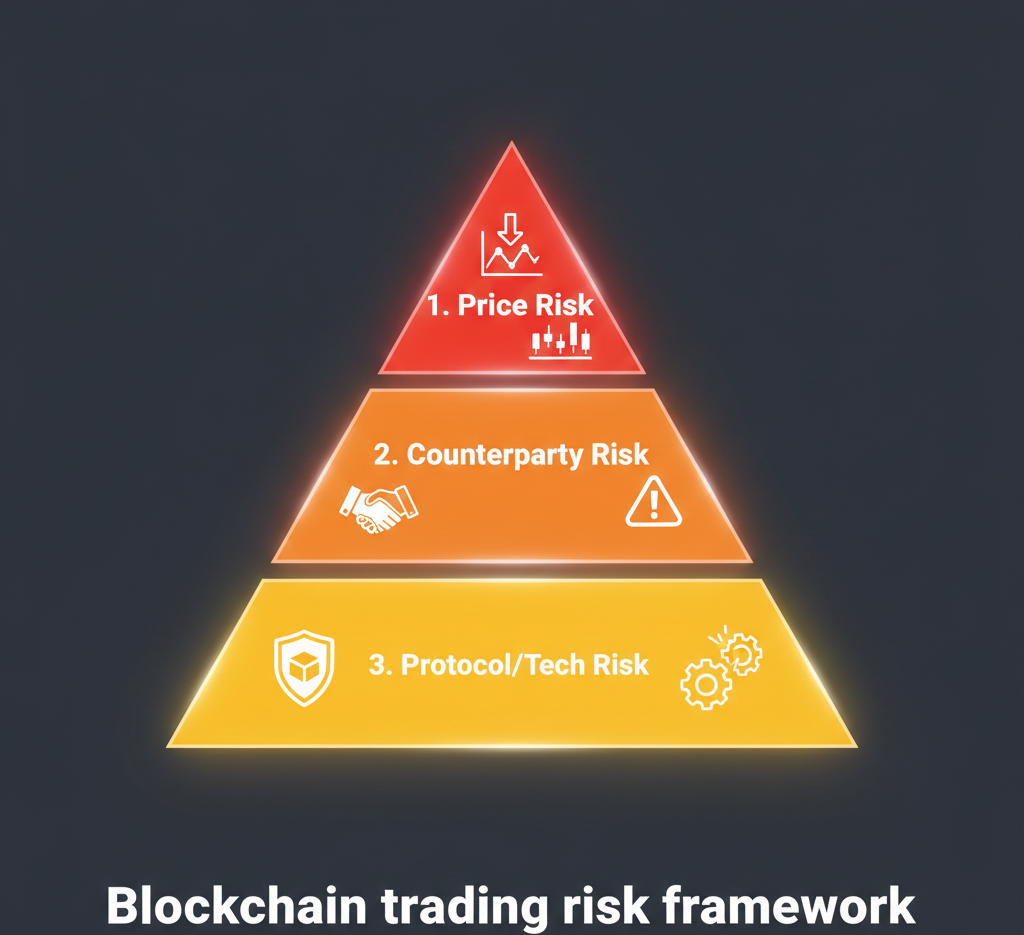

Simple Risk Framework For Trading In A Blockchain World

1. Separate Tech Risk From Price Risk

Price risk is BTC going from 30,000 to 25,000. Tech risk is the bridge you’re using, getting hacked, or a smart contract draining a liquidity pool overnight. In traditional markets, you mainly deal with price and counterparty risk; in blockchain-based markets, protocol risk is a whole extra layer.

Before entering a trade, ask: “If price does what I expect but the protocol breaks, am I still safe?” If the honest answer is no, size down or stay off that platform entirely.

2. Respect Network Conditions

When volatility spikes, networks get congested, fees skyrocket, and confirmation times stretch out. If your strategy relies on tight timing and fast execution, high-fee, slow-confirmation environments can turn winning setups into losing ones just from slippage and gas.

Check gas trackers or network dashboards before planning a busy trading session. If conditions are terrible, sometimes the smartest move is to stand aside rather than fighting the chain as well as the chart.

3. Don’t Overcomplicate Wallet Infrastructure

More wallets and more chains don’t automatically mean more edge. They often mean more confusion. Start with a simple setup: one hardware wallet for storage, one hot wallet for active use, and a clear written list of which networks you use and why.

The fewer moving parts you have, the less likely you are to send funds to the wrong chain or lose track of where your collateral is sitting during a volatile weekend.

My Honest Take: What Blockchain Is And Isn’t For Traders

Here’s the part many “crypto educators” won’t say out loud. Blockchain technology is powerful, but it doesn’t care if you win or lose. It doesn’t stop you from chasing pumps, overleveraging, or following bad signals. It just records the result permanently on a public ledger.

What blockchain does give you is:

- A transparent record of asset movements.

- Faster settlement than banks in many cases.

- New products and markets, if you’re willing to learn how they work.

What it doesn’t give you is:

- Guaranteed profits.

- Protection from scams or bad projects.

- A free pass to ignore risk management.

If you’re going to trade in crypto, especially using platforms that rely heavily on smart contracts and on-chain settlement, you owe it to your account balance to truly understand the basics of “What Is Blockchain Technology?” before you size up. It won’t save you from every mistake, but it will stop some of the dumbest ones — like my 7,500 dollar network mishap — before they happen.

For more help building a sane approach to this space, check the position sizing and psychology articles on traderss.site as your next step, because tech knowledge plus emotional control is where traders actually survive long term.

Conclusion: What Is Blockchain Technology? In Real Trader Terms

So what is blockchain technology? In simple trader language, it’s a shared, tamper-evident digital ledger that records every transaction in chained blocks across a network of computers, without needing a central authority. It’s the underlying engine behind Bitcoin, Ethereum, stablecoins, DeFi platforms, and most of the crypto instruments you touch when you trade.https://aws.amazon.com/what-is/blockchain/

If you’re trading in this space, you don’t need to become a hardcore developer. But you do need to grasp how blocks, hashes, nodes, and consensus come together, because they directly affect your fees, confirmation times, risk profile, and even the kinds of strategies you can safely run.

The truth? Blockchain won’t fix bad trading habits. It won’t refund a blown futures account or save you from aping into garbage because a Telegram group spammed a ticker. But if you respect what the tech can do — and, just as importantly, what it can’t — you can use it as an edge instead of a black box. That’s the real edge: understanding the game you’re actually playing, not just the chart on your screen.

Before moving serious capital, take time to practice with small amounts, learn how your chosen networks behave, and read more of the educational pieces on the traders’ site so your next trade is backed by both technical understanding and solid risk management.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Cryptocurrency and blockchain-based trading involve substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

- I’m not a certified financial advisor, licensed broker, or investment professional.

- My results (including both profitable trades and painful losses) don’t predict your outcomes.

- Cryptocurrency markets are highly volatile, blockchain networks can suffer congestion, hacks, and technical failures, and on-chain protocols can fail or be exploited.

- Only risk money you’re completely prepared to lose.

- Before Trading: Learn how the specific blockchain and platform you’re using actually work, start with a demo or very small positions, and test withdrawals and deposits before sending large amounts.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

Frequently Asked Questions About Blockchain Technology

1. Is blockchain the same as Bitcoin?

No, and this confusion burns a lot of beginners. Bitcoin uses blockchain technology, but blockchain itself is the underlying infrastructure — the system of chained blocks, hashes, and nodes that stores data in a decentralized way. You can think of Bitcoin as one application built on top of this idea, mainly focused on digital money and value transfer.

Other networks like Ethereum, Solana-style chains, and even private enterprise blockchains use the same core concept but adapt it for smart contracts, tokenization, or internal company workflows. So when you trade BTC, you’re using one particular blockchain; when you interact with a DeFi protocol on Ethereum, you’re using another, even though they share the same foundational technology.

2. Can someone just change data on the blockchain?

In practice, it’s extremely hard to change past data on a well-secured public blockchain like Bitcoin or Ethereum because you’d need to control a majority of the network’s validating power to rewrite history. Each block includes the hash of the previous block, so altering one block forces you to recompute all subsequent blocks, which quickly becomes computationally and economically expensive.

There have been 51% attacks on smaller chains where an attacker temporarily controlled enough hashing or staking power to double-spend or reorganize blocks. That’s why traders usually treat large, established chains as more secure settlement layers and treat small, low-security chains with more caution, especially when moving serious money.

3. Why are blockchain fees sometimes so high?

Fees, often called gas, are the price you pay to get your transaction included in a block, and they rise when lots of people are trying to use the network at the same time. Validators or miners naturally prioritize transactions with higher fees because that’s how they make more money, so low-fee transactions can get stuck in the mempool during peak demand.

For traders, this means trying to scalp small moves on a congested chain with high gas can be a losing game, because fees eat a huge chunk of your profits or turn winners into losers. Many traders deal with this by using layer 2 networks, sidechains, or timing their bigger on-chain moves during quieter periods.

4. Is blockchain completely anonymous?

Most major public blockchains are pseudonymous, not fully anonymous. The ledger shows wallet addresses and transaction amounts, but not your real name or ID directly. However, once an address is linked to your identity through an exchange KYC process or careless use, on-chain analytics can trace your activity surprisingly far back.

As a trader, assume on-chain activity can be analyzed and connected, especially if you regularly move funds through centralized exchanges. This can be good (for transparency and fraud detection), but also means you shouldn’t rely on “crypto = anonymous” as some sort of privacy shield. It’s more like a permanent, public record with labels that can be filled in over time.

5. How long do blockchain transactions take?

It depends heavily on the chain and network load. Bitcoin blocks are mined roughly every 10 minutes, and many services wait for several confirmations, so finality can take 30 minutes or more in some cases. Ethereum blocks are faster, often in seconds, but high congestion can still slow effective confirmation or cause failed transactions when gas is mispriced.

Newer chains and layer 2 solutions can confirm transactions in under a second, but you should always check typical block times and recommended confirmation counts for the specific asset and use case. For trading, your strategy needs to match these realities — you can’t reasonably scalp a few seconds on a slow chain and expect the system to bend to your time frame.

6. Can I use blockchain without knowing how to code?

Yes. Most traders interact with blockchains through wallets, exchanges, and user interfaces that hide the code behind buttons and sliders. You don’t need to write smart contracts or understand every detail of cryptography to trade.

What you do need is a practical understanding of addresses, networks, fees, and basic transaction flow. Knowing how to read a transaction on a block explorer, verify a contract address, and recognize when a network is congested will already put you ahead of a lot of people who blindly click confirm on everything.

7. Is blockchain safer than a bank for storing money?

“Safer” depends on what you’re afraid of. With a bank, you’re trusting a regulated institution and legal system, but you also risk account freezes, withdrawal delays, or currency controls. With blockchain, you can self-custody assets and move them without permission, but you take on responsibilities like securing private keys, avoiding scams, and learning how networks and protocols work.

For most traders, a hybrid approach is common: some funds on centralized exchanges for active trading, some in self-custody on established chains, and maybe a smaller portion in higher-risk DeFi strategies. The key is understanding that blockchain removes some middlemen but adds technical and operational risk that you personally have to manage.

Thanks For The Reading!

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 23, 2026

- simpactaku

- 3:37 pm

Financial Disclaimer

Financial Disclaimer