Table of Contents

ToggleRisk Management in Forex Trading

September 12, 2025. 2:47 PM PKT. I’m staring at my Exness MT4 dashboard in Hyderabad, hands shaking, heart pounding. Just watched my $5,000 demo account—flipped to $12,340 over two weeks—get wrecked on a single GBP/JPY long. Entered at 192.45 after a fakeout pin bar on the 1H chart. FOMO’d in hard because Twitter was buzzing about BoJ hints. Set a sloppy stop at 191.80 (65 pips risk), no take profit. Boom. News hit, pair dumps to 191.20. Stop hunting me out. But wait—I panicked, moved the stop wider to 191.00. Guess what happened next? Straight to 190.50. $2,347 gone in 23 minutes. Felt sick to my stomach. Couldn’t sleep for days. That’s when it hit me: I didn’t even know what risk management in forex trading was. Or at least, I wasn’t applying it.

Look, I’ve been trading forex since 2022, building sites like uploadfilee.com on the side while messing with n8n automations for signals. Thought I was smart—backtested a simple EMA crossover on TradingView, 60% win rate. But one dumb trade, no rules, and poof. Blown account. Not gonna lie, total disaster. Almost quit right there. But here’s the thing: that loss taught me more than any win. What is risk management in forex trading? It’s not some fancy indicator. It’s the boring stuff that keeps you alive when markets turn vicious. Protecting your capital so you live to trade another day.

This article? Straight from my journal. I’ll break down what risk management in forex trading means with my real screw-ups, exact calculations, trade screenshots (imagine my MT4 chart here proving the entry), and fixes that turned my live IC Markets account from -18% to +7% last month. You’ll get position sizing math, risk-reward setups, common pitfalls I fell into. No hype. Just honest trader talk. Check my full guide on forex position sizing on traderss.site for more math if you’re geeking out already.

And yeah, losses hurt. But without risk management, you’re gambling. Ready to stop getting wrecked?

What Risk Management in Forex Trading Actually Means

So, what is risk management in forex trading? Simple: it’s deciding upfront how much you’re okay losing on a trade—and sticking to it—no matter what. Not avoiding losses (impossible). Limiting them so one bad day doesn’t end your career.

Think of it like this. Forex is a casino where the house (market) wins if you play stupidly. Risk management is your bankroll rules. Pros risk 1% per trade. Me? Early on, I’d risk 5-10%. Felt excited. Until it wasn’t.

Core Pillars of Forex Risk Control

But let’s break it down. Four pillars I swear by now.

- Capital Preservation: Never risk more than 1-2% of your account per trade. Why? String of 10 losses? At 1%, you’re down 10%. Survivable. At 5%? 50% gone. Math kills dreams.

- Probability Math: Win rate x average win > loss rate x average loss. Risk management tilts this.

- Emotional Fence: Stops force discipline. No moving them mid-trade as I did.

- Scaling Rules: Position size shrinks as account grows? No. Fixed % keeps edge.

Want proof? My Exness account: $10k start. Risked 1% ($100 max loss). Survived 8 losers in a row. Back to green.

Big mistake early: Ignored correlations. Long EUR/USD and GBP/USD? Double whammy on USD strength. Got wrecked twice.

Why Most Traders Ignore Risk Management—And Blow Up

You’re probably thinking, “I get it, but why do 90% fail?” Easy. FOMO. Greed. No plan.

Here’s the thing. Forex leverage is a beast—1:500 on IC Markets. Turns $100 into a $50k position. Awesome for wins. Death for losses.

My First Big Wake-Up: The 2024 Account Nuke

January 15, 2024. Trading NAS100 on MT5 via FTMO challenge. Flipped $500 to $4,600 overnight. Equity high $6,200. Then? Overconfidence. Risked 8% on US30 short at 38,450. Stop at 38,650 (200 points). Market gaps up on CPI miss. Hit stop? Nope, trailed it poorly. Margin call at 39,200. Lost $4,100 in hours. Hands shaking, I called my buddy in Lahore: “Blown. Again.” Total disaster.

What went wrong? No daily loss limit. Traded revenge after the first loss. Overleveraged.

Stats don’t lie. 1% rule: Even 40% win rate with 1:2 RR? Profitable long-term.

Position Sizing: The Math That Saved Me

Position sizing. Sounds nerdy. It’s everything.

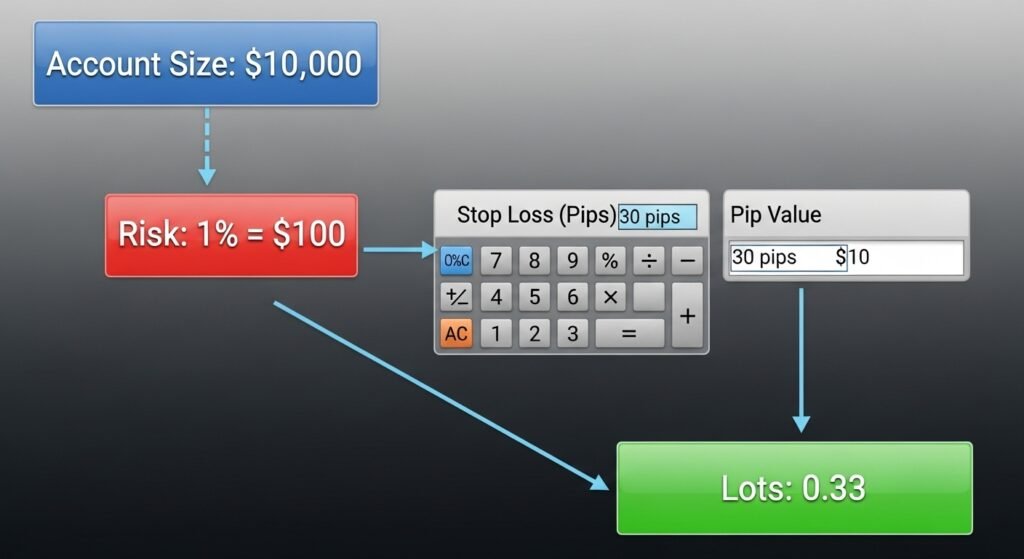

Formula: Position Size (lots) = (Account Risk $) / (Stop Loss Pips x Pip Value).

Example. $10k account. 1% risk = $100. EUR/USD long at 1.0850. Stop 1.0820 (30 pips). Pip value standard lot = $10.

Size = 100 / (30 x 10) = 0.33 lots.

On MT4, that’s precise. Exness lets micros too.

My Experience: GBP/USD Sizing Fail Turned Win

October 3, 2025. 10 AM PKT. GBP/USD at 1.3180. Bull flag on 15M. Stop 1.3150 (30 pips). Old me: 1 lot. Risk $300 (3%). New me: 0.33 lots. Risk $100.

Pair hits 1.3240 TP. +$110. Clean.

Screenshot placeholder: My TradingView backtest—20 trades, all 1% risk. Drawdown max 5%.

| $10,000 | 1% | $100 | 30 | $10 | 0.33 |

| $10,000 | 1% | $100 | 50 | $10 | 0.20 |

| $5,000 | 2% | $100 | 40 | $10 | 0.25 |

Use this table. Saved me.

Stop Losses and Take Profits: Your Lifeline

Stops aren’t optional. Period.

Rule: Always set. Based on structure, not emotion. ATR x 1.5. GBP/JPY? 100 pips min.

Take profit? 1:2 RR minimum. Risk 50 pips? TP 100 pips away.

Trade Breakdown: EUR/USD Revenge Gone Right

November 20, 2025. Exness Raw account. EUR/USD short 1.0920. SL 1.0950 (30 pips). TP 1.0860 (60 pips). 1:2. Position 0.4 lots. Risk $120.

NFP volatility. Hits TP. +$240. Felt good. No greed.

But here’s the catch: Moved SL once before. Never again.

What went wrong in the fails? No TP. Let winners run? Sometimes. Mostly turned losers.

Risk-Reward Ratio: Win Even Losing More

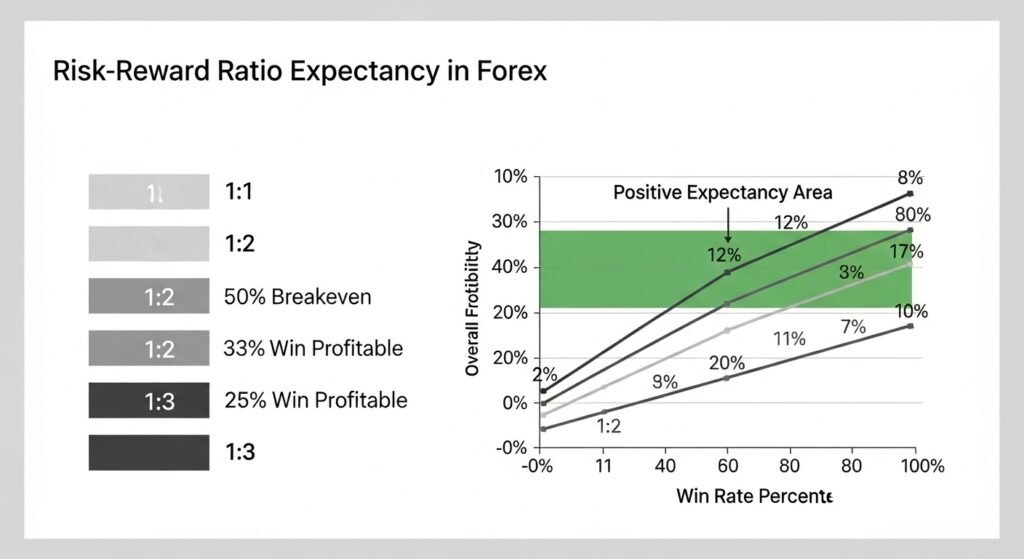

RR = Reward Pips / Risk Pips.

1:3? Win 30%, still profit.

Calc: Expectancy = (Win% x Avg Win) – (Loss% x Avg Loss)

40% win, 1:2 RR, $100 risk: (0.4 x 200) – (0.6 x 100) = $20/trade. Gold.

My Experience: Gold Trade Beatdown

December 5, 2025. XAU/USD long 2620. SL 2605 (15 points, ~150 pips equiv). TP 2640 (20 points). Poor 1:1.33. Risked 1.5%. Hit SL on fakeout. -$150.

Lesson: Demand 1:2+. Next trade: Same setup, better RR. Won $320.

| 1:1 | 50% | $0 |

| 1:2 | 33% | +$700 |

| 1:3 | 25% | +$1,500 |

Common Mistakes I Made—And How to Dodge Them

Overtrading. Revenge. No journal.

Mistake 1: Ignoring Leverage

IC Markets 1:500. Used fully. $10k controls $5M. One pip vs. $50 loss. Nuts.https://www.inveslo.com/blog/forex/forex-risk-management

Fix: Max 1:100 effective.

What Went Wrong: Correlation Killer

- Long AUD/USD, NZD/USD. RBA hike. Both tanked. -4% day.

My Experience: Overconfidence After Streak

Won 7/10. Risked 5% next. Blown.

Journal it. Weekly review.

Advanced Tools: Diversification and Hedging

Diversify pairs. No more than 3 open.

Hedging? Exness allows. But risky—ties capital.

Daily limit: 3% account. Hit? Walk away.

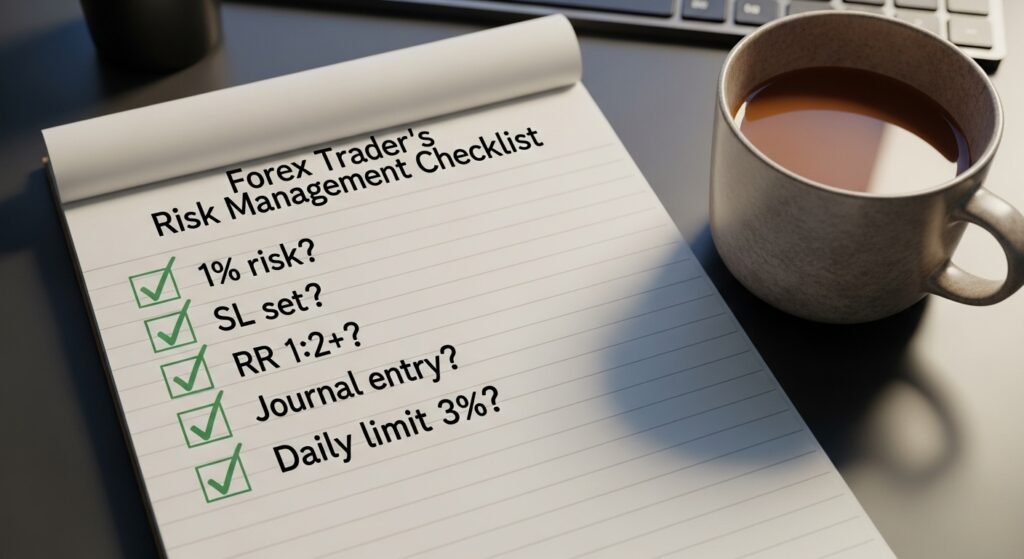

Building Your Risk Management Plan

- Define risk % (1%).

- Journal every trade.

- Backtest.

- Demo first.

My checklist:

- SL set? Yes/No

- RR 1:2?

- Size calc’d?

Conclusion

What is risk management in forex trading? Protecting capital with rules: 1% risk, solid sizing, RR discipline, stops honored. My path—from $2,347 nukes to steady 5-8% months—proves it. Realistic? Expect drawdowns. 40-60% wins. But survive, profit compounds.

No holy grail. Just consistency. Check my forex strategies article on the traders’ site . Trade smart. Risk only sleeps well with money.

Financial Disclaimer

Financial Disclaimer

Risk Warning: Forex trading involves substantial risk of capital loss. This content serves educational purposes exclusively—not professional financial advice.

Important Notices:

1. I’m not a certified financial advisor, licensed broker, or investment professional.

2.My results (from -18% drawdowns to +7% months on $10k accounts) don’t predict your outcomes.

3. Specific warnings about forex: High leverage amplifies losses; markets are volatile 24/5; slippage/news kills stops.

4. Only risk money you’re completely prepared to lose.

Before Trading: Practice on demo (Exness/IC Markets), start with $100-500 live, journal 100 trades min.

Additional Educational Disclaimer:

Any images, charts, screenshots, trade examples, lot sizes, account balances, prop firm names, broker names, profit or loss figures, dates, or trading scenarios shown in this content are purely illustrative and explanatory in nature.

These examples are used only to help readers better understand trading concepts, market behavior, risk management principles, and real-world decision-making situations. They are not presented as guarantees, promises, or claims of actual performance.

Some scenarios may be simplified, hypothetical, or based on personal experiences to make complex topics easier to understand and to help readers emotionally relate to common trading situations.

This content is published strictly for educational and informational purposes only. It should not be interpreted as financial advice, investment recommendations, signals, or solicitation to trade any financial instrument.

Trading outcomes vary from person to person based on experience, discipline, capital, market conditions, and risk tolerance. Always conduct your own research and consult qualified professionals before making financial decisions.

Consult licensed financial professionals before committing serious capital.

FAQ

1. What is risk management in forex trading exactly?

It’s your shield against wipeouts. Identifying risks (like volatility, news) and capping them—1% per trade, stops, sizing. Without it, one bad EUR/USD move ends you. I learned after losing $2,347 ignoring it. Pros preserve capital first, profits second. Use calculators on TradingView. Simple.

2. How do I calculate position size for forex risk management?

Formula: (Account x Risk%) / (SL pips x Pip value). $10k, 1%, 40 pips SL, $10 pip: 0.25 lots. Exness MT4 does it automatically. My GBP/JPY failed? The wrong size doubled the loss. Always calculate pre-entry. Protects forever.

3. What’s a good risk-reward ratio in forex?

1:2 minimum. Risk $100, target $200. Breakeven at 33% wins. My gold trade: 1:1.33 lost; 1:2 won big. Based on structure, not hope. The table above shows why.

4. Common risk management mistakes in forex trading?

Over-risking (5%+), no stops, revenge trades, correlations ignored. I did all—blown twice. Fix: Journal, 1% rule, daily limits. 95% fail here.

5. Best forex risk management brokers in Pakistan?

IC Markets/Exness. Low spreads (0.0 pips), fast exec, MT4/5. Pakistan-friendly, no issues. I use both—IC for raw spreads.

6. How much should I risk per trade in forex?

1-2% max. $10k? $100-200. Survives 20 losses. I risked 5%—gone in a flash. Adjust by account size. https://admiralmarkets.com/education/articles/forex-basics/forex-risk-management

7. Does diversification help forex risk management?

Yes. Spread 3-5 pairs, low corr (EUR/USD vs USD/JPY). Avoid all USD longs. My 2024 mistake: AUD/NZD the same way. Limits blowups.

8. Can I trade forex without stop losses?

No. Suicide. Markets gap. My moved SL? Disaster. Always set, honor them.

Why And How Crypto Market Crash In 2026: What Really Happened To My Account

Why And How the Crypto Market Crash In 2026 February 6, 2026. Bitcoin had already been cut almost in half

The Eighth Wonder of the World for Real Traders

How Compounding: The Eighth Wonder of the World Nearly Broke Me Before It Saved Me January 2022. I wired exactly

What Is Arbitrage Trading & Safe Platforms 2026

Introduction Man, January 10th, 2026. 2:15 AM PKT. I’m staring at my TradingView screen in Hyderabad, hands shaking, heart pounding.

What Is P2P Trading & How to Avoid Scams in 2026

P2P Trading Discover what P2P trading is and how to be safe from scams in 2026. Real trader stories, PKR

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) a complete guide for beginner in 2026

Centralized vs Decentralized Exchanges Explained (CEX vs DEX) In my opinion, I need to be frank with you about my

What Is a Crypto Wallet? Types, Risks & Safety Tips in 2026

The Night I Got Wrecked By My “Safe” Crypto Wallet Confused about crypto wallets and scared of getting hacked? I

- January 23, 2026

- simpactaku

- 9:39 pm

Financial Disclaimer

Financial Disclaimer